The stock market faced downward pressure after the holiday - Photo: QUANG DINH

Joy is not shared equally.

After conquering the record high of 1,700 points, the market quickly came under strong downward pressure due to a wave of profit-taking. Prior to that, consecutive price peaks were recorded in many banking and securities stocks.

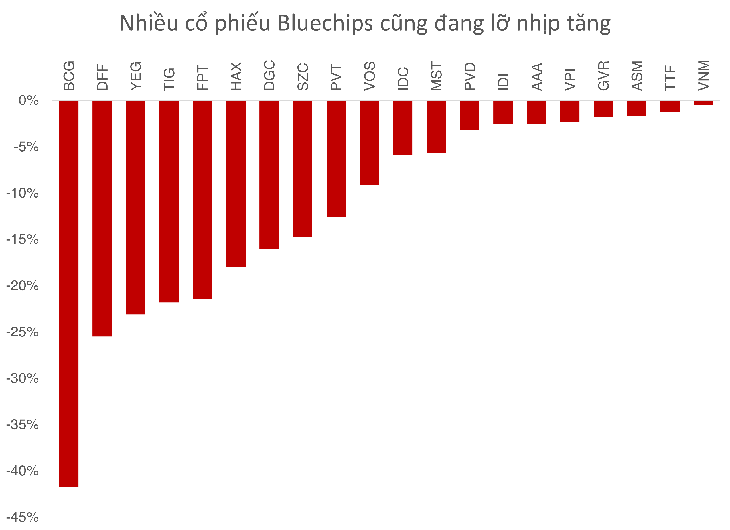

However, many other stocks that hadn't yet "climbed the wave" along with the general market euphoria are now facing a challenging correction phase.

Statistics from the three exchanges up to September 5th show that more than 500 stocks continued to experience negative growth despite the overall index rising, equivalent to nearly 34% of all stocks in the market.

Many stocks are illiquid, but there are also many cases where trading is active yet the price moves against the index.

For example, BCG (Bamboo Capital) has fallen 42% since the beginning of 2025 due to facing risks related to legal issues and senior leadership.

Another name, YEG (Yeah1), best known for its show "Brother Overcoming a Thousand Obstacles," has also lost more than 23% of its value since the beginning of the year, despite positive business results.

In the first half of 2025, YEG's after-tax profit increased 2.6 times, reaching nearly 56.6 billion VND.

Not only midcap or penny stocks, but even the big blue-chip stocks are not keeping pace with the VN-Index's rise.

FPT's stock price has fallen 21.4% since the beginning of 2025 due to profit-taking by major investors.

Vinamilk, with its new brand identity, is still down about 1%. Meanwhile, GVR, a major player in the industrial park and rubber sector, along with SZC and IDC, are still showing the lingering effects of the tariff shock on the entire industry group.

Mr. Khang, an investor, said: "My portfolio hasn't really recovered from the sharp drop in April 2025. Industrial park stocks account for a large proportion of my portfolio, and cash flow remains very cautious due to information about tariffs."

At the same time, many sectors such as oil and gas, chemicals, and consumer goods like PVT, PVD, DGC, and HAX have been almost "forgotten" by the market.

Expert opinion: cash flow will become more diversified.

Mr. Nguyen Anh Khoa - Director of Analysis at Agriseco Securities - believes that the differentiation will become even more pronounced in the coming period:

"The banking and real estate sectors are retesting short-term price levels, in line with signals of declining liquidity across the market. This reflects a less than enthusiastic state of new buying activity. The momentum to simultaneously support price increases for all three large-cap sectors is not strong enough," Mr. Khoa said.

According to Mr. Khoa, the market may enter a phase of clearer differentiation, with capital likely shifting towards midcap stocks with strong fundamentals or expectations of positive Q3 earnings, such as construction materials, retail, and ports.

Technically, the VN-Index is likely to fluctuate within a wide range, with psychological resistance around 1,700 points and short-term support in the 1,610 (±10) point range.

According to Mr. Khoa, market valuations are not yet at "bubble" levels, and there is still room for growth. In previous strong bull cycles (2017-2018, 2020-2021), the period of increase from leading stocks lasted from 1 to 1.5 years. Therefore, capital can still spread to other sectors, but it is difficult to expect the entire market to break through simultaneously.

From a different perspective, Mr. Nguyen The Minh - Director of Individual Client Analysis at Yuanta Securities Vietnam - emphasized the shift in the structure of capital flows: "Currently, the market is being driven by domestic institutional capital, despite net selling by foreign investors. In the last two years, domestic institutions have been the group with the strongest impact on VNIndex fluctuations, unlike the period from 2019 to 2023 when individuals played the main role."

According to Mr. Minh, the increased involvement of institutions helps to stabilize and professionalize the market, but it also intensifies the differentiation process, as capital flows mainly into stocks with clear prospects.

Mr. Minh also noted that during September and October, investors worldwide tend to trade cautiously. This also provides a basis for investors to prepare defensive strategies during the autumn period – which is often highly volatile – and to seize the "Santa Claus rally" opportunity at the end of the year.

While banking, securities, and conglomerates like Vingroup and Gelex are continuously surging, many other sectors and businesses are still struggling to regain their growth momentum.

This misalignment raises the question: can the market maintain its current momentum, or will money begin to shift to neglected sectors?

Source: https://tuoitre.vn/chung-khoan-kho-nhan-20250908113937027.htm

![[Photo] Enchanted by the deciduous forest during the leaf-changing season.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F02%2F04%2F1770196861704_2066642_8ffd5f25c3c9433be0e644abe71613ae.jpeg&w=3840&q=75)

![[Photo] Heartwarming "Journey Home for Tet" in the Year of the Horse at the People's Police Academy](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F02%2F04%2F1770198043990_hv-cong-an-13-1206-jpg.webp&w=3840&q=75)

![[Photo] Enchanted by the deciduous forest during the leaf-changing season.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F402x226%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F02%2F04%2F1770196861704_2066642_8ffd5f25c3c9433be0e644abe71613ae.jpeg&w=3840&q=75)

Comment (0)