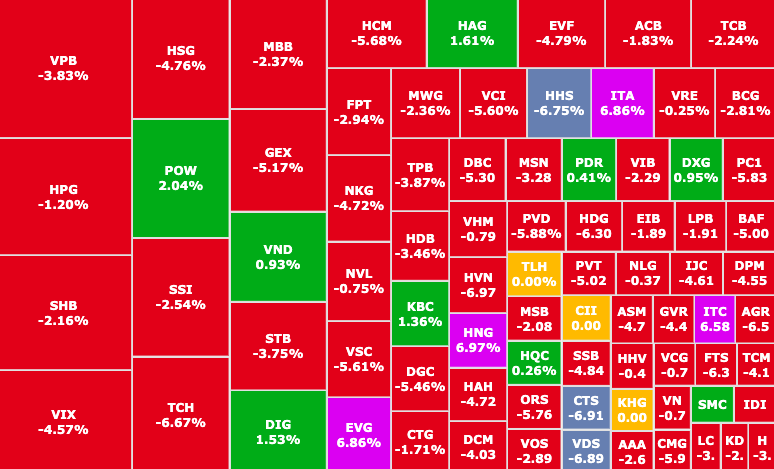

VN-Index appeared to be in a "plummeting" state right from the middle of the morning session in the context of short-term profit-taking pressure overwhelming the market. The two groups of stocks that fell sharply were technology and banking stocks such as FPT , VPB, TCB...

After a week of sideways trading at 1,270 – 1,290 points, VN-Index suddenly faced profit-taking pressure in the first session of the week (June 24), mainly from blue-chip stocks. The index "plummeted" below 1,260 points after "evaporating" nearly 28 points, at 1,254 points.

Besides, the HNX and UPCoM floors also retreated to 239.74 points (down 1.89%) and 99.06 points (down 1.51%), respectively.

Liquidity increased dramatically, reaching more than 36,800 billion VND in the whole market. Of which, on the HOSE floor alone, the liquidity reached 31,800 billion VND, an increase of nearly 50% compared to the previous session, showing that selling pressure overwhelmed the whole market.

Right from the middle of the morning session, VN-Index gradually lost its sideways state, reversed and decreased with red covering the entire market, 378 stocks decreased (24 stocks hit the floor) and 74 stocks increased (8 stocks hit the ceiling).

Red spread across the market due to profit-taking pressure

Investor cash flow is concentrated in banking, real estate, and financial services. Many sectors decreased by more than 4%: industrial services, oil and gas, telecommunications, chemicals, goods, and financial services.

The market's pillar industries in recent times: Securities, Banking, Technology, etc., and the VN30 "basket" stocks all turned down, becoming factors creating a negative trend for the market.

Blue-chip stocks all turned around, causing the VN-Index to drop sharply by 28 points (Photo: SSI iBoard)

Leading the group pulling the market "downhill" was technology stock FPT (FPT, HOSE) down 2.94%.

Next is the banking group with the most representatives, such as: VPB (VPBank, HOSE) decreased by 3.83%, TCB (Techcombank, HOSE) decreased by 2.24%, STB (Sacombank, HOSE) decreased by 3.75%, ACB (ACB, HOSE) decreased by 1.83%,...

The securities group was also strongly affected when SSI (SSI Securities, HOSE) was also included in the group of stocks that negatively affected the index today.

BIDV Securities shares plummeted, hitting the "floor" price in today's session (Photo: SSI iBoard)

Besides, other securities stocks such as BSI (BIDV Securities, HOSE), TVS (Thien Viet Securities, HOSE), VDS (Rong Viet Securities, HOSE), CTS (VietinBank Securities, HOSE) all "hit the floor", while MBS (MBBank Securities, HNX) fell sharply by 8.65%, VCI (Vietcap Securities, HOSE) fell by 5.6%,...

Not only in the group of domestic investors but also in the net selling movement from foreign investors , reaching a value of 925 billion VND, mainly in the codes FPT (FPT, HOSE), NLG (Nam Long Investment, HOSE), VRE (Vincom Retails, HOSE),... This is also the 13th consecutive session of overwhelming net selling by foreign investors.

According to expert Bui Ngoc Trung, Mirae Asset Securities , today's session has made investors' psychology become worried and their will to absorb the weak supply of stocks, pessimism may appear in the short term after today's session.

Based on liquidity and trading style today (June 24), it can be seen that cash flow is showing signs of withdrawal from the market in the short term when large-cap stocks show signs of reversal (securities, banking, technology,...) and no industry group is really leading.

Currently, the market is in a relatively information-free period, and investors' expectations are focused on the upcoming Q2/2024 business results.

In addition, Mr. Trung emphasized that the long-term trend will still be up, the market will soon see balance points in trading psychology and market foundation, from factors such as: Good profit growth quality in 2024; the interest rate environment is still quite low; industry groups such as Real Estate, Retail, Export will also soon attract cash flow again after some stocks return to reasonable price zones.

Source: https://phunuvietnam.vn/co-phieu-cong-nghe-ngan-hang-lao-doc-trong-phien-vn-index-mat-28-diem-20240624162440216.htm

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)