|

According to FiinGroup's periodic report on investment fund performance, the total net outflow from investment funds in the first quarter of 2025 reached nearly VND 4,700 billion, marking the fifth consecutive quarter of net capital outflow from funds, indicating that defensive sentiment remains dominant in the market.

According to Ms. Van Do, Head of Data Analysis, Business Information Division, FiinGroup, in the overall picture, equity funds are the group facing the strongest capital outflow pressure. In the first quarter of 2025, equity funds experienced net outflows of over VND 5,300 billion, double that of the previous quarter.

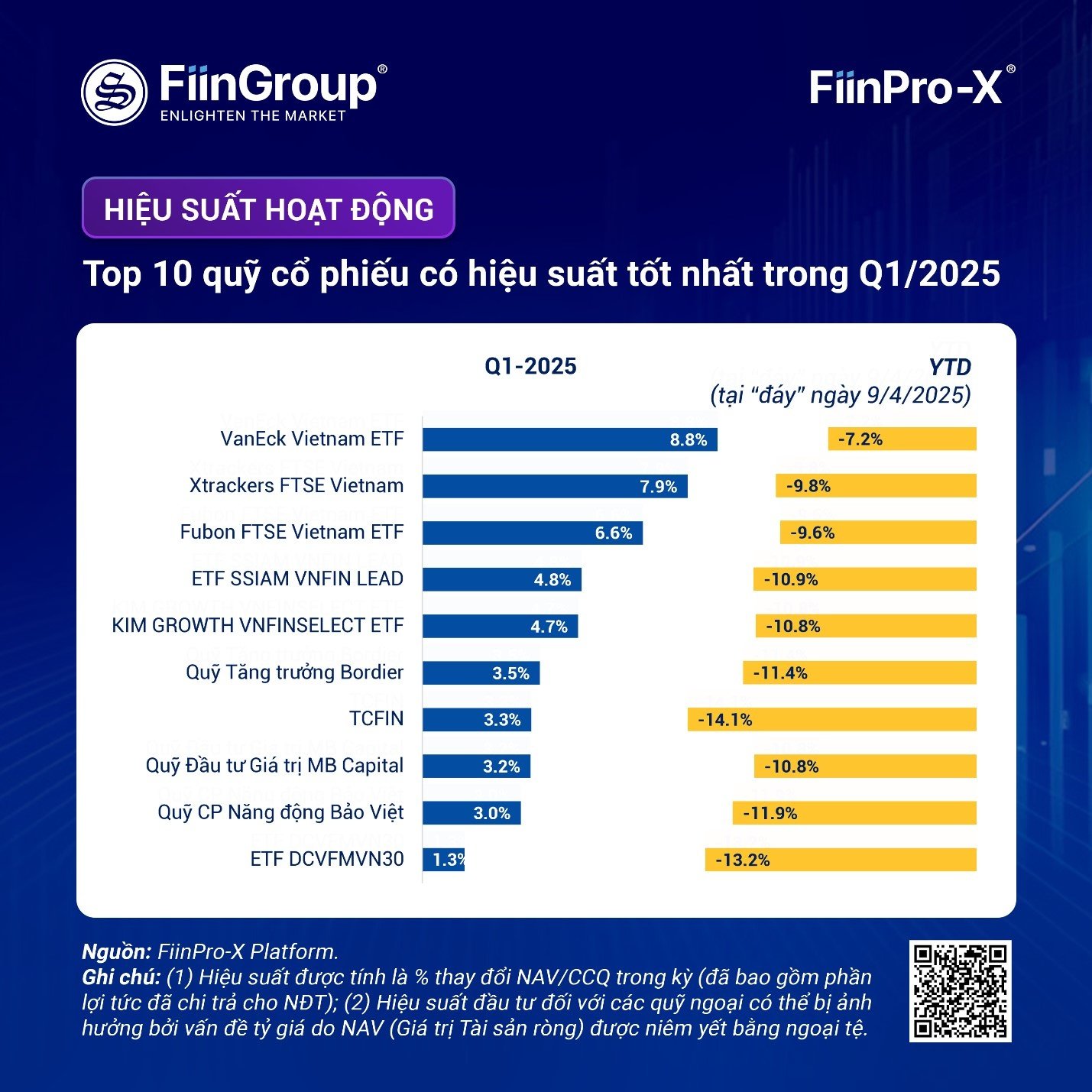

In particular, foreign ETFs recorded net outflows of up to VND 4,100 billion, with Fubon FTSE Vietnam ETF – the largest fund from Taiwan – being the most prominent, despite the fund itself achieving positive performance in the past quarter. Not only ETFs, but also closed-end funds experienced significant outflows, exceeding VND 1,800 billion.

Conversely, according to Ms. Van Do, open-ended equity funds have somewhat maintained their attractiveness to capital flows, with a modest net inflow of 700 billion VND in the first quarter. However, compared to the average of over 3,300 billion VND per quarter in 2024, this figure shows a significant decline in the attractiveness of open-ended funds. A rare bright spot is Dragon Capital's Vietnam Select Equity Fund (VFMVSF), which leads in attracting net capital flows, focusing on banking and retail stocks such as MWG and CTG.

Notably, the caution of fund managers is also reflected in their cash holdings. In March 2025, as many as 19 out of 31 open-ended equity funds increased their cash holdings compared to the previous month, especially large-scale funds like DC Dynamic Securities (DCDS), which raised their cash holdings from 5.3% to 21.2%. This indicates that fund managers are being cautious about making new investments, waiting for clearer signals from the market.

|

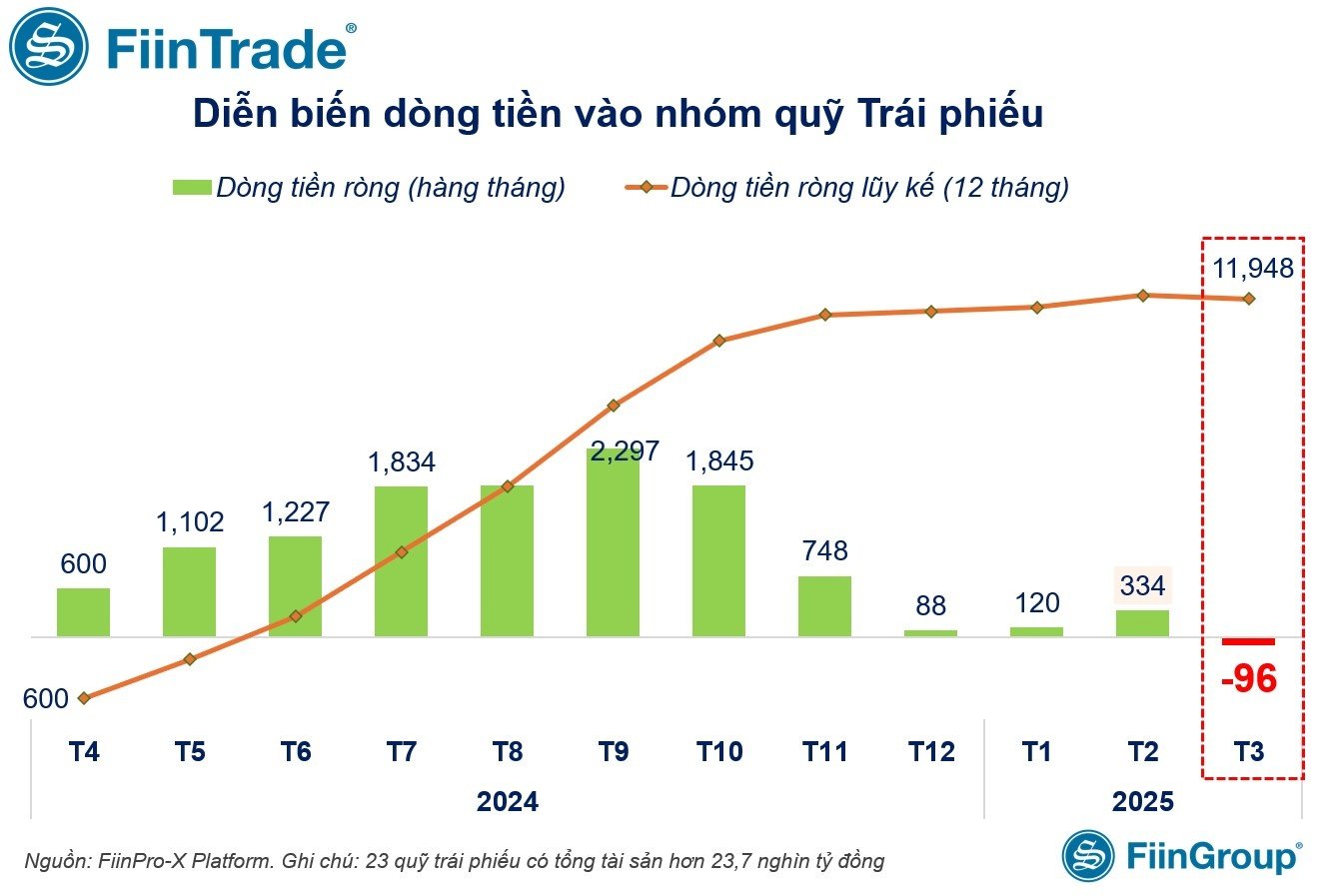

Ms. Van Do stated that not only equity funds, but also bond funds, once considered "safe havens," are beginning to show cracks. After a continuous 12-month streak of attracting net inflows in 2024, March 2025 saw a slight net outflow of nearly 100 billion VND from bond funds. Although the net inflow for the quarter was still around 358 billion VND, this figure represents a significant decrease compared to the previous average of over 3,600 billion VND per quarter. Large funds such as TCBF, DCBF, and VFF all recorded capital outflows, while only a few funds like the An Binh Bond Fund (ABBF) maintained their attractiveness to investors.

The cash flow picture in Q1/2025 clearly reflects the defensive sentiment of institutional investors, amidst a market heavily impacted by external uncertainties, particularly the news of the US plan to impose retaliatory tariffs of up to 46% on Vietnamese imported goods. This factor triggered a sharp market correction, causing the VNINDEX to fall by 16.9% in just the first two weeks of April and wiping out the gains of most funds. Although the index subsequently recovered impressively by +12.2%, the overall investor sentiment remains cautious.

According to Ms. Van Do, for individual investors, the sharp withdrawal of institutional capital in the past quarter has important implications. Firstly, it should be noted that net outflows from ETFs and large funds could add volatility to the market, especially in large-cap stocks. Secondly, while open-ended equity funds continue to attract capital, fundamentally sound stocks in the banking and retail sectors – such as VCB, MWG,and FPT – continue to be preferred and could serve as potential support. Thirdly, the increase in cash holdings by funds indicates that short-term disbursement pressure will not be too strong; investors need patience and should choose the right time to disburse funds.

"Overall, differentiation is becoming a characteristic of the Vietnamese stock market at the present time. Investors should not panic in the face of net outflows, but should observe more closely the active capital flows, choose stocks that are prioritized for accumulation, and be ready to seize opportunities when attractive price levels are established," Ms. Van Do shared.

Source: https://thoibaonganhang.vn/dong-tien-cac-quy-dau-tu-quy-i2025-luc-rut-rong-manh-me-163645.html

![[Photo] Prime Minister Pham Minh Chinh presides over a meeting on private sector economic development.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F20%2F1766237501876_thiet-ke-chua-co-ten-40-png.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh presides over the conference announcing the establishment of the International Finance Centre in Vietnam.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F21%2F1766309817714_ndo_br_dsc-3400-jpg.webp&w=3840&q=75)

Comment (0)