Thị trường chứng khoán trải qua tháng 9 - tháng 10 với nền thanh khoản yếu, không có động lực rõ ràng để thu hút dòng tiền của nhà đầu tư.

Thị trường chứng khoán trải qua tháng 9 - tháng 10 với nền thanh khoản yếu, không có động lực rõ ràng để thu hút dòng tiền của nhà đầu tư.

|

Tiền vào chứng khoán “nhỏ giọt”

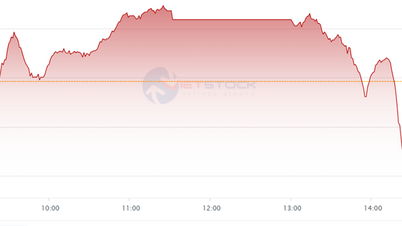

Dòng tiền vào thị trường chứng khoán đang ở mặt bằng thấp, với những phiên thanh khoản sụt giảm nghiêm trọng. Phiên giao dịch ngày 5/11, thanh khoản khớp lệnh sàn HoSE sụt giảm còn 8.200 tỷ đồng, thấp nhất kể từ giữa tháng 5/2023, khối ngoại nâng quy mô rút ròng lên 853 tỷ đồng.

Thậm chí, trong phiên 6/11, VN-Index tăng hơn 15 điểm sau hiệu ứng tái đắc cử của Tổng thống Donald Trump, thì dòng tiền vào sàn vẫn chưa được cải thiện. Dòng tiền trong cả 2 phiên sau đó không có sự bứt phá, thanh khoản tiếp tục đi ngang ở mức thấp với giá trị khớp lệnh quanh ngưỡng 11.000 - 12.000 tỷ đồng

Thanh khoản cả tháng 10/2024 chỉ đạt 17.764 tỷ đồng, tương đương tháng 9/2024 và cũng là mức thấp nhất kể từ đầu năm. Mấy tháng qua, VN-Index ở trong trạng thái giằng co liên tục, chỉ số dập dình không bứt phá; khối ngoại liên tục bán ròng, còn nhà đầu tư cá nhân vẫn giảm mở mới tài khoản.

Ông Trương Hiền Phương, Giám đốc cấp cao Công ty cổ phần Chứng khoán KIS Việt Nam cho biết, tình hình địa chính trị trên thế giới, cuộc bầu cử Tổng thống Mỹ và các xung đột địa chính trị có khuynh hướng lan rộng khiến nhà đầu tư quan ngại và thận trọng hơn trong việc giải ngân.

Trong khi đó, tình hình trong nước chưa có nhiều thông tin tích cực. Kỳ báo cáo kết quả kinh doanh quý III/2024 đã gần hoàn tất, vấn đề nâng hạng thị trường chưa thực hiện được. Tỷ giá tăng, giá vàng tăng hoặc một số địa phương sôi động giá đất, dù chỉ là hiện tượng cục bộ, nhưng cũng khiến nhà đầu tư chứng khoán cân nhắc thêm các kênh đầu tư khác. Việc nhà đầu tư nước ngoài liên tục bán ròng ảnh hưởng không nhỏ đến tâm lý nhà đầu tư trong nước.

Cần thêm thời gian để non-prefunding phát huy hiệu quả

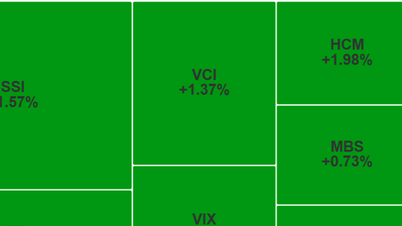

Đầu tháng 11/2024, quy định mới cởi trói Pre-funding chính thức có hiệu lực, nhà đầu tư tổ chức nước ngoài có thể mua cổ phiếu không yêu cầu có đủ tiền khi đặt lệnh. Đây là một trong những nút thắt cuối cùng giúp thị trường chứng khoán Việt Nam được nâng hạng và được kỳ vọng sẽ giúp thu hút lượng vốn ngoại lớn vào thị trường. Tuy nhiên, các chuyên gia đều đồng tình rằng, ảnh hưởng tích cực của quy định này cần có thời gian mới thẩm thấu vào thị trường.

“Các quỹ ngoại đang đầu tư ở Việt Nam đều đã đầu tư lâu năm và quen thuộc với các quy định trước đây, do đó không quá ảnh hưởng. Các tổ chức nước ngoài khác cũng cần thời gian, cần xem xét, nghiên cứu và định giá kỹ lưỡng trước khi tham gia thị trường”, ông Trương Hiền Phương nhận định.

Cùng quan điểm, ông Vicente Nguyễn, Giám đốc đầu tư Quỹ AFC Vietnam Fund cho rằng, quy định non-prefunding chưa có tác động gì đáng kể một cách trực tiếp. Nhờ quy định này, việc nâng hạng thị trường bởi FTSE Rusell có cơ hội hiện thực hóa và nếu thị trường chứng khoán Việt Nam được nâng hạng, điều đó mới có thể giúp thu hút vốn ngoại.

Kích thích thanh khoản bằng cách nào?

Bàn về triển vọng thanh khoản thị trường từ giờ đến cuối năm, các chuyên gia vẫn có nhiều e ngại khi chưa có nhiều thông tin tích cực. Tuy nhiên, xét về dài hạn, Giám đốc đầu tư Quỹ AFC Vietnam Fund cho rằng, có rất nhiều phương án để cải tiến thị trường chứng khoán và thu hút dòng vốn cả trong lẫn ngoài nước. Ngoài quy định non-prefunding, thì việc cải thiện, cải tiến quy trình giao dịch, rút ngắn quá trình giao dịch từ T+2,5 xuống còn T0 là các biện pháp có thể xem xét.

Ông Vicente Nguyễn nhấn mạnh: “Nếu để ý, chúng ta sẽ thấy, trong 3 năm qua, gần như không có thương vụ IPO nào trên thị trường để bổ sung hàng mới. Quanh đi quẩn lại, thị trường vẫn chỉ có các công ty đó, không có sản phẩm, sao có thể thu hút thêm sự quan tâm được? Do đó, thúc đẩy IPO, hay cổ phần hóa các doanh nghiệp nhà nước, khuyến khích doanh nghiệp tư nhân niêm yết là cách thúc đẩy thị trường chứng khoán thu hút thêm dòng tiền từ nhà đầu tư”.

Cơ bản nhất vẫn là bản thân các doanh nghiệp phải không ngừng lớn mạnh để thúc đẩy sự quan tâm của nhà đầu tư.

Góp ý thêm các giải pháp từ phía chính sách, ông Trương Hiền Phương đưa ra kỳ vọng, các cơ quan quản lý tiếp tục đẩy mạnh chống và xử phạt các đối tượng làm giá trên thị trường chứng khoán, rà soát và có cơ chế đối với những hội nhóm hô hào tư vấn chứng khoán tự phát không có cơ sở, làm méo mó thị trường và gây ảnh hưởng đến tâm lý nhà đầu tư.

Đặc biệt, ông Phương mong muốn các cơ quan xúc tiến, đẩy mạnh hơn nữa để hoàn thiện các quy trình, đáp ứng được yêu cầu của tổ chức thẩm định, đưa thị trường chứng khoán được nâng hạng sớm nhất có thể.

Cố gắng từ một phía không thể thúc đẩy sự phát triển chung của toàn thị trường. Nỗ lực từ cả cơ quan nhà nước - doanh nghiệp niêm yết mới có thể kích thích tâm lý tích cực của nhà đầu tư, thu hút dòng tiền quay trở lại thị trường, cả dòng tiền của nhà đầu tư trong nước lẫn nước ngoài.

Nguồn: https://baodautu.vn/kich-thich-thanh-khoan-cho-thi-truong-chung-khoan-d229646.html

Bình luận (0)