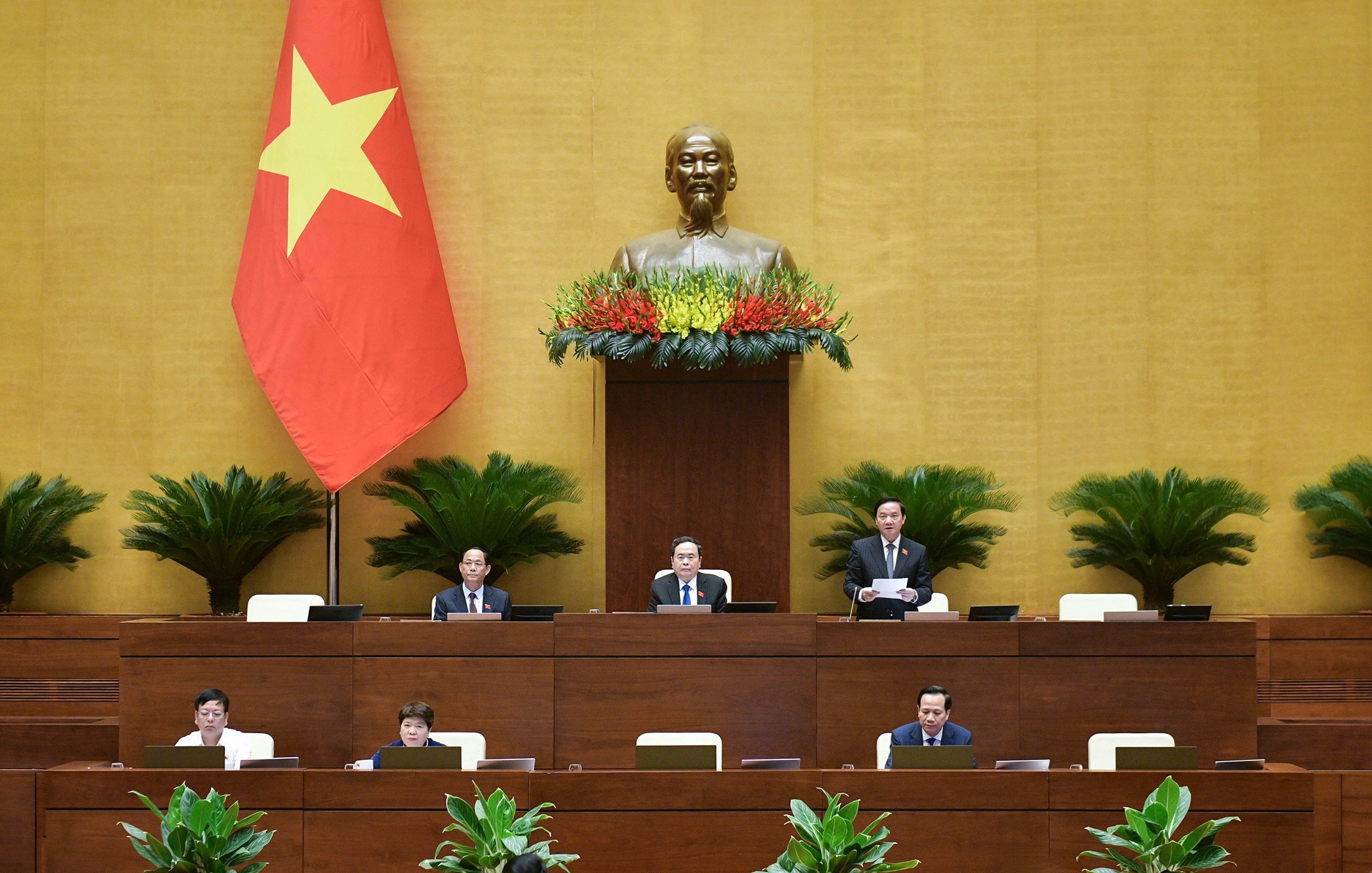

Continuing the 7th Session of the 15th National Assembly, on the morning of May 27 at the National Assembly House, under the chairmanship of National Assembly Chairman Tran Thanh Man , the National Assembly held a plenary session in the hall, discussing a number of contents with different opinions of the draft Law on Social Insurance (amended). Vice Chairman of the National Assembly Nguyen Khac Dinh chaired the meeting.

Continuing the 7th Session of the 15th National Assembly , on the morning of May 27 at the National Assembly House, under the chairmanship of National Assembly Chairman Tran Thanh Man, the National Assembly held a plenary session in the hall, discussing a number of contents with different opinions of the draft Law on Social Insurance (amended). Vice Chairman of the National Assembly Nguyen Khac Dinh chaired the meeting.

7th Session, 15th National Assembly

At the meeting, the National Assembly listened to Member of the National Assembly Standing Committee, Chairwoman of the National Assembly's Committee on Social Affairs Nguyen Thuy Anh present a Report on explanation, acceptance and revision of the draft Law on Social Insurance (amended). After the National Assembly discussed a number of contents with different opinions of the draft Law on Social Insurance (amended), the submitting agency and the agency in charge of the review coordinated to explain and clarify a number of issues raised by National Assembly deputies. The National Assembly's Electronic Information Portal will continuously update the content of the meeting... 09:21: Delegate Nguyen Thi Thu Thuy - Delegation of National Assembly deputies of Binh Dinh province: Need to complete and supplement in the direction of protecting the rights of workers as the top priority. Through studying the draft Law on Social Insurance (amended), delegate Nguyen Thi Thu Thuy realized that the Drafting Committee had fully absorbed the opinions of National Assembly deputies at the previous session and expressed agreement with the Review Report of the Committee on Social Affairs. Regarding the protection of employees' rights when handling violations of social insurance, health insurance and bankruptcy procedures, the delegate said that, in order of priority, based on Article 54 of the Bankruptcy Law 2014, the costs that enterprises need to prioritize payment: costs of enterprise administrators, auditing costs, asset liquidation costs...; payment of salary debts, severance pay, social insurance, health insurance for employees and other benefits according to the labor contract that the company has signed... Therefore, the delegate said that caring for, protecting, creating long-term benefits for employees, building stable and sustainable labor relations is a vital factor to help businesses develop sustainably.

Regarding the protection of employees' rights when handling violations of social insurance, health insurance and bankruptcy procedures, the delegate said that, in order of priority, based on Article 54 of the Bankruptcy Law 2014, the costs that enterprises need to prioritize payment: costs of enterprise administrators, auditing costs, asset liquidation costs...; payment of salary debts, severance pay, social insurance, health insurance for employees and other benefits according to the labor contract that the company has signed... Therefore, the delegate said that caring for, protecting, creating long-term benefits for employees, building stable and sustainable labor relations is a vital factor to help businesses develop sustainably.  From Article 37 to Article 40, the delegate found that the draft Law clearly stipulated, in line with the current context, the principle is to handle violations to the extent of the violation. Regarding the contents related to the specific mechanism in Article 41, delegate Nguyen Thi Thu Thuy said that this is a process of implementing social insurance in line with point a, clause 1, Article 54 on the order of asset division in the Bankruptcy Law 2014. Therefore, the delegate suggested that the Drafting Committee continue to research, perfect and supplement in the direction of protecting the rights of employees in any case, they are considered as the top priority subjects, must carry out legal procedures on bankruptcy and handle violations of social insurance and health insurance with enterprises.

From Article 37 to Article 40, the delegate found that the draft Law clearly stipulated, in line with the current context, the principle is to handle violations to the extent of the violation. Regarding the contents related to the specific mechanism in Article 41, delegate Nguyen Thi Thu Thuy said that this is a process of implementing social insurance in line with point a, clause 1, Article 54 on the order of asset division in the Bankruptcy Law 2014. Therefore, the delegate suggested that the Drafting Committee continue to research, perfect and supplement in the direction of protecting the rights of employees in any case, they are considered as the top priority subjects, must carry out legal procedures on bankruptcy and handle violations of social insurance and health insurance with enterprises.  Regarding the measures to handle violations of slow and evasive social insurance payments by enterprises as stipulated in Articles 37 to 40, delegate Nguyen Thi Thu Thuy noted that the Drafting Committee has accepted and revised the draft Law on Social Insurance (amended) in the direction of maximum protection of employees' rights. However, there is a lack of compatibility between the Law on Health Insurance and the draft Law on Social Insurance (amended) this time. Therefore, the delegate suggested that the Drafting Committee should study and clearly define the responsibilities of State management agencies on insurance and the responsibilities of enterprises to ensure that the rights of employees are not affected in handling or imposing sanctions on violating enterprises. 9:15: Delegate Dao Chi Nghia - Delegation of National Assembly Deputies of Can Tho City: Proposed to add a regulation that employers are responsible for reporting the status of social insurance payments for employees. Delegate Dao Chi Nghia basically agreed with the report on acceptance, explanation and revision of the draft Law of the National Assembly Standing Committee. Commenting on the subjects participating in compulsory social insurance and voluntary social insurance, the delegate said that the current scope of regulation stipulated in the draft law is very broad, making it difficult for the authorities to manage. There is currently no database on labor, so the feasibility is not high. Therefore, it is recommended to study this content more clearly to ensure feasibility.

Regarding the measures to handle violations of slow and evasive social insurance payments by enterprises as stipulated in Articles 37 to 40, delegate Nguyen Thi Thu Thuy noted that the Drafting Committee has accepted and revised the draft Law on Social Insurance (amended) in the direction of maximum protection of employees' rights. However, there is a lack of compatibility between the Law on Health Insurance and the draft Law on Social Insurance (amended) this time. Therefore, the delegate suggested that the Drafting Committee should study and clearly define the responsibilities of State management agencies on insurance and the responsibilities of enterprises to ensure that the rights of employees are not affected in handling or imposing sanctions on violating enterprises. 9:15: Delegate Dao Chi Nghia - Delegation of National Assembly Deputies of Can Tho City: Proposed to add a regulation that employers are responsible for reporting the status of social insurance payments for employees. Delegate Dao Chi Nghia basically agreed with the report on acceptance, explanation and revision of the draft Law of the National Assembly Standing Committee. Commenting on the subjects participating in compulsory social insurance and voluntary social insurance, the delegate said that the current scope of regulation stipulated in the draft law is very broad, making it difficult for the authorities to manage. There is currently no database on labor, so the feasibility is not high. Therefore, it is recommended to study this content more clearly to ensure feasibility.  Regarding the responsibilities of employers in Article 12, delegate Dao Chi Nghia proposed adding a provision that employers are responsible for reporting the status of social insurance payments for employees quarterly to competent authorities to ensure the rights of employees. This is also a form of inspection and supervision of social insurance payments for employees.

Regarding the responsibilities of employers in Article 12, delegate Dao Chi Nghia proposed adding a provision that employers are responsible for reporting the status of social insurance payments for employees quarterly to competent authorities to ensure the rights of employees. This is also a form of inspection and supervision of social insurance payments for employees.  Regarding the responsibility of the social insurance agency in Article 17, delegate Dao Chi Nghia said that the regulation on the time for the social insurance agency to report to the Social Insurance Management Council, the Ministry of Labor, War Invalids and Social Affairs, the Ministry of Health, the Ministry of Finance , and the People's Committee at the same level on the situation and issues related to social insurance and periodically assess the ability to balance the Pension and Death Fund in the report on the management of the Social Insurance Fund every 5 years is too long and does not promptly handle existing problems. Therefore, the delegate proposed to reduce the time prescribed in this Article in the direction: The social insurance agency periodically reports to the management agency every 3 months, reports to the Ministry of Labor, War Invalids and Social Affairs and related Ministries every 6 months; reports to the People's Committee at the same level every 6 months and periodically assesses and forecasts the ability to balance the fund every 3 years.

Regarding the responsibility of the social insurance agency in Article 17, delegate Dao Chi Nghia said that the regulation on the time for the social insurance agency to report to the Social Insurance Management Council, the Ministry of Labor, War Invalids and Social Affairs, the Ministry of Health, the Ministry of Finance , and the People's Committee at the same level on the situation and issues related to social insurance and periodically assess the ability to balance the Pension and Death Fund in the report on the management of the Social Insurance Fund every 5 years is too long and does not promptly handle existing problems. Therefore, the delegate proposed to reduce the time prescribed in this Article in the direction: The social insurance agency periodically reports to the management agency every 3 months, reports to the Ministry of Labor, War Invalids and Social Affairs and related Ministries every 6 months; reports to the People's Committee at the same level every 6 months and periodically assesses and forecasts the ability to balance the fund every 3 years.  Regarding measures to handle violations of late payment of compulsory social insurance, delegate Dao Chi Nghia proposed to add a regulation requiring competent authorities to notify employees of the names and addresses of businesses that are late in paying or evading social insurance on mass media, as well as update the database systems of referral centers and job brokers... so that employees have full information before making a decision to work. This regulation also aims to increase warning, deterrence and transparency of information. Regarding one-time social insurance, delegate Dao Chi Nghia agreed with option 2. The delegate said that although this option does not end the situation of one-time withdrawal of social insurance, it ensures the right to choose of social insurance participants; keeps employees participating in social insurance for a long time and in the long term, employees will be guaranteed social security. 9:08: Delegate Bui Thi Quynh Tho - National Assembly Delegation of Ha Tinh Province Speaking at the meeting, delegate Bui Thi Quynh Tho expressed her basic agreement with the Report on explanation, acceptance and revision of the draft Law. The draft Law submitted to the National Assembly at the 7th Session has incorporated the opinions of the National Assembly deputies.

Regarding measures to handle violations of late payment of compulsory social insurance, delegate Dao Chi Nghia proposed to add a regulation requiring competent authorities to notify employees of the names and addresses of businesses that are late in paying or evading social insurance on mass media, as well as update the database systems of referral centers and job brokers... so that employees have full information before making a decision to work. This regulation also aims to increase warning, deterrence and transparency of information. Regarding one-time social insurance, delegate Dao Chi Nghia agreed with option 2. The delegate said that although this option does not end the situation of one-time withdrawal of social insurance, it ensures the right to choose of social insurance participants; keeps employees participating in social insurance for a long time and in the long term, employees will be guaranteed social security. 9:08: Delegate Bui Thi Quynh Tho - National Assembly Delegation of Ha Tinh Province Speaking at the meeting, delegate Bui Thi Quynh Tho expressed her basic agreement with the Report on explanation, acceptance and revision of the draft Law. The draft Law submitted to the National Assembly at the 7th Session has incorporated the opinions of the National Assembly deputies.  Regarding specific issues, the draft Law has expanded a number of subjects participating in compulsory social insurance, including registered business owners, business managers, unpaid cooperative and cooperative union operators, etc. Through research, delegates said that according to the provisions in the draft Law, business owners and unpaid business managers, cooperative and cooperative union operators will have to shoulder two roles, being both employees and employers, and must contribute a total of 25%.

Regarding specific issues, the draft Law has expanded a number of subjects participating in compulsory social insurance, including registered business owners, business managers, unpaid cooperative and cooperative union operators, etc. Through research, delegates said that according to the provisions in the draft Law, business owners and unpaid business managers, cooperative and cooperative union operators will have to shoulder two roles, being both employees and employers, and must contribute a total of 25%.  The delegate pointed out that the positive impact is that when the above subjects are expanded, there will be more people participating in social insurance and an increase in the social insurance fund. However, regarding the interests of the affected subjects, the Government 's impact assessment report only gives very qualitative comments, without data proving that this group of subjects has a need to participate in compulsory social insurance. Delegate Bui Thi Quynh Tho said that the drafting agency needs to organize to collect opinions from subjects affected by the draft Law, ensuring fairness between these subjects and other subjects paying social insurance, not for the purpose of increasing the number of people paying social insurance but ignoring the needs and wishes of the subjects. Along with that, it is necessary to study and consider whether the above subjects should participate in compulsory or voluntary social insurance.

The delegate pointed out that the positive impact is that when the above subjects are expanded, there will be more people participating in social insurance and an increase in the social insurance fund. However, regarding the interests of the affected subjects, the Government 's impact assessment report only gives very qualitative comments, without data proving that this group of subjects has a need to participate in compulsory social insurance. Delegate Bui Thi Quynh Tho said that the drafting agency needs to organize to collect opinions from subjects affected by the draft Law, ensuring fairness between these subjects and other subjects paying social insurance, not for the purpose of increasing the number of people paying social insurance but ignoring the needs and wishes of the subjects. Along with that, it is necessary to study and consider whether the above subjects should participate in compulsory or voluntary social insurance.  Regarding workers who work abroad under contract, the delegate said that in recent times, many social insurance agencies in localities have reported that it is very difficult to collect social insurance from these subjects. The delegate analyzed that these subjects may have to pay for another 12-15 years of social insurance after 3 to 5 years of working abroad if they want to enjoy social insurance, retirement and death benefits if they do not want to lose the amount they have paid. Therefore, it is necessary to have a flexible mechanism for applying compulsory social insurance and voluntary social insurance for Vietnamese workers who work abroad and return home in cases where their income is not stable and continuous, ensuring correct and sufficient collection while also meeting the rights of workers. 9:01: Delegate Nguyen Thi Yen Nhi - National Assembly Delegation of Ben Tre Province: It is necessary to add options on time off work to enjoy benefits when having pregnancy check-ups for employees. Delegate Nguyen Thi Yen Nhi agreed and agreed with the majority of the contents of the draft Law, highly appreciated the acceptance of the issues raised by the National Assembly Delegates, and commented at the 6th session and at the Conference of specialized National Assembly Delegates. To complete the draft Law, the delegates commented on a number of contents:

Regarding workers who work abroad under contract, the delegate said that in recent times, many social insurance agencies in localities have reported that it is very difficult to collect social insurance from these subjects. The delegate analyzed that these subjects may have to pay for another 12-15 years of social insurance after 3 to 5 years of working abroad if they want to enjoy social insurance, retirement and death benefits if they do not want to lose the amount they have paid. Therefore, it is necessary to have a flexible mechanism for applying compulsory social insurance and voluntary social insurance for Vietnamese workers who work abroad and return home in cases where their income is not stable and continuous, ensuring correct and sufficient collection while also meeting the rights of workers. 9:01: Delegate Nguyen Thi Yen Nhi - National Assembly Delegation of Ben Tre Province: It is necessary to add options on time off work to enjoy benefits when having pregnancy check-ups for employees. Delegate Nguyen Thi Yen Nhi agreed and agreed with the majority of the contents of the draft Law, highly appreciated the acceptance of the issues raised by the National Assembly Delegates, and commented at the 6th session and at the Conference of specialized National Assembly Delegates. To complete the draft Law, the delegates commented on a number of contents:  Regarding the time off work to enjoy the regime when having a pregnancy check-up, delegate Nguyen Thi Yen Nhi said that Article 53, Clause 1 stipulates: "During pregnancy, female workers are allowed to take time off work to go for a pregnancy check-up up to 5 times. The maximum time off work to enjoy the regime when having a pregnancy check-up is 2 days for 1 pregnancy check-up". In fact, through contact with voters who are workers and employees in enterprises, there are many opinions on this content. When pregnant female workers go for a routine pregnancy check-up, the doctor usually orders a re-examination after 30 days. However, according to current regulations and the draft Law, female workers are only allowed to take time off work to go for a pregnancy check-up up to 5 times. If the fetus develops normally, but if the fetus develops abnormally, the doctor will order a re-examination after 1 week, 10 days, 15 days,... for the doctor to monitor. Thus, the time prescribed in the draft Law and the current Law is only allowed to take no more than 5 breaks, which is too low for cases where the fetus is not developing normally. To ensure good health care conditions for pregnant female workers to work with peace of mind, delegates suggested that it is also necessary to consider and stipulate the option of taking a maximum of 5 breaks, each time not exceeding 2 days or increasing the number of prenatal check-ups to 9-10 times during pregnancy to ensure that female workers are fully monitored for the health of the fetus to develop well.

Regarding the time off work to enjoy the regime when having a pregnancy check-up, delegate Nguyen Thi Yen Nhi said that Article 53, Clause 1 stipulates: "During pregnancy, female workers are allowed to take time off work to go for a pregnancy check-up up to 5 times. The maximum time off work to enjoy the regime when having a pregnancy check-up is 2 days for 1 pregnancy check-up". In fact, through contact with voters who are workers and employees in enterprises, there are many opinions on this content. When pregnant female workers go for a routine pregnancy check-up, the doctor usually orders a re-examination after 30 days. However, according to current regulations and the draft Law, female workers are only allowed to take time off work to go for a pregnancy check-up up to 5 times. If the fetus develops normally, but if the fetus develops abnormally, the doctor will order a re-examination after 1 week, 10 days, 15 days,... for the doctor to monitor. Thus, the time prescribed in the draft Law and the current Law is only allowed to take no more than 5 breaks, which is too low for cases where the fetus is not developing normally. To ensure good health care conditions for pregnant female workers to work with peace of mind, delegates suggested that it is also necessary to consider and stipulate the option of taking a maximum of 5 breaks, each time not exceeding 2 days or increasing the number of prenatal check-ups to 9-10 times during pregnancy to ensure that female workers are fully monitored for the health of the fetus to develop well.  Regarding one-time social insurance, delegates proposed to choose Option 1, which is "Employees who have paid social insurance before the effective date of this Law, after 12 months are not subject to compulsory social insurance, do not participate in voluntary social insurance and have paid social insurance for less than 20 years". Delegate Nguyen Thi Yen Nhi said that Option 1 is to ensure the correct implementation of the principles of social insurance and ensure old age security for employees, limit complications in the organization and implementation, this option also received many supportive opinions during the consultation process and this is a safer option.

Regarding one-time social insurance, delegates proposed to choose Option 1, which is "Employees who have paid social insurance before the effective date of this Law, after 12 months are not subject to compulsory social insurance, do not participate in voluntary social insurance and have paid social insurance for less than 20 years". Delegate Nguyen Thi Yen Nhi said that Option 1 is to ensure the correct implementation of the principles of social insurance and ensure old age security for employees, limit complications in the organization and implementation, this option also received many supportive opinions during the consultation process and this is a safer option.

Prime Minister Pham Minh Chinh at the meeting.

In the long term, it is necessary to have a communication orientation on participating in social insurance to aim for a sustainable social security regime for workers in case of illness, work-related accidents - occupational diseases, health insurance, and pensions when they retire. Encouraging participation and not receiving one-time social insurance also depends on the socio- economic development situation, labor - employment. At the same time, it is necessary to research to have a credit support policy with preferential interest rates for workers who lose their jobs, are sick, ... to overcome immediate difficulties. Complaints and settlement of complaints; lawsuits against decisions and actions on social insurance of social insurance agencies. At Point b, Clause 3 of the draft Law stipulates: "The head of the social insurance agency at a higher level is responsible for resolving second-time complaints against decisions and administrative actions of the head of the directly subordinate social insurance agency that have been resolved for the first time but are still being complained about or the first-time complaint has expired but has not been resolved". Delegates suggested that continuing to inherit the regulations on the order of handling complaints about decisions and actions on social insurance in Clause 2 and Clause 3, Article 119 of the 2014 Law on Social Insurance would be more suitable to reality, that is, assigning the state management agency on labor (People's Committees at all levels) to handle the second complaint would be more objective and convincing. Regarding denunciations and handling of denunciations on social insurance (Article 132), Clause 2, Article 132 of the draft Law stipulates: "Denunciations of violations of the law by agencies, organizations and individuals in complying with the provisions of the law on social insurance before 1995, the state management agency on labor at the provincial level is responsible for handling on the basis of advice from the provincial social insurance agency". The delegate proposed to remove the phrase "based on the advice of the provincial social insurance agency" because it was not appropriate and said that in principle, the Law and specialized Laws only need to stipulate the authority and responsibility for handling complaints. 8:54: Delegate Tran Khanh Thu - National Assembly Delegation of Thai Binh province: Towards a sustainable social security regime for workers when they are sick or have work-related accidents Delegate Tran Khanh Thu assessed that the content of the draft Law is consistent with the Party's guidelines, policies and guidelines, consistent with the Constitution, ensuring consistency in the legal system. However, he suggested that the Drafting Committee continue to review to ensure consistency and consistency, based on scientific grounds, practicality, careful assessment, specific calculation, high predictability and codification of regulations on policies and laws on social insurance. The draft Law after being accepted and revised includes 11 Chapters and 147 Articles, adding 11 new articles and adjusting most of the articles.

Delegates suggested that continuing to inherit the regulations on the order of handling complaints about decisions and actions on social insurance in Clause 2 and Clause 3, Article 119 of the 2014 Law on Social Insurance would be more suitable to reality, that is, assigning the state management agency on labor (People's Committees at all levels) to handle the second complaint would be more objective and convincing. Regarding denunciations and handling of denunciations on social insurance (Article 132), Clause 2, Article 132 of the draft Law stipulates: "Denunciations of violations of the law by agencies, organizations and individuals in complying with the provisions of the law on social insurance before 1995, the state management agency on labor at the provincial level is responsible for handling on the basis of advice from the provincial social insurance agency". The delegate proposed to remove the phrase "based on the advice of the provincial social insurance agency" because it was not appropriate and said that in principle, the Law and specialized Laws only need to stipulate the authority and responsibility for handling complaints. 8:54: Delegate Tran Khanh Thu - National Assembly Delegation of Thai Binh province: Towards a sustainable social security regime for workers when they are sick or have work-related accidents Delegate Tran Khanh Thu assessed that the content of the draft Law is consistent with the Party's guidelines, policies and guidelines, consistent with the Constitution, ensuring consistency in the legal system. However, he suggested that the Drafting Committee continue to review to ensure consistency and consistency, based on scientific grounds, practicality, careful assessment, specific calculation, high predictability and codification of regulations on policies and laws on social insurance. The draft Law after being accepted and revised includes 11 Chapters and 147 Articles, adding 11 new articles and adjusting most of the articles.  Regarding the conditions for receiving one-time social insurance, delegates said that the two options proposed in the Draft Law are not optimal options, because they have not thoroughly resolved the situation of receiving one-time social insurance and have not created high consensus. In which, Option 1 has more advantages. To ensure the correct implementation of the principles of social insurance and ensure old-age security for workers, limit the arising of complications in the organization and implementation, Option 1 basically ensures the inheritance of current regulations, does not cause disruption in society, and limits the situation of a social insurance participant receiving one-time social insurance multiple times in the past. In the long term, new participants will no longer be entitled to one-time social insurance, so it contributes to increasing the number of people staying in the system to enjoy social insurance regimes from the accumulation process when participating in social insurance and reducing the burden on the whole society; gradually moving towards the universal principle of social insurance that when having a job and income, one must participate in social insurance to accumulate for the future when retiring in the context of increasing aging, our country has officially entered the stage of population aging.

Regarding the conditions for receiving one-time social insurance, delegates said that the two options proposed in the Draft Law are not optimal options, because they have not thoroughly resolved the situation of receiving one-time social insurance and have not created high consensus. In which, Option 1 has more advantages. To ensure the correct implementation of the principles of social insurance and ensure old-age security for workers, limit the arising of complications in the organization and implementation, Option 1 basically ensures the inheritance of current regulations, does not cause disruption in society, and limits the situation of a social insurance participant receiving one-time social insurance multiple times in the past. In the long term, new participants will no longer be entitled to one-time social insurance, so it contributes to increasing the number of people staying in the system to enjoy social insurance regimes from the accumulation process when participating in social insurance and reducing the burden on the whole society; gradually moving towards the universal principle of social insurance that when having a job and income, one must participate in social insurance to accumulate for the future when retiring in the context of increasing aging, our country has officially entered the stage of population aging.  The delegate also emphasized that in the coming time, there should be a communication orientation on participation in social insurance to aim for a sustainable social security regime for workers in case of illness, work-related accidents - occupational diseases, health insurance, and pensions when they retire. Encouraging participation and not receiving one-time social insurance also depends on the socio-economic development situation, labor - employment. At the same time, it is necessary to research to have a credit support policy with preferential interest rates for workers who lose their jobs, are sick, ... to overcome the current difficulties. 8:47: Delegate Tran Kim Yen - National Assembly Delegation of Ho Chi Minh City. Ho Chi Minh City: Business households should not be transferred to the group of compulsory social insurance participants. Delegate Tran Thi Kim Yen, concerned about the regulations on subjects participating in compulsory social insurance, added the case of being identified as an employee but the two parties did not sign a labor contract but had an agreement with a different name but the content was expressed in terms of paid work, salary and management, operation and supervision of one party, stipulated in a, clause 1, Article 3 of the draft law.

The delegate also emphasized that in the coming time, there should be a communication orientation on participation in social insurance to aim for a sustainable social security regime for workers in case of illness, work-related accidents - occupational diseases, health insurance, and pensions when they retire. Encouraging participation and not receiving one-time social insurance also depends on the socio-economic development situation, labor - employment. At the same time, it is necessary to research to have a credit support policy with preferential interest rates for workers who lose their jobs, are sick, ... to overcome the current difficulties. 8:47: Delegate Tran Kim Yen - National Assembly Delegation of Ho Chi Minh City. Ho Chi Minh City: Business households should not be transferred to the group of compulsory social insurance participants. Delegate Tran Thi Kim Yen, concerned about the regulations on subjects participating in compulsory social insurance, added the case of being identified as an employee but the two parties did not sign a labor contract but had an agreement with a different name but the content was expressed in terms of paid work, salary and management, operation and supervision of one party, stipulated in a, clause 1, Article 3 of the draft law.  According to the delegate, if the assessment is in essence in accordance with the provisions on labor contracts stipulated in the Labor Code (Article 13), however, in terms of form, labor contracts must be concluded in writing for contracts with a term of 1 month or more and ensure the basic contents according to the provisions of the Labor Code. Therefore, if it is determined that a labor relationship exists and the two parties have not performed in accordance with the provisions of the labor law, there must be timely adjustments. The implementation of insurance obligations must be determined and based on a legal labor contract. Only then can the inspection and supervision work be carried out well.

According to the delegate, if the assessment is in essence in accordance with the provisions on labor contracts stipulated in the Labor Code (Article 13), however, in terms of form, labor contracts must be concluded in writing for contracts with a term of 1 month or more and ensure the basic contents according to the provisions of the Labor Code. Therefore, if it is determined that a labor relationship exists and the two parties have not performed in accordance with the provisions of the labor law, there must be timely adjustments. The implementation of insurance obligations must be determined and based on a legal labor contract. Only then can the inspection and supervision work be carried out well.  Many opinions assess that this regulation will pave the way and indirectly recognize these types of contracts with other names, but in reality, many businesses have used this method to avoid fulfilling their obligations under the provisions of labor law. Therefore, if this type of labor contract is discovered, it is necessary to adjust the form and content, thereby clearly defining the obligations of the parties participating in the insurance. The drafting committee also needs to study and evaluate an additional subject that needs to be expanded in the provisions of the Law on Social Insurance, which is labor that does not choose time, for example, technology car workers. If according to Article 13 of the Labor Code, this subject is essentially a labor relationship, so it is necessary to add this as a subject that needs to participate in compulsory social insurance in the spirit of Resolution 28.

Many opinions assess that this regulation will pave the way and indirectly recognize these types of contracts with other names, but in reality, many businesses have used this method to avoid fulfilling their obligations under the provisions of labor law. Therefore, if this type of labor contract is discovered, it is necessary to adjust the form and content, thereby clearly defining the obligations of the parties participating in the insurance. The drafting committee also needs to study and evaluate an additional subject that needs to be expanded in the provisions of the Law on Social Insurance, which is labor that does not choose time, for example, technology car workers. If according to Article 13 of the Labor Code, this subject is essentially a labor relationship, so it is necessary to add this as a subject that needs to participate in compulsory social insurance in the spirit of Resolution 28.  The draft law also adds at point m, clause 1 of Article 3 that business owners of business households are required to register their business. The delegate believes that the nature of this group of subjects is different from that of salaried workers. This is a group of subjects that can be completely self-sufficient in income through production and business activities and proactive in finding financial solutions to ensure family life. Therefore, this group of subjects should not be transferred to compulsory social insurance but still be kept under voluntary social insurance. The delegate also proposed to add to Article 16 on the right to sue of social insurance agencies, because in reality, it has been shown that in the recent past when the Trade Union organization carried out the task of suing employers for violating social insurance laws, accessing and collecting evidence and accessing documents and data related to social insurance was very difficult. Delegates proposed to add policies to encourage people who want to have children, because Vietnam is experiencing a rapid population aging; at the same time, add policies to encourage people who want to have children, that is, add to the social insurance leave when going to see a doctor and receiving infertility treatment... 8:42: Delegate Nguyen Tri Thuc - Ho Chi Minh City National Assembly Delegation: Continue to research and clarify some provisions of the Draft Law on Social Insurance (amended). Delegate Nguyen Tri Thuc said that in Article 47 on recuperation and health recovery after illness, there are still unclear words such as: 10 days off for workers whose health has not recovered, 07 days for people who have not recovered after surgery,... Delegate Nguyen Tri Thuc assessed that this provision is still vague, so experts should be left to decide on each specific case.

The draft law also adds at point m, clause 1 of Article 3 that business owners of business households are required to register their business. The delegate believes that the nature of this group of subjects is different from that of salaried workers. This is a group of subjects that can be completely self-sufficient in income through production and business activities and proactive in finding financial solutions to ensure family life. Therefore, this group of subjects should not be transferred to compulsory social insurance but still be kept under voluntary social insurance. The delegate also proposed to add to Article 16 on the right to sue of social insurance agencies, because in reality, it has been shown that in the recent past when the Trade Union organization carried out the task of suing employers for violating social insurance laws, accessing and collecting evidence and accessing documents and data related to social insurance was very difficult. Delegates proposed to add policies to encourage people who want to have children, because Vietnam is experiencing a rapid population aging; at the same time, add policies to encourage people who want to have children, that is, add to the social insurance leave when going to see a doctor and receiving infertility treatment... 8:42: Delegate Nguyen Tri Thuc - Ho Chi Minh City National Assembly Delegation: Continue to research and clarify some provisions of the Draft Law on Social Insurance (amended). Delegate Nguyen Tri Thuc said that in Article 47 on recuperation and health recovery after illness, there are still unclear words such as: 10 days off for workers whose health has not recovered, 07 days for people who have not recovered after surgery,... Delegate Nguyen Tri Thuc assessed that this provision is still vague, so experts should be left to decide on each specific case.  In Article 53, regarding pregnancy examination, Delegate Nguyen Tri Thuc said that it should be divided into 02 groups: normal pregnancy and pathological pregnancy and in Article 54, there is no basis for dividing gestational age. Therefore, Delegate Nguyen Tri Thuc suggested that the Drafting Committee review these 02 Articles. Finally, in Section 1, Clause c, Article 74 stipulates that the subjects who are eligible to withdraw social insurance at one time are those who are suffering from one of the following diseases: cancer, paralysis, cirrhosis, severe tuberculosis, AIDS. Delegate Nguyen Tri Thuc suggested removing this clause because there are some diseases that can be completely treated and the employee can return to work normally. Delegate Nguyen Tri Thuc also said that the above concepts have not updated medical knowledge, if included in the Law it would be inappropriate. Therefore, Delegate Nguyen Tri Thuc suggested removing this clause and for each case, the working capacity should be determined and the working capacity should be determined by the Medical Assessment Council. 8:37: Delegate Tran Thi Thu Phuoc - National Assembly Delegation of Kon Tum province: Clarifying the impacts and influences of new policies

In Article 53, regarding pregnancy examination, Delegate Nguyen Tri Thuc said that it should be divided into 02 groups: normal pregnancy and pathological pregnancy and in Article 54, there is no basis for dividing gestational age. Therefore, Delegate Nguyen Tri Thuc suggested that the Drafting Committee review these 02 Articles. Finally, in Section 1, Clause c, Article 74 stipulates that the subjects who are eligible to withdraw social insurance at one time are those who are suffering from one of the following diseases: cancer, paralysis, cirrhosis, severe tuberculosis, AIDS. Delegate Nguyen Tri Thuc suggested removing this clause because there are some diseases that can be completely treated and the employee can return to work normally. Delegate Nguyen Tri Thuc also said that the above concepts have not updated medical knowledge, if included in the Law it would be inappropriate. Therefore, Delegate Nguyen Tri Thuc suggested removing this clause and for each case, the working capacity should be determined and the working capacity should be determined by the Medical Assessment Council. 8:37: Delegate Tran Thi Thu Phuoc - National Assembly Delegation of Kon Tum province: Clarifying the impacts and influences of new policies  Delegate Tran Thi Thu Phuoc expressed her high agreement with the draft Law on Social Insurance (amended) which has been absorbed and revised; at the same time, she said that the draft Law presented at this Session has ensured to meet both theoretical and practical requirements. According to the delegate, this is of great significance in the context of the domestic, regional and world economies facing many difficulties due to the consequences of the Covid-19 pandemic as well as world political conflicts that have greatly impacted the income and employment of workers...

Delegate Tran Thi Thu Phuoc expressed her high agreement with the draft Law on Social Insurance (amended) which has been absorbed and revised; at the same time, she said that the draft Law presented at this Session has ensured to meet both theoretical and practical requirements. According to the delegate, this is of great significance in the context of the domestic, regional and world economies facing many difficulties due to the consequences of the Covid-19 pandemic as well as world political conflicts that have greatly impacted the income and employment of workers...  Therefore, delegate Tran Thi Thu Phuoc said that it is necessary to clarify all aspects, especially the impacts and influences of the new policies proposed in the draft Law, while promoting the spirit of democracy, listening with a spirit of openness, sharing the difficulties and aspirations of workers. "Because for them, just one sentence, one word changed in the promulgated legal document will decide the issue of social security for the whole life.", delegate Phuoc said. 8:31: Delegate Vuong Thi Huong - National Assembly Delegation of Ha Giang province: Consider designing a way to calculate pensions with a sharing nature to support those with very low pensions

Therefore, delegate Tran Thi Thu Phuoc said that it is necessary to clarify all aspects, especially the impacts and influences of the new policies proposed in the draft Law, while promoting the spirit of democracy, listening with a spirit of openness, sharing the difficulties and aspirations of workers. "Because for them, just one sentence, one word changed in the promulgated legal document will decide the issue of social security for the whole life.", delegate Phuoc said. 8:31: Delegate Vuong Thi Huong - National Assembly Delegation of Ha Giang province: Consider designing a way to calculate pensions with a sharing nature to support those with very low pensions  Regarding the subjects participating in compulsory and voluntary social insurance stipulated in Article 3 of the draft Law, delegate Vuong Thi Huong said that Clause i and Clause n of Article 3 stipulate that the subjects participating in compulsory social insurance include business managers. According to Clause 24, Article 4 of the amended Law on Enterprises, business managers are private business managers and company managers include private business owners, general partners, Chairman of the Board of Members, members of the Board of Members, Chairman of the company, Chairman of the Board of Directors, members of the Board of Directors, Directors or General Directors and individuals holding other management positions as prescribed in the company's Charter. According to Clause 7, Article 3 of the Law on Management and Use of State Capital Invested in Production and Business at Enterprises, it is stipulated that: Business managers include Chairman and members of the Board of Members, Chairman of the company, General Director or Director, Deputy General Director or Deputy Director, Chief Accountant.

Regarding the subjects participating in compulsory and voluntary social insurance stipulated in Article 3 of the draft Law, delegate Vuong Thi Huong said that Clause i and Clause n of Article 3 stipulate that the subjects participating in compulsory social insurance include business managers. According to Clause 24, Article 4 of the amended Law on Enterprises, business managers are private business managers and company managers include private business owners, general partners, Chairman of the Board of Members, members of the Board of Members, Chairman of the company, Chairman of the Board of Directors, members of the Board of Directors, Directors or General Directors and individuals holding other management positions as prescribed in the company's Charter. According to Clause 7, Article 3 of the Law on Management and Use of State Capital Invested in Production and Business at Enterprises, it is stipulated that: Business managers include Chairman and members of the Board of Members, Chairman of the company, General Director or Director, Deputy General Director or Deputy Director, Chief Accountant.  Thus, the same term "business manager" has been interpreted differently in the two laws above. To unify the understanding and avoid arbitrary application in practice, delegate Vuong Thi Huong proposed to supplement the explanation of the term "business manager" to apply within the scope of this Law. Second, regarding the reduction of the minimum number of years of social insurance payment for participants to receive pensions from 25 to 15 years as prescribed in Article 68 of the draft Law, delegate Vuong Thi Huong affirmed: This policy aims to concretize Resolution No. 28 of the Central Executive Committee on reforming social insurance policies, which is consistent with the reality when our country's labor market is still in the early stages of development, creating opportunities for those who participate in social insurance late or have an intermittent participation process to have time to pay social insurance.

Thus, the same term "business manager" has been interpreted differently in the two laws above. To unify the understanding and avoid arbitrary application in practice, delegate Vuong Thi Huong proposed to supplement the explanation of the term "business manager" to apply within the scope of this Law. Second, regarding the reduction of the minimum number of years of social insurance payment for participants to receive pensions from 25 to 15 years as prescribed in Article 68 of the draft Law, delegate Vuong Thi Huong affirmed: This policy aims to concretize Resolution No. 28 of the Central Executive Committee on reforming social insurance policies, which is consistent with the reality when our country's labor market is still in the early stages of development, creating opportunities for those who participate in social insurance late or have an intermittent participation process to have time to pay social insurance.  However, because the monthly pension is calculated based on the time of contribution to the salary and income used as the basis for social insurance payment, reducing the condition on the time of social insurance payment will cause more cases of workers retiring with very low pensions, male workers only receive 33.75%. In addition, the draft Law no longer stipulates the lowest monthly pension as stipulated in Clause 5, Article 56 of the Social Insurance Law 2014. This is something that many workers are very concerned about and worry about, which could lead to the impoverishment of a segment of the population in the future. Therefore, it is recommended that the Drafting Committee consider designing a shared pension calculation method to support those with very low pensions so that these subjects can ensure their lives. 8:24: Delegate Le Thi Thanh Lam - Delegation of National Assembly Deputies of Hau Giang Province: Need to support groups of subjects participating in both compulsory and voluntary social insurance. Speaking at the meeting, delegate Le Thi Thanh Lam agreed with the necessity of promulgating the draft Law on Social Insurance (amended). In order to complete the draft Law, in Clause 5, Article 7, the delegate proposed to remove the phrase "voluntary" to achieve the goal of covering subjects participating in social insurance according to Resolution 28 of the Central Committee. The State Budget needs to support groups of subjects participating in both compulsory and voluntary social insurance depending on the budget balance capacity of each period. Regarding this issue, the law on health insurance has also had solutions from previous years and achieved the expected health insurance coverage rate.

However, because the monthly pension is calculated based on the time of contribution to the salary and income used as the basis for social insurance payment, reducing the condition on the time of social insurance payment will cause more cases of workers retiring with very low pensions, male workers only receive 33.75%. In addition, the draft Law no longer stipulates the lowest monthly pension as stipulated in Clause 5, Article 56 of the Social Insurance Law 2014. This is something that many workers are very concerned about and worry about, which could lead to the impoverishment of a segment of the population in the future. Therefore, it is recommended that the Drafting Committee consider designing a shared pension calculation method to support those with very low pensions so that these subjects can ensure their lives. 8:24: Delegate Le Thi Thanh Lam - Delegation of National Assembly Deputies of Hau Giang Province: Need to support groups of subjects participating in both compulsory and voluntary social insurance. Speaking at the meeting, delegate Le Thi Thanh Lam agreed with the necessity of promulgating the draft Law on Social Insurance (amended). In order to complete the draft Law, in Clause 5, Article 7, the delegate proposed to remove the phrase "voluntary" to achieve the goal of covering subjects participating in social insurance according to Resolution 28 of the Central Committee. The State Budget needs to support groups of subjects participating in both compulsory and voluntary social insurance depending on the budget balance capacity of each period. Regarding this issue, the law on health insurance has also had solutions from previous years and achieved the expected health insurance coverage rate.  In Clause 2, Article 43, delegate Le Thi Thanh Lam proposed to stipulate additional time off to take care of sick children, in case of children under 16 years old, or to stipulate that employees are entitled to sick leave according to the provisions in Point a, Clause 1, Article 44 and Clause 2, Article 44 of this Law. In Point b, Clause 1, Article 48, which stipulates "in case the patient dies at a medical examination and treatment facility, if there is a summary of the medical record", the delegate proposed to replace it with "certified copies or certified copies of documents proving the inpatient or semi-patient treatment process, or documents clearly stating the date of hospitalization". At the same time, it is suggested to consider the old regulations, replacing them with "copy of notice of death" to facilitate the proof process.

In Clause 2, Article 43, delegate Le Thi Thanh Lam proposed to stipulate additional time off to take care of sick children, in case of children under 16 years old, or to stipulate that employees are entitled to sick leave according to the provisions in Point a, Clause 1, Article 44 and Clause 2, Article 44 of this Law. In Point b, Clause 1, Article 48, which stipulates "in case the patient dies at a medical examination and treatment facility, if there is a summary of the medical record", the delegate proposed to replace it with "certified copies or certified copies of documents proving the inpatient or semi-patient treatment process, or documents clearly stating the date of hospitalization". At the same time, it is suggested to consider the old regulations, replacing them with "copy of notice of death" to facilitate the proof process.  In Clause 1, Article 53, delegate Le Thi Thanh Lam proposed to study increasing the minimum number of prenatal check-ups to 5 times, and the number of times can be more than 5 times in cases where there is an indication from a practitioner in a medical examination and treatment facility. 8:19: Vice Chairman of the National Assembly Nguyen Khac Dinh moderated and suggested some focused discussion contents. Moderating the discussion contents, Vice Chairman of the National Assembly Nguyen Khac Dinh said that the Draft Law on Social Insurance (amended) was discussed by the National Assembly at the 6th Session. Immediately after the Session, the National Assembly Standing Committee directed the agency in charge of the review to coordinate with the agency in charge of drafting and relevant agencies to organize research and survey activities to collect opinions from directly affected subjects, experts, and scientists to absorb, explain, and revise the draft law submitted to the National Assembly.

In Clause 1, Article 53, delegate Le Thi Thanh Lam proposed to study increasing the minimum number of prenatal check-ups to 5 times, and the number of times can be more than 5 times in cases where there is an indication from a practitioner in a medical examination and treatment facility. 8:19: Vice Chairman of the National Assembly Nguyen Khac Dinh moderated and suggested some focused discussion contents. Moderating the discussion contents, Vice Chairman of the National Assembly Nguyen Khac Dinh said that the Draft Law on Social Insurance (amended) was discussed by the National Assembly at the 6th Session. Immediately after the Session, the National Assembly Standing Committee directed the agency in charge of the review to coordinate with the agency in charge of drafting and relevant agencies to organize research and survey activities to collect opinions from directly affected subjects, experts, and scientists to absorb, explain, and revise the draft law submitted to the National Assembly.  The Vice Chairman of the National Assembly stated that the Standing Committee of the National Assembly recognized that this is a draft law with many large, complex, specialized, highly socialized contents, and a very wide range of direct impacts. The Standing Committee of the National Assembly and the National Assembly Chairmen and Vice Chairmen have chaired many meetings with relevant agencies and organizations to provide comments to complete the draft law to be submitted to the National Assembly. Up to now, the draft law has been received and revised on the basis of maximum acceptance and specific explanation of the opinions of National Assembly deputies and relevant agencies and organizations. The Vice Chairman of the National Assembly requested that National Assembly deputies focus on giving comments on the key issues mentioned in the report and the issues of concern to National Assembly deputies. 8:01: Member of the National Assembly Standing Committee, Chairwoman of the National Assembly's Social Affairs Committee Nguyen Thuy Anh presented a report explaining, accepting and revising the draft Law on Social Insurance (amended). Reporting at the Session on the conditions for receiving one-time social insurance for people who are not old enough to receive pension, do not continue to pay social insurance, have not paid social insurance for twenty years and have a request to receive one-time social insurance, Chairwoman of the Social Affairs Committee Nguyen Thuy Anh said that at the 6th session, the Government presented two options to the National Assembly:

The Vice Chairman of the National Assembly stated that the Standing Committee of the National Assembly recognized that this is a draft law with many large, complex, specialized, highly socialized contents, and a very wide range of direct impacts. The Standing Committee of the National Assembly and the National Assembly Chairmen and Vice Chairmen have chaired many meetings with relevant agencies and organizations to provide comments to complete the draft law to be submitted to the National Assembly. Up to now, the draft law has been received and revised on the basis of maximum acceptance and specific explanation of the opinions of National Assembly deputies and relevant agencies and organizations. The Vice Chairman of the National Assembly requested that National Assembly deputies focus on giving comments on the key issues mentioned in the report and the issues of concern to National Assembly deputies. 8:01: Member of the National Assembly Standing Committee, Chairwoman of the National Assembly's Social Affairs Committee Nguyen Thuy Anh presented a report explaining, accepting and revising the draft Law on Social Insurance (amended). Reporting at the Session on the conditions for receiving one-time social insurance for people who are not old enough to receive pension, do not continue to pay social insurance, have not paid social insurance for twenty years and have a request to receive one-time social insurance, Chairwoman of the Social Affairs Committee Nguyen Thuy Anh said that at the 6th session, the Government presented two options to the National Assembly:  + Option 1: Employees are divided into two groups: Group 1, employees participating in social insurance before the Law takes effect (expected July 1, 2025), after 12 months are not subject to compulsory social insurance, do not participate in voluntary social insurance and have less than 20 years of social insurance payment. Group 2, employees who start participating in social insurance from the date the Law takes effect onwards, are not subject to the regulations on conditions for receiving one-time social insurance. + Option 2: Employees are partially resolved but not more than 50% of the total time contributed to the pension and death fund. The remaining social insurance payment period is reserved for employees to continue participating and enjoying social insurance regimes.

+ Option 1: Employees are divided into two groups: Group 1, employees participating in social insurance before the Law takes effect (expected July 1, 2025), after 12 months are not subject to compulsory social insurance, do not participate in voluntary social insurance and have less than 20 years of social insurance payment. Group 2, employees who start participating in social insurance from the date the Law takes effect onwards, are not subject to the regulations on conditions for receiving one-time social insurance. + Option 2: Employees are partially resolved but not more than 50% of the total time contributed to the pension and death fund. The remaining social insurance payment period is reserved for employees to continue participating and enjoying social insurance regimes.  The Chairman of the Social Committee said that the majority of opinions in the National Assembly Standing Committee agreed with Option 1 proposed by the Government and was also the opinion of the majority of workers in a number of localities that the agency in charge of the review sought opinions from. However, he suggested that the Government soon have a support plan and issue appropriate regulations, while promoting communication work so that workers understand the benefits of receiving monthly pensions instead of choosing to receive social insurance in a lump sum. “The National Assembly Standing Committee finds that this is a difficult issue, with many different opinions and directly related to the rights of many workers at present and when they reach retirement age. The National Assembly Standing Committee respectfully requests that National Assembly deputies continue to discuss and give further opinions on this issue as well as specific options to create consensus when submitting it to the National Assembly for approval,” emphasized Chairman of the Social Committee Nguyen Thuy Anh.

The Chairman of the Social Committee said that the majority of opinions in the National Assembly Standing Committee agreed with Option 1 proposed by the Government and was also the opinion of the majority of workers in a number of localities that the agency in charge of the review sought opinions from. However, he suggested that the Government soon have a support plan and issue appropriate regulations, while promoting communication work so that workers understand the benefits of receiving monthly pensions instead of choosing to receive social insurance in a lump sum. “The National Assembly Standing Committee finds that this is a difficult issue, with many different opinions and directly related to the rights of many workers at present and when they reach retirement age. The National Assembly Standing Committee respectfully requests that National Assembly deputies continue to discuss and give further opinions on this issue as well as specific options to create consensus when submitting it to the National Assembly for approval,” emphasized Chairman of the Social Committee Nguyen Thuy Anh.  Regarding electronic transactions in the field of social insurance, Chairwoman of the Social Affairs Committee Nguyen Thuy Anh said that, taking into account the opinions of National Assembly deputies, the draft Law has added principles on electronic transactions in the organization and implementation of social insurance. Regarding late payment of compulsory social insurance, evasion of compulsory social insurance and handling measures, the draft Law has been revised to clarify the content, separate the provisions on each act and handling measures for late payment and evasion of social insurance. The draft Law has also amended and supplemented the sanction of temporary suspension of exit according to the guidance on the application of the provisions of the Law on Exit and Entry of Vietnamese Citizens and the Law on Entry, Exit, Transit and Residence of Foreigners in Vietnam and has not yet prescribed the sanction of stopping the use of invoices for acts of late payment and evasion of social insurance.

Regarding electronic transactions in the field of social insurance, Chairwoman of the Social Affairs Committee Nguyen Thuy Anh said that, taking into account the opinions of National Assembly deputies, the draft Law has added principles on electronic transactions in the organization and implementation of social insurance. Regarding late payment of compulsory social insurance, evasion of compulsory social insurance and handling measures, the draft Law has been revised to clarify the content, separate the provisions on each act and handling measures for late payment and evasion of social insurance. The draft Law has also amended and supplemented the sanction of temporary suspension of exit according to the guidance on the application of the provisions of the Law on Exit and Entry of Vietnamese Citizens and the Law on Entry, Exit, Transit and Residence of Foreigners in Vietnam and has not yet prescribed the sanction of stopping the use of invoices for acts of late payment and evasion of social insurance.  Regarding the special mechanism to protect employees in case the employer is no longer able to pay social insurance for the employee, the draft Law has added a provision on a "special" mechanism to protect employees in case the employer absconds and is no longer able to pay social insurance for the employee. Regarding the subject of business household owners participating in compulsory social insurance, the National Assembly Standing Committee has directed to amend Clause 1 of Article 3 in the direction of "Business household owners of registered business households". Regarding complaints, denunciations and handling of violations of social insurance, the National Assembly Standing Committee has directed to amend the draft Law in the direction of adding a provision on handling complaints against decisions on administrative sanctions by social insurance agencies to be implemented similarly to handling complaints by state administrative agencies; Supplement and demonstrate in Clause 2, Article 132 that the settlement of denunciations for the period before 1995 is the responsibility of the provincial-level state labor management agency. Regarding the average salary used as the basis for social insurance contributions to calculate pensions, one-time allowances and salary adjustments used as the basis for compulsory social insurance contributions, the National Assembly Standing Committee finds that this is an issue directly related to millions of people who have, are and will receive pensions. Therefore, it needs to be considered comprehensively and thoroughly in the context of salary reform and the impact on pensioners at different times, in different regions and fields needs to be carefully assessed.

Regarding the special mechanism to protect employees in case the employer is no longer able to pay social insurance for the employee, the draft Law has added a provision on a "special" mechanism to protect employees in case the employer absconds and is no longer able to pay social insurance for the employee. Regarding the subject of business household owners participating in compulsory social insurance, the National Assembly Standing Committee has directed to amend Clause 1 of Article 3 in the direction of "Business household owners of registered business households". Regarding complaints, denunciations and handling of violations of social insurance, the National Assembly Standing Committee has directed to amend the draft Law in the direction of adding a provision on handling complaints against decisions on administrative sanctions by social insurance agencies to be implemented similarly to handling complaints by state administrative agencies; Supplement and demonstrate in Clause 2, Article 132 that the settlement of denunciations for the period before 1995 is the responsibility of the provincial-level state labor management agency. Regarding the average salary used as the basis for social insurance contributions to calculate pensions, one-time allowances and salary adjustments used as the basis for compulsory social insurance contributions, the National Assembly Standing Committee finds that this is an issue directly related to millions of people who have, are and will receive pensions. Therefore, it needs to be considered comprehensively and thoroughly in the context of salary reform and the impact on pensioners at different times, in different regions and fields needs to be carefully assessed.  Regarding social pension benefits, Chairwoman of the Social Committee Nguyen Thuy Anh said that in order to ensure that the social pension benefit level is appropriate for each period, the National Assembly Standing Committee has directed the revision and addition of the provisions in Clause 1, Article 21 in the direction: "Every 3 years, the Government shall review and propose adjustments to the social pension benefit level to report to the National Assembly when submitting the 3-year State Financial and Budget Plan". The Chairwoman of the Social Committee emphasized that the Draft Law after being received and revised includes 11 chapters and 147 articles (an increase of 1 chapter and 11 articles compared to the draft Law submitted by the Government) along with 15 new points. 8:00 a.m.: Vice Chairman of the National Assembly Nguyen Khac Dinh chaired the meeting. Chairing the meeting on May 27, Vice Chairman of the National Assembly Nguyen Khac Dinh said that according to the working program, the National Assembly will spend the whole day discussing the draft Law on Social Insurance (amended). Before proceeding with the discussion, the National Assembly listened to Member of the National Assembly Standing Committee, Chairwoman of the National Assembly's Social Committee Nguyen Thuy Anh present a Report on explanation, acceptance and revision of the draft Law on Social Insurance (amended).

Regarding social pension benefits, Chairwoman of the Social Committee Nguyen Thuy Anh said that in order to ensure that the social pension benefit level is appropriate for each period, the National Assembly Standing Committee has directed the revision and addition of the provisions in Clause 1, Article 21 in the direction: "Every 3 years, the Government shall review and propose adjustments to the social pension benefit level to report to the National Assembly when submitting the 3-year State Financial and Budget Plan". The Chairwoman of the Social Committee emphasized that the Draft Law after being received and revised includes 11 chapters and 147 articles (an increase of 1 chapter and 11 articles compared to the draft Law submitted by the Government) along with 15 new points. 8:00 a.m.: Vice Chairman of the National Assembly Nguyen Khac Dinh chaired the meeting. Chairing the meeting on May 27, Vice Chairman of the National Assembly Nguyen Khac Dinh said that according to the working program, the National Assembly will spend the whole day discussing the draft Law on Social Insurance (amended). Before proceeding with the discussion, the National Assembly listened to Member of the National Assembly Standing Committee, Chairwoman of the National Assembly's Social Committee Nguyen Thuy Anh present a Report on explanation, acceptance and revision of the draft Law on Social Insurance (amended).

Source: https://quochoi.vn/tintuc/Pages/tin-hoat-dong-cua-quoc-hoi.aspx?ItemID=87099

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

Comment (0)