Investment analysis

Tien Phong Securities (TPS): The VN-Index may move into a narrow trading range and build a base around the 1,285 - 1,295 point range (+/- 10 points) until it finds momentum to break through the 1,300 point resistance.

In a worse-case scenario, the market may experience a correction as divergence between the RSI and MACD indicators is present. Investors should exercise caution, only investing when the market breaks through resistance or buying at support levels below.

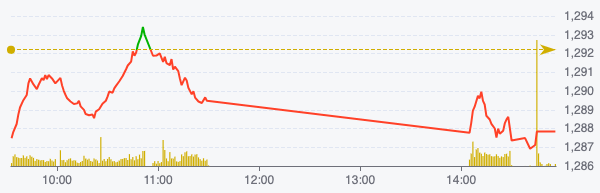

VN-Index performance on October 2nd (Source: FireAnt).

Vietcombank Securities (VCBS): Given the current developments, investors are continuing to gradually take profits on stocks showing signs of weakness in their portfolios, as strong selling pressure emerges at resistance levels or fails to maintain movement above the MA20 line.

In addition, investors may consider making partial investments in some stocks that have been consolidating sideways and are starting to rebound, creating a stable upward trend in sectors such as banking, oil and gas, shipping, and public investment.

Beta Securities: The main index is currently in a consolidation phase, awaiting more positive signals regarding capital flow to create momentum to break through the 1,300-point resistance level.

In this context, investors need to closely monitor liquidity developments, especially movements from foreign investors. This will be a key factor influencing the market trend in the short term. Corrections during this accumulation phase could be opportunities to enter stocks with long-term growth potential.

However, caution is needed when choosing the timing of purchases, and investment goals should be clearly defined to avoid chasing market trends without clear signals, thereby minimizing risks.

Investment recommendations

- CTR ( Viettel Construction Joint Stock Company): Waiting to buy.

Updating its business results for the first eight months of 2024, the company achieved revenue of VND 7,935 billion (an 11% increase compared to the same period last year) and pre-tax profit of VND 422 billion (+% increase compared to the same period last year). With these results, the corporation has completed 63% of its full-year profit target.

According to TCBS's assessment, the company's growth rate is showing signs of slowing down, especially in the infrastructure leasing segment, as the cumulative construction progress of BTS stations by the end of August 2024 is lower than planned.

Currently, the stock is trading at a forward P/E valuation of approximately 26.x (higher than the stock's long-term average P/E of 18.x). Therefore, according to TCBS, at the current price, investors should observe the situation from the sidelines.

- VCI (Vietcap Securities Joint Stock Company): Waiting to sell.

The company has approved the implementation of a private placement of 143.6 million shares at a price of VND 28,000 per share (expected to raise over VND 4,000 billion). This will serve as a foundation for the company to expand its business activities.

In addition, the approval of the non-prefunding draft will benefit large securities companies like VCI. The stock is currently trading at a forward P/B ratio of 1.8x - lower than the long-term average of the stock at 2.1x.

TCBS recommends that investors can continue to hold the stock.

Source: https://www.nguoiduatin.vn/lang-kinh-chung-khoan-3-10-da-den-luc-chot-loi-204241002164448075.htm

![[Photo] Golden season of organic farming under the canopy of the vast Mang Den forest.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F24%2F1769247398190_ndo_br_cam-15-jpg.webp&w=3840&q=75)

Comment (0)