Behind that seemingly "small" experience is the combination of three factors that are reshaping Vietnam's financial landscape: banking - fintech - AI technology.

As all three work towards the common goal of expanding safe and flexible financial access to people, the "3-minute spending limit" is not just a new utility, but a testament to a smarter, more personalized, and closer financial approach to the daily lives of Vietnamese people.

The "billion-dollar" handshake between banks and fintech: When technology fills the financial void

According to data from the State Bank of Vietnam, 72% of fintech companies in Vietnam now partner with commercial banks – a figure that shows that cooperation is gradually replacing the competitive model. Banks have capital flows, brands and risk management experience; fintech has speed, technology and the ability to understand users at the behavioral data level. When the two sides join hands, the “financial gap” – where millions of people have never had a credit score or are not eligible to access formal financial services – begins to be filled.

EY Vietnam's report Improving Vietnam's Financial Inclusion and Fintech's Role points out that fintech platforms are playing an increasingly important role in helping banks expand their reach through "alternative data" - a collection of financial signals that the traditional credit system could not exploit before: bill payment history, phone top-up frequency, recurring spending habits...

These data do not replace the old credit system, but complement and complete the financial picture of each user. Thanks to AI and real-time data analysis, financial institutions can assess customers' spending capacity, repayment ability and financial behavior in a more flexible and comprehensive way.

If in the past, access to credit was almost exclusively for groups with stable income, collateral and clear credit history, now, with the support of AI, the wall between "people with scores" and "people who have never been scored" is gradually disappearing.

This approach is in line with the Government 's direction in the National Financial Inclusion Strategy, when Vietnam aims for 80% of adults to have financial transaction accounts by 2025, and gradually form an open credit ecosystem on a digital platform.

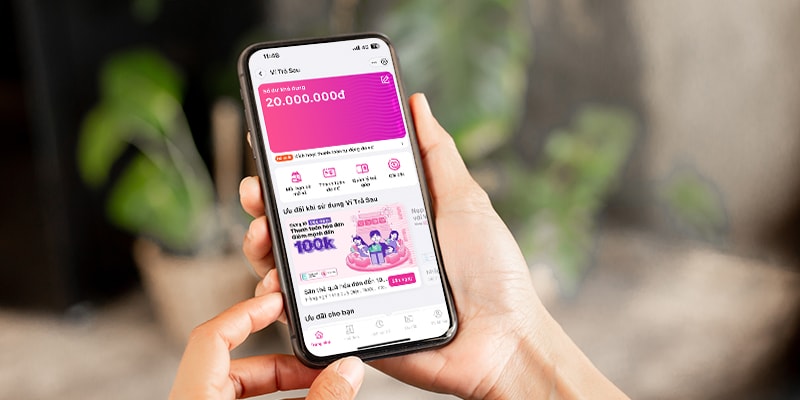

MoMo Postpaid Wallet – "flexible source of money" for modern life

In the picture of cooperation between banks and fintech, Postpaid Wallet (VTS), a product developed by TPBank and MBV and seamlessly deployed on the super app MoMo, is a typical example.

Contrary to popular belief, Postpaid Wallet does not create debt, but provides users with a flexible source of money that can be used immediately when needed, with a personalized limit based on actual financial capacity. With Postpaid Wallet, users can be more proactive in balancing cash flow, instead of passively waiting for income or looking for unofficial sources of capital.

From a banking perspective, this cooperation model also brings clear benefits: operating costs are optimized, the approval process is shortened, while risk management capabilities are increased thanks to transparent scoring technology.

From an economic perspective, many experts consider Postpaid Wallet to be a clear demonstration of the effectiveness of the cooperation model between banks and fintech platforms. What is noteworthy, according to experts, is that solutions like MoMo are an "extended arm" expanding the service capacity of the financial system through data and technology. At the same time, helping millions of people to be recorded with CIC points for the first time - an important step towards the goal of financial inclusion and developing the digital economy.

It can be seen that the combination of banking and fintech is opening a new chapter for Vietnamese finance: faster, more transparent and more comprehensive.

And in that picture, MoMo and partners like TPBank and MBV are proving that technology not only helps cash flow operate effectively, but also brings financial opportunities closer to each person.

Source: https://daibieunhandan.vn/co-hoi-tai-chinh-cho-hang-trieu-nguoi-fintech-va-ngan-hang-giup-xoa-bo-buc-tuong-giai-nguoi-co-va-chua-co-diem-tin-dung-10392778.html

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)