| Commodity market today, September 16th: Global commodity markets experience a lively trading week. Commodity market today, September 17th: Commodity markets see sideways movement in the first trading session of the week. |

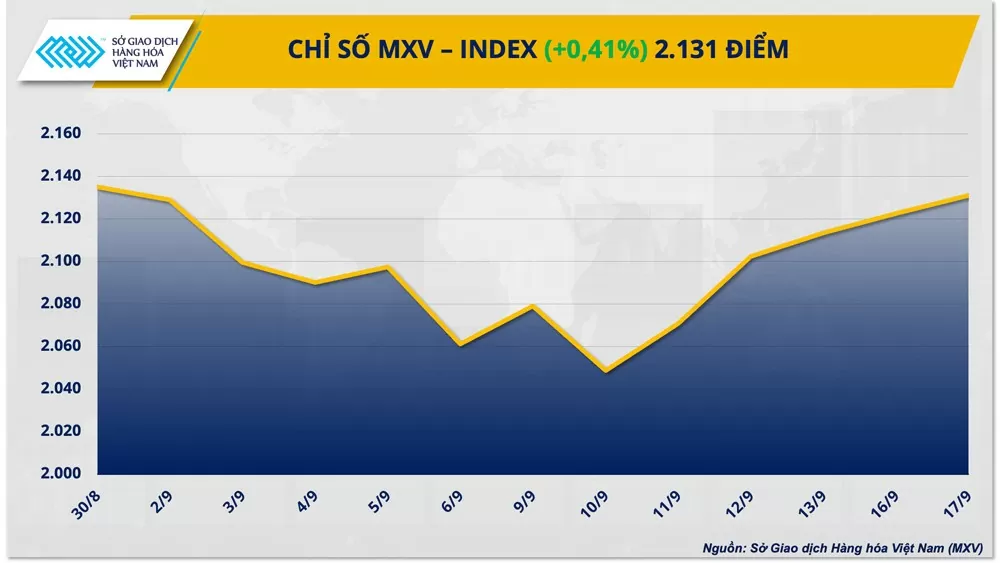

Buying pressure prevailed, pushing the MXV-Index up 0.41% to 2,131 points. Notably, in the industrial raw materials market, the prices of both coffee commodities reversed their downward trend after the previous correction. Contrary to the overall market upturn, all metals (except iron ore) saw price declines.

|

| MXV-Index |

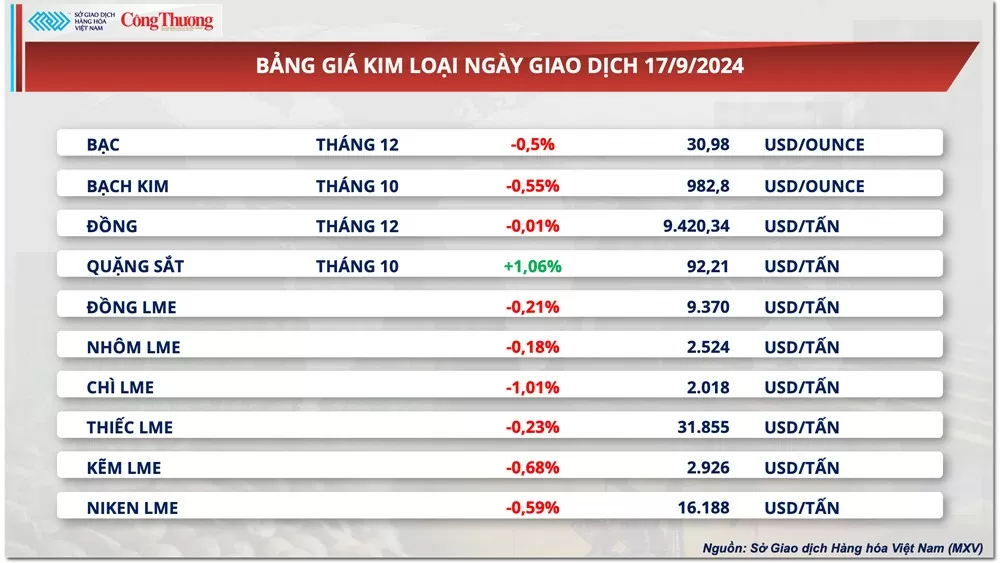

Metals market in the red

According to MXV, at the close of trading on September 17th, with the exception of iron ore, all metal commodities simultaneously declined in price due to market caution ahead of the US Federal Reserve's (FED) plan to cut interest rates. For precious metals, silver prices reversed course and fell slightly by 0.5% to $30.97 per ounce, ending a three-session winning streak. Platinum prices also continued their downward trend, falling by 0.55% to $982.8 per ounce.

|

| Metal price list |

The market is focusing on US retail sales and industrial production data released last night, as these are the last economic data points to be released before the Fed decides whether to cut interest rates early tomorrow morning.

According to a report from the US Department of Commerce, retail sales in August unexpectedly increased by 0.1% on a monthly basis, exceeding market expectations of a 0.2% decrease. Industrial production growth also beat market forecasts, reaching a 0.8% increase in August, higher than the predicted 0.2%. These positive economic figures, combined with previously released data showing a decrease in the unemployment rate, have reduced the likelihood of a large-scale interest rate cut by the Fed. This diminished market optimism has led investors to withdraw funds from the precious metals market.

In addition, the US dollar also surged strongly following yesterday's data releases, indirectly putting pressure on silver and platinum prices. Specifically, the Dollar Index closed up 0.13% at 100.89 points, ending a three-day losing streak.

For base metals, after a volatile trading session, COMEX copper prices remained relatively stable, falling only slightly by 0.01% to $9,420 per ton.

On the one hand, the strengthening US dollar combined with investor caution ahead of the Fed's interest rate decision put pressure on copper prices yesterday. On the other hand, expectations that China will continue to implement policies to support its economy, along with a more optimistic consumption outlook during the peak season, were the main drivers supporting copper prices during the session.

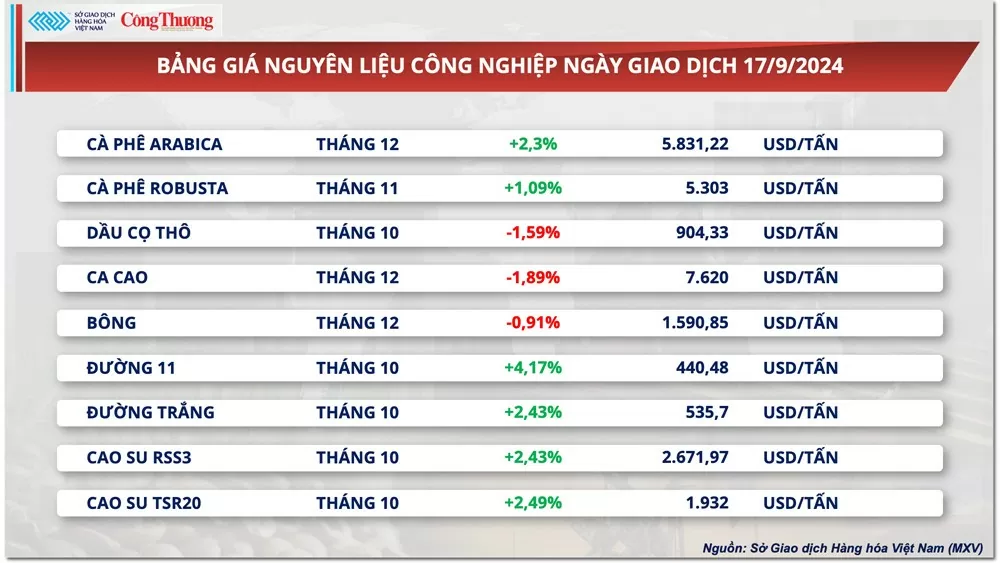

Sugar prices surged by more than 4%.

|

| Industrial raw material price list |

Sugar prices surged more than 4%, reaching their highest level in over two months. Wildfires in parts of Brazil have burned approximately 30,000 hectares of Tereos' sugarcane fields, equivalent to 10% of the company's area in Brazil, the world's largest sugar exporter. The sugar industry group UNICA estimates that at least 230,000 hectares of sugarcane were affected by the fires in August in the state of Sao Paulo.

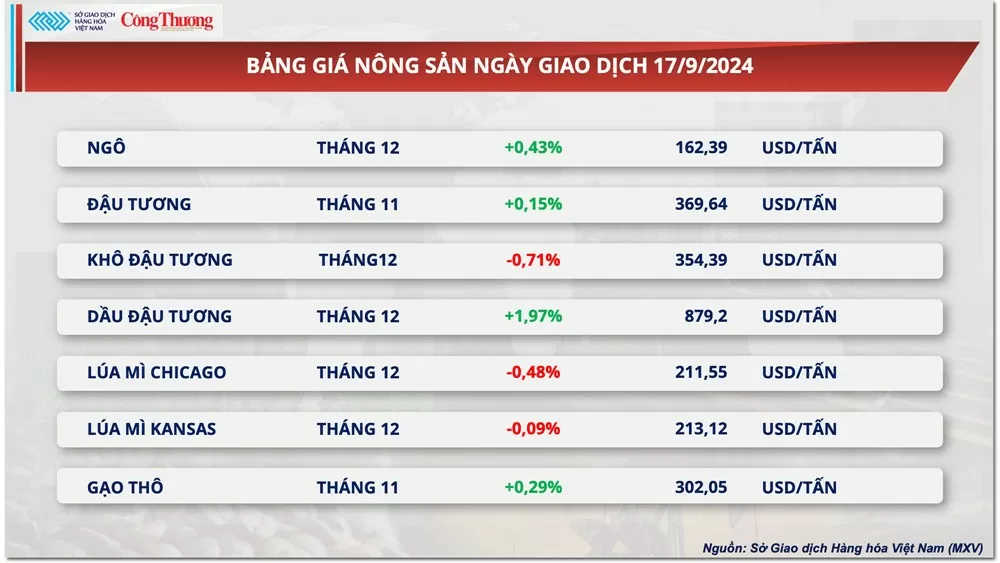

Prices of some other goods

|

| Agricultural product price list |

|

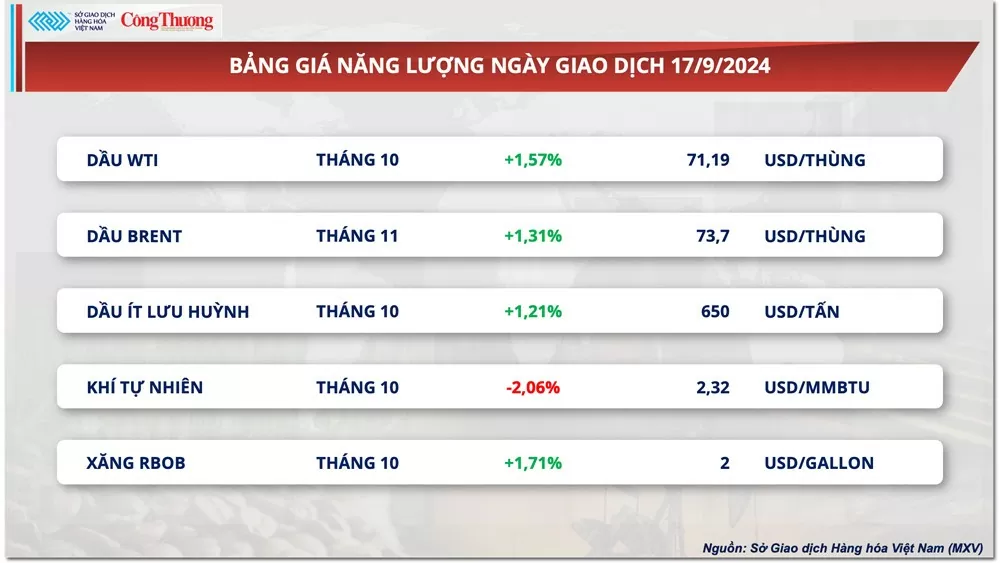

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-189-thi-truong-hang-hoa-nguyen-lieu-the-gioi-hap-dan-dong-tien-dau-tu-346643.html

Comment (0)