VN-Index fell more than 22 points over the past week of trading, a series of female leaders sold off shares heavily, the market awaits important signals,ACB shares are expected to rise 28%, and the dividend payment schedule is underway.

VN-Index fell 22.25 points.

At the end of last week's trading, the VN-Index fell 22.25 points (equivalent to a 1.75% decrease) to 1,251.71 points.

The flow of money into the market was somewhat sluggish, decreasing by 21.3% compared to the average trading value, trading around 15,000 billion VND, and even dropping to 10,000 billion VND in some sessions (September 12), the lowest in almost a year.

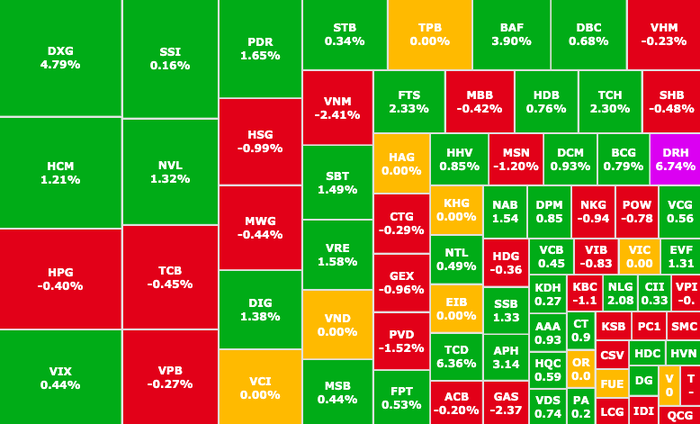

The group of "pillar" stocks reversed course en masse, with many "big" names appearing in the top list of stocks negatively impacting the VN-Index: SSB ( SeABank , HOSE), TCB (Techcombank, HOSE), VNM (Vinamilk, HOSE), VIC (Vingroup, HOSE), NVL (Novaland, HOSE),…

A series of "blue-chip" stocks reversed course and declined last week (Photo: SSI iBoard)

Foreign investors also resumed net selling in the last trading session of the week. Specifically on September 13th, foreign investors sold a net of over 189 billion VND worth of VHM (Vinhomes, HOSE) shares and 124.3 billion VND worth of MWG (Mobile World Group , HOSE) shares…

NVL shares are approaching their historical low (Image: SSI iBoard)

Real estate stocks have attracted attention with sharp declines. For example, NVL (Novaland, HOSE) fell by more than 11% in value last week, to 11,500 VND/share. The current price is only about 1,500 VND away from its historical low.

A "bright spot" emerged in the agricultural sector, with many stocks rising sharply against the market trend: AGM (An Giang Import-Export, HOSE), DBC (Dabaco, HOSE), PAN (Pan Group, HOSE),…

Thus, from the first trading session of September until now, the VN-Index has fallen sharply by nearly 30 points, with most sessions being unfavorable and "red" playing a dominant role in the market.

Female leader sells shares aggressively.

Ms. Truong Nguyen Thien Kim reported selling 13.2 million VCI shares of Vietcap Securities Joint Stock Company. The transaction was carried out from September 4th to September 11th through order matching and/or negotiated transactions.

Based on the closing price, Ms. Kim is estimated to have earned approximately 600 billion VND after completing the transaction. After the transaction, Ms. Kim still holds more than 9.6 million VCI shares, equivalent to a 2.18% ownership stake.

Ms. Kim is the wife of Vietcap's CEO and Board Member, To Hai. Currently, Mr. To Hai holds over 99.1 million VCI shares (22.44%).

Two female leaders, Ms. Truong Nguyen Thien Kim (left) and Ms. Dang Huynh Uc My (right), simultaneously sold off their shares aggressively (Photo: ST).

Additionally, she is known as the owner of the Katinat and Phê La chain; Chairwoman and CEO of D1 Concepts JSC; Member of the Supervisory Board of Ben Xe Mien Tay JSC (WCS, HNX); and Member of the Board of Directors of International Dairy Products JSC (IDP, UPCoM).

In a similar move, Ms. Dang Huynh Uc My also registered to sell all 110,419 SCR (HOSE) shares of Saigon Thuong Tin Real Estate Joint Stock Company - TTC Land, from September 18th to October 17th. The purpose is to restructure her investment portfolio.

Currently, SCR is trading around 5,390 VND/share, less than half of its book value of 12,314 VND/share. Since the beginning of April, SCR has decreased by approximately 32%. Compared to the price at the beginning of 2022, the market price of SCR has fallen by 78%.

ACB bank shares are expected to rise by 28%.

According to SSI Securities, in the second quarter of 2024, ACB's (Asia Commercial Bank, HOSE) credit growth reached 12.8% year-on-year, totaling VND 550.2 trillion.

ACB's non-performing loans increased by 10.5% compared to the previous quarter, but the non-performing loan ratio remained at 1.48% thanks to stable credit growth.

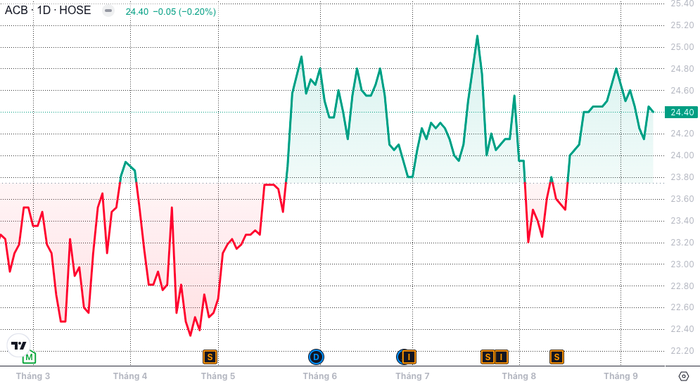

The performance of ACB shares on the stock exchange over the past 6 months (Image: SSI iBoard)

Regarding card business operations, the percentage of active cards at ACB increased to 70% by the end of Q2/2024, with over 5.5 million debit and credit cards. In addition, spending per card also increased by 8% compared to the previous quarter, reaching over 4 million VND after remaining stable for three consecutive quarters.

SSI predicts that revenue from card fees and related services will continue its growth trajectory in the second half of 2024 as consumer demand gradually recovers.

Based on the above factors, SSI forecasts that ACB's after-tax profit in 2024 and 2025 will be VND 22 trillion (a 10% increase year-on-year) and VND 26 trillion (a 17.8% increase year-on-year), respectively.

The company issued a Buy recommendation for ACB with a target price of VND 31,200/share, expecting a 28% increase compared to the price on September 13th.

Stocks are "waiting for signals" from the Fed.

Analysts believe the sluggish trading activity last week stemmed from cautious sentiment ahead of key macroeconomic developments. Specifically, the market is awaiting signals from the State Bank of Vietnam following the US Federal Reserve's interest rate cut.

The Fed's interest rate cut will support the long-term upward cycle of global stock markets, and is expected to have a positive impact on the domestic stock market as well.

In September, Yuanta Securities predicted that the Fed was likely to cut interest rates, and coupled with the cooling USD/VND exchange rate, this created conditions for the State Bank of Vietnam to maintain low interest rates to support the economy.

Cash flow could increase again after the Fed may begin deciding on interest rate cuts at its meeting next week.

Assessment and recommendations

According to Mr. Do Thanh Son, Head of Investment Consulting at Mirae Asset Securities , the market is experiencing more sadness than joy in the first half of September. The VN-Index has fallen 2.5% since the beginning of the month, and liquidity has "disappeared," leaving investors confused.

The market is experiencing a rather unfavorable September.

According to him, the market no longer seems as cheap as investors often expect; in fact, manufacturing sectors in particular, and midcap stocks in general, are no longer considered undervalued. Stocks need clearer business stories for investors to consider accepting a higher valuation. Furthermore, the market is under pressure from net selling by foreign investors, but this selling pressure is expected to subside by the end of September thanks to signs of capital returning to Southeast Asia.

Overall, the compelling market narrative largely remains rooted in fundamental factors that impact the overall picture: Positive EPS growth in 2024 – 2025 will depend on the global recession; the general recovery of the Vietnamese economy, reflected in GDP (expected 6-6.5% in 2024); and favorable fiscal and monetary policies of the government for both investment and business recovery.

In the long term, the market is still expected to remain relatively stable in the final months of the year, but we need to look forward to clearer signs from the economy.

The VN-Index will probably not be able to break out of the large range of 1,200 – 1,300 points in the short term, and investment opportunities will be diversified. Investors are advised to consider choosing stocks that: (1) have a very unique story, (2) have strong cash flow, and (3) are still at an "attractive" valuation level. Some stocks to consider include: Real estate sector: PDR – AGG; Banking: CTG (VietinBank, HOSE); Essential retail: MSN (Masan, HOSE).

According to SSI Securities , the index is fluctuating within a narrow range of 1,248 – 1,255 points, and technical indicators suggest that the short-term downtrend continues. The VN-Index is forecast to continue oscillating in the 1,245 – 1,254 point range.

DSC Securities assesses that the market still has bright spots as it has held the important support level of 1,250 points, and low liquidity during the correction is not a bad sign. The important thing now is for the market to successfully test "supply" before moving on to test "demand" at the resistance level above. Next week, the market will face several important events such as the Fed's policy meeting, derivative expiration, and ETF portfolio restructuring. These will be "tests" to assess the true supply and demand of the market.

Dividend payment schedule this week

According to statistics, 31 companies finalized dividend entitlements between September 4th and 6th, including 25 companies paying in cash, 2 companies paying in shares, 1 company exercising subscription rights, and 1 company paying a combination of both.

The highest percentage is 50%, the lowest is 1%.

Two companies paid in shares:

Ba Ria - Vung Tau Housing Development Joint Stock Company (HDC, HOSE), the ex-dividend date is September 16th, with a dividend rate of 15%.

Tan Cang Song Than ICD Joint Stock Company (IST, UPCoM), ex-dividend date is September 19th, with a dividend rate of 25%.

One company exercises its purchase right:

TNH Hospital Group Joint Stock Company (TNH, HOSE), the ex-dividend date is September 17th, with a dividend rate of 13.8%.

1 business pays in combination:

Vietnam Export Import Commercial Bank (EIB, HOSE) will pay dividends in cash and issue additional shares. For the additional share issuance, the ex-dividend date is September 19th, and the dividend rate is 7%.

Cash dividend payment schedule

* Ex-dividend date: This is the trading day on which a buyer, upon establishing ownership of the shares, will no longer be entitled to related rights such as the right to receive dividends or the right to subscribe to newly issued shares, but will still retain the right to attend the shareholders' meeting.

| Code | Floor | Ex-dividend date | TH Day | Proportion |

|---|---|---|---|---|

| CKA | UPCOM | September 16th | 3/10 | 50% |

| SAS | UPCOM | September 16th | September 27th | 6% |

| HMC | HOSE | September 16th | September 27th | 8% |

| ADP | HOSE | September 16th | 3/10 | 7% |

| SVC | HOSE | September 16th | September 23 | 5% |

| SMB | HOSE | September 17th | 3/10 | 20% |

| SRC | HOSE | September 17th | 3/10 | 6% |

| CHS | UPCOM | September 17th | 8/10 | 9.5% |

| TNW | UPCOM | September 17th | September 25th | 5.7% |

| HDW | UPCOM | September 18th | September 30th | 7.9% |

| VGR | UPCOM | September 18th | 3/10 | 20% |

| PSE | HNX | September 18th | October 16th | 8% |

| VLC | UPCOM | September 19th | October 22nd | 6% |

| HTC | HNX | September 19th | September 30th | 3% |

| EIB | HOSE | September 19th | 4/10 | 3% |

| PVO | UPCOM | September 19th | October 15th | 1% |

| VTV | HNX | September 19th | October 24th | 1% |

| PTS | HNX | September 19th | 4/10 | 2% |

| PVT | HOSE | September 19th | 10/10 | 3% |

| PBT | UPCOM | September 19th | September 27th | 6.6% (2023) |

| PBT | UPCOM | September 19th | September 27th | 1.1% (in 2009) |

| NBP | HNX | September 20th | November 28 | 5% |

| ICG | HNX | September 20th | October 17th | 5% |

| SZL | HOSE | September 20th | 2/10 | 20% |

| BTH | UPCOM | September 20th | October 21st | 7% (in 2023) |

| BTH | UPCOM | September 20th | October 21st | 10% (in 2024) |

| BAL | UPCOM | September 20th | October 23 | 7% |

| GH3 | UPCOM | September 20th | October 24th | 4.3% |

| HAT | HNX | September 20th | October 23 | 30% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-16-20-9-mot-so-nu-lanh-dao-ban-manh-co-phieu-20240916064308682.htm

Comment (0)