Domestic gold price today April 9, 2025

At the time of survey at 4:30 a.m. on April 9, 2025, the domestic gold price increased beyond the 100 million VND mark. Specifically:

DOJI Group listed the price of SJC gold bars at 97.7-100.2 million VND/tael (buy - sell), an increase of 600 thousand VND/tael for buying and an increase of 100 thousand VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed at 97.7-100.2 million VND/tael (buy - sell), an increase of 600 thousand VND/tael for buying and an increase of 100 thousand VND/tael for selling. The difference between buying and selling prices was at 2.5 million VND/tael.

SJC gold price at Bao Tin Minh Chau Company Limited listed SJC gold bar price at 97.8-100.2 million VND/tael (buy - sell), increased by 500 thousand VND/tael for buying and increased by 100 thousand VND/tael for selling. The difference between buying and selling price is at 2.4 million VND/tael.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 97.7-100.2 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 100 thousand VND/tael for selling. The difference between buying and selling is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98-100.3 million VND/tael (buy - sell), an increase of 400 thousand VND/tael for buying and unchanged for selling. The difference between buying and selling is 2.3 million VND/tael.

The latest gold price list today, April 9, 2025 is as follows:

| Gold price today | April 9, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 97.7 | 100.2 | +600 | +100 |

| DOJI Group | 97.7 | 100.2 | +600 | +100 |

| Red Eyelashes | 99.4 | 100.4 | +700 | -300 |

| PNJ | 97.7 | 100.2 | +600 | +100 |

| Vietinbank Gold | 100.2 | +100 | ||

| Bao Tin Minh Chau | 97.8 | 100.2 | +500 | +100 |

| Phu Quy | 97.7 | 100.2 | +400 | +100 |

| 1. DOJI - Updated: April 9, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 97,700 ▲600K | 100,200 ▲100K |

| AVPL/SJC HCM | 97,700 ▲600K | 100,200 ▲100K |

| AVPL/SJC DN | 97,700 ▲600K | 100,200 ▲100K |

| Raw material 9999 - HN | 97,500 ▲1000K | 99,300 ▲100K |

| Raw material 999 - HN | 97,400 ▲1000K | 99,200 ▲100K |

| 2. PNJ - Updated: April 9, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 9,770 | 10,020 |

| PNJ 999.9 Plain Ring | 9,770 | 10,020 |

| Kim Bao Gold 999.9 | 9,770 | 10,020 |

| Gold Phuc Loc Tai 999.9 | 9,770 | 10,020 |

| 999.9 gold jewelry | 9,760 | 10,010 |

| 999 gold jewelry | 9,750 | 10,000 |

| 9920 jewelry gold | 9,690 | 9,940 |

| 99 gold jewelry | 9,670 | 9,920 |

| 750 Gold (18K) | 7,273 | 7,523 |

| 585 Gold (14K) | 5,621 | 5,871 |

| 416 Gold (10K) | 3,929 | 4,179 |

| PNJ Gold - Phoenix | 9,770 | 10,020 |

| 916 Gold (22K) | 8,929 | 9,179 |

| 610 Gold (14.6K) | 5,871 | 6,121 |

| 650 Gold (15.6K) | 6,272 | 6,522 |

| 680 Gold (16.3K) | 6,572 | 6,822 |

| 375 Gold (9K) | 3,519 | 3,769 |

| 333 Gold (8K) | 3,068 | 3,318 |

| 3. SJC - Updated: 4/9/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 97,700 ▲600K | 100,200 ▲100K |

| SJC gold 5 chi | 97,700 ▲600K | 100,220 ▲100K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 97,700 ▲600K | 100,230 ▲100K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 97,600 ▲600K | 100,100 ▲100K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 97,600 ▲600K | 100,200 ▲100K |

| Jewelry 99.99% | 97,600 ▲600K | 99,800 ▲100K |

| Jewelry 99% | 95,811 ▲99K | 97,700 ▲99K |

| Jewelry 68% | 65,020 ▲68K | 97,700 ▲68K |

| Jewelry 41.7% | 38,770 ▲41K | 97,700 ▲41K |

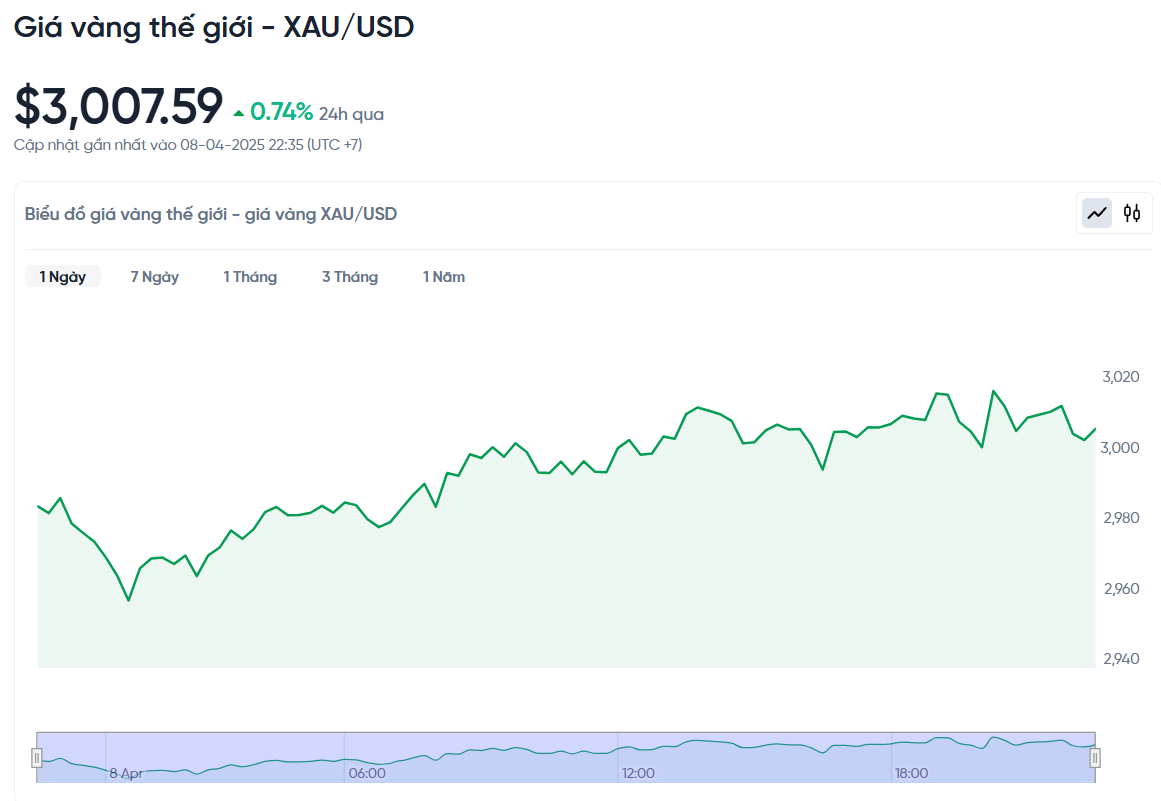

World gold price today April 9, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,007.59 USD/ounce. Today's gold price increased by 21.96 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,140 VND/USD), the world gold price is about 95.7 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 4.42 million VND/tael higher than the international gold price.

World gold prices have rebounded after hitting their lowest level in nearly four weeks. This development occurred in the context of global markets experiencing many fluctuations and concerns about widespread trade tensions, causing investors to rush to buy to seek opportunities from corrections.

Jigar Trivedi, an expert at Reliance Securities, said that although gold prices have fallen in recent sessions, the precious metal has shown strength and is likely to continue its upward trend. The market sentiment is still quite optimistic.

According to Goldman Sachs, the recent gold sell-off was mainly due to short-term technical factors. Many investors were forced to sell gold to cut losses when the stock market fell, and at the same time, they transferred money to other assets. However, in the medium term, Goldman Sachs still assessed that gold is very firmly supported. They believe that each time gold prices fall, it will be an opportunity to accumulate more.

Gold prices have risen about 15% so far this year, supported by sustained central bank buying and its status as a safe haven in times of economic and geopolitical uncertainty.

However, domestically, the large gap between buying and selling prices is a notable warning sign. If the world gold price reverses and decreases, short-term investors may have to bear a significant loss. Therefore, careful consideration before deciding to buy at this time is necessary.

Regarding trade policy, US President Donald Trump still maintains a tough stance with partners. He declared that he has no intention of delaying the imposition of tariffs, but is still ready to negotiate with China, Japan and a number of other countries.

Investors are closely watching the minutes of the latest Federal Reserve meeting, due to be released on Wednesday. The market will then pay attention to two important reports: the Consumer Price Index (CPI) on Thursday and the Producer Price Index (PPI) on Friday. These data will help shape expectations for the Fed's next interest rate policy.

Futures are currently pricing in expectations that the Fed will cut interest rates by about 96 basis points between now and the end of 2025. In that context, gold, which is sensitive to interest rates, could still benefit from a more dovish monetary policy.

Besides gold, other precious metals also recorded gains. Silver prices rose 0.4% to $30.23 an ounce, platinum rose 1.3% to $925.33, while palladium fell slightly by 0.5% to $914.18.

Gold Price Forecast

Technically, the bulls in the gold market still have the upper hand in the short term. Recent developments show that selling pressure has weakened significantly. The immediate target for the bulls is to push the gold price above the strong resistance level at $3,201/ounce. Meanwhile, if the price corrects lower, the strong support zone to watch is around $2,950. The two important price levels now are the resistance zone around $3,050 and the support zone at $3,000.

Manav Modi of Motilal Oswal said the market panicked earlier this week over rumours that President Trump would hold off on tariffs to negotiate with other countries. However, the rumours were untrue. Soon after, concerns about a global trade war resurfaced, boosting safe-haven demand and sending gold prices soaring.

Experts James Steel said that the factors that caused gold to surge in the late 1970s, such as the Iranian revolution and the oil crisis, were resolved relatively quickly, leading to only short-term increases in gold. But now, the lack of cooperation between major countries is keeping gold prices high for a long time, reflecting the increasingly clear geopolitical demand for safe havens.

Unlike previous crises that often saw coordinated responses from major economies, there is no sign of a common global solution to ease trade tensions, according to expert George Griffiths from AMT Futures.

While gold has surpassed several historical highs, there is one milestone yet to be reached: $850 an ounce in January 1980, or about $3,486 in today’s money. While gold has set a new record in nominal terms, it is not necessarily so in real terms, adjusted for inflation, according to Rhona O’Connell of StoneX.

Bank of America strategist Michael Widmer recently raised his gold price forecast to $3,063 in 2025 and $3,350 in 2026. He even believes that gold could hit $3,500 within the next two years. However, he acknowledged that $3,500 is a challenging target, as the conditions for gold to maintain its current strong rally require a lot of persistent uncertainty.

This week, investors will be watching the minutes of the US Federal Reserve's policy meeting, as well as important economic indicators such as CPI and PPI. In addition, the interest rate decision of the Central Bank of India (RBI) is also closely watched, as it could affect global gold price trends.

Adrian Day, chairman of Adrian Day Asset Management, said that gold prices may fall in the short term. However, the decline will not be deep and will not last long. He emphasized that the factors supporting gold over the past two years have not only not disappeared but have become clearer, continuing to promote the long-term upward trend.

Kevin Grady, president of Phoenix Futures and Options, predicts that the gold market may remain under pressure in the short term. He believes that gold prices can only recover sustainably if they can separate themselves from the volatility of the stock market, which is being negatively affected by recession fears.

Source: https://baoquangnam.vn/gia-vang-hom-nay-9-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-vi-thuong-chien-my-trung-3152324.html

![[Photo] Party and State leaders meet with representatives of all walks of life](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/24/66adc175d6ec402d90093f0a6764225b)

![[Photo] Phu Quoc: Propagating IUU prevention and control to the people](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/24/f32e51cca8bf4ebc9899accf59353d90)

Comment (0)