Tax industry brings AI to serve taxpayers on eTax Mobile

eTax Mobile "one-stop - one-touch point" for taxpayers

On December 9, the Tax Department organized a combined online and in-person conference for the entire industry to train the features of the eTax Mobile application and deploy the Chatbot virtual assistant to support taxpayers. This is a specialized activity, aiming to help tax officials at all levels master the profession, understand correctly, operate correctly and support taxpayers more effectively in the process of carrying out registration, declaration and tax payment procedures.

According to Deputy Director of the Tax Department Mai Son, after nearly 4 years of operation, eTax Mobile has been upgraded and strongly improved towards building a unified platform, where taxpayers can perform all tax obligations on just one application.

Currently, eTax Mobile has integrated login via VNeID and all essential functions including: tax registration; tax declaration; tax payment (including payment on behalf of others); tax obligation lookup; electronic invoice registration and adjustment; business household information lookup and feedback. This integration aims to realize the goal of taxpayers being able to fulfill their obligations anytime, anywhere on mobile devices.

Statistics have shown the increasing popularity of this application. Since March 2022, eTax Mobile has had over 13 million downloads and installations. The system has received and processed over 17.2 million tax payment transactions, with the total amount of money paid to the budget through the application reaching over VND 26.5 trillion.

The year 2025 alone recorded strong growth in both scale and frequency of use. During the year, the number of new registrations reached over 7 million, 1.2 times the total number of the previous 3 years combined. The number of transactions reached 13.3 million, 3.36 times higher than the previous period. The total amount of money paid to the budget through the application during the year was approximately 18 trillion VND, 2.1 times higher than the previous period.

Notably, eTax Mobile has risen to the No. 1 position in the "Business" category on the App Store Vietnam. According to Deputy Director Mai Son, this result reflects the level of interest and shows that the application has truly entered life, becoming a familiar and reliable tool for people to carry out tax procedures.

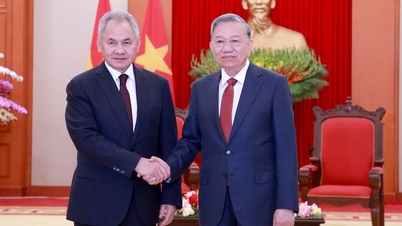

Deputy Director of the Tax Department Mai Son speaks at the Conference - Photo: VGP/HT

Not stopping there, the upgrade on December 6, 2025 marked a new step forward when the Tax industry officially introduced artificial intelligence to support taxpayers through the Chatbot virtual assistant integrated right on eTax Mobile.

The chatbot operates on a "quick question and answer" mechanism using natural language, available 24/7. Taxpayers can look up information on tax debts, enforcement status, and exit status; and also use additional utilities such as converting voice to text and vice versa. The application also allows users to rate answers for further improvement of the system.

Integrating virtual assistants is an important step to meet the need for instant support in the context of increasing volumes of information and data.

Key tasks for AI to serve correctly and accurately

To effectively implement eTax Mobile and Chatbot, the leaders of the Tax Department have requested units across the industry to synchronously carry out 3 key groups of tasks.

Firstly, each tax official must have a firm grasp of the features, operations and core business on eTax Mobile and Chatbot. This is identified as the tax authority's 24/7 online service channel for individuals and businesses. With the motto "each tax official is a tax propagandist", officials at each unit must proactively provide correct instructions and quick answers, avoiding the situation where each place understands differently and provides different instructions.

Immediately after the conference, the units were asked to promote multi-channel communication so that taxpayers know, understand and use the application. The goal is to make people realize the real benefits: instead of having to go to the tax office or wait by phone, taxpayers can ask Chatbot at any time to get information about their tax obligations.

Second, continue to standardize taxpayer data. According to the Tax Department's leader, no matter how modern the technology is, the input of AI is still data. Therefore, reviewing, cleaning and standardizing data is considered a regular task and is decisive for the quality of virtual assistant operations.

The Tax Department leader emphasized that data must meet four criteria: "Correct - Sufficient - Clean - Alive". Only when data is standardized can Chatbot provide accurate answers. If data is incomplete or incorrect, the system may provide incorrect information, affecting taxpayers' trust in electronic tax services.

Third, it is necessary to organize coordination "right role - right job - right contact". According to the plan, Chatbot is integrated and operated centrally in eTax Mobile. Relevant units coordinate in administration, training, support and periodic upgrading. At the local level, each unit needs to appoint a contact to synthesize feedback, clearly classify professional or technical problems, and then transfer them to the right department for timely handling.

At the conference, delegates were directly introduced to the functions on eTax Mobile; watched Chatbot demo; practiced handling common situations; and discussed problems arising locally. This is the basis for unifying the operations and approaches across the industry when deploying digital tools.

Mr. Minh

Source: https://baochinhphu.vn/nganh-thue-dua-ai-vao-phuc-vu-nguoi-nop-thue-tren-etax-mobile-102251209164228219.htm

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)