In a recent investor commentary, Petri Deryng, head of PYN Elite Fund, reviewed the factors driving the recent upward trend of the Vietnamese stock market.

First, the tariff agreement framework between the US and Vietnam shows promising signs, although the specific effective tariff rates for each item have not yet been officially announced.

Next, the upcoming FTSE upgrade is bolstered by the ongoing modernization of the Vietnamese stock market, increasing expectations of an upgrade to emerging market (EM) status.

Globally , the US Federal Reserve (FED) is projected to begin a cycle of interest rate cuts within the next 6–12 months. This will positively support the Vietnamese bond market and contribute to a stronger VND.

In Vietnam, the economy achieved an 8% GDP growth rate, coupled with supportive government policies that are boosting growth through major infrastructure projects, VAT reductions, accelerated real estate licensing, and expanded bank credit.

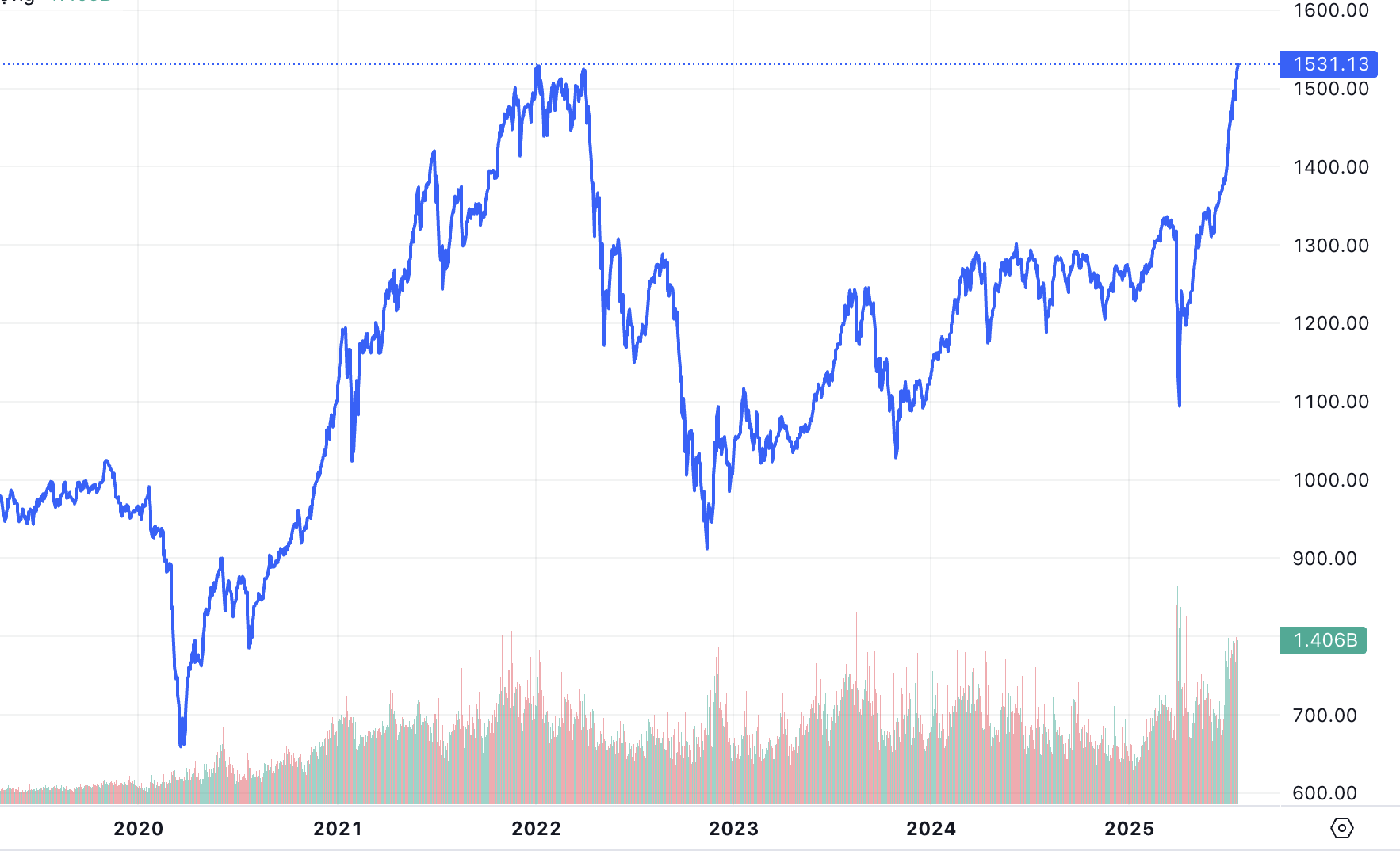

On the stock market, the VN-Index has surpassed the 1,500-point mark. Foreign investors have returned to net buying following news about US tariffs, although the cumulative net buying volume remains negative since the beginning of the year. The market may continue its upward trend, supported by low valuations, strong sentiment, and a solid foundation, according to the assessment of PYN Elite Fund managers.

Mr. Petri Dyring stated that the current market growth is not entirely uniform. For example, within the fund's portfolio, securities company stocks have risen sharply, and Vietnam Airlines ' HVN shares have also seen good growth. Banking stocks have increased at a lower rate. Meanwhile, some investments in the portfolio have yet to "take off."

PYN Elite Fund has noted forecasts from securities companies suggesting that the VN-Index could reach 1,800 points by the end of this year.

"We don't consider this an impossible scenario, although profit-taking by domestic investors may occasionally cause sharp corrections," Petri Dyring said, offering a positive assessment of market index growth and affirming that the Vietnamese stock market could continue its outstanding growth.

|

| The VN-Index has surpassed its previous peak after a 3.5-year wait. |

Meanwhile, at the close of trading on July 25, 2025, the VN-Index had just added another 10 points to reach 1,531.13 points, officially surpassing its all-time high (based on closing price). The total trading value on the HoSE reached 35,903 billion VND.

Source: https://baodautu.vn/kich-ban-vn-index-nam-2025-dat-1800-diem-khong-he-bat-kha-thi-d341105.html

![[Photo] Prime Minister Pham Minh Chinh attends the Conference on the Implementation of Tasks for 2026 of the Industry and Trade Sector](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F19%2F1766159500458_ndo_br_shared31-jpg.webp&w=3840&q=75)

Comment (0)