Mr. Luong Van Tr. (residing in Long An ) mistakenly transferred 450 million VND to a stranger named Pham Duy A. in Ben Tre. After more than 4 months, Mr. Tr. is still struggling to get back the mistakenly transferred money.

On July 27, Mr. Tr. said that there was still no new information after he contacted the police of Duc Hoa district (Long An), where he opened an account, and filed a complaint to request the return of the mistakenly transferred money. At the same time, if Mr. Tr. sues the person who received the money by mistake, he will have to go to the People's Court of Giong Trom district ( Ben Tre ), where Mr. Pham Duy A. resides, to request the return of the mistakenly received money.

After the Lao Dong Newspaper reported the incident, some readers said they had mistakenly transferred money and tried to get it back but to no avail. Transferring money to someone else’s bank account by mistake often happens, causing inconvenience and trouble for both parties.

According to banks, normally, the account opening bank/remitting bank will coordinate with the beneficiary bank to support checking and recovering the mistakenly transferred money for the customer in the fastest time.

The mistakenly transferred money will be refunded to the customer as soon as the recipient agrees to refund and their account has enough balance for the beneficiary bank to transfer the money back. Problems will arise when the recipient of the mistakenly transferred money does not cooperate, does not agree to refund...

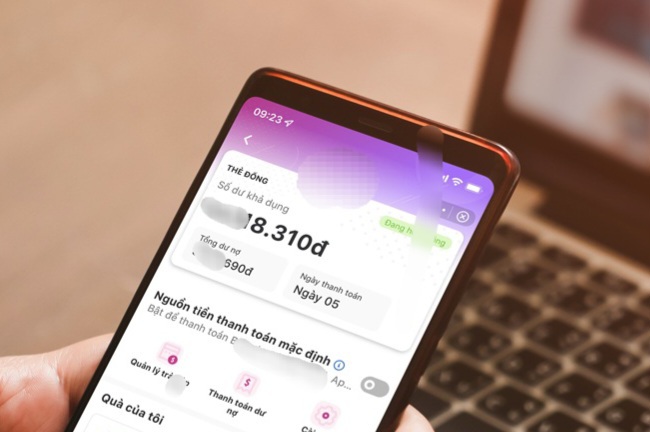

Online transactions are becoming more and more popular, banks advise users to be careful when transferring money.

Therefore, to avoid transferring money by mistake and losing money, Bank A. said that there are common mistakes that lead to transferring money by mistake. First, entering the wrong or missing characters in the beneficiary account number. Second, selecting the wrong beneficiary in the saved beneficiary list (for example, a beneficiary with the same name but different surname). Third, selecting the wrong beneficiary bank. Fourth, the customer's phone has the auto-fill/auto-correct function for data fields, so there may be a case where the customer enters number A but the phone automatically suggests (and corrects) it to number B but the customer does not pay attention.

"The transaction fell into the pending verification status, making the customer think the transaction failed, so the customer performed the transaction again. After the system synchronized the data, the first transaction was recorded as completed. Thus, the customer performed successfully and the account was deducted for both transactions," said a representative of bank A.

Meanwhile, S. Bank, where Mr. Luong Van Tr. made the wrong transfer, recommends that customers carefully check the beneficiary's information before making a money transfer, including: Full name, Account number, amount, and Beneficiary bank. Bank applications often have a screen that displays all of this information so that customers can check and confirm again before transferring to avoid the risk of transferring the wrong money.

"If you transfer money to someone else by mistake, immediately contact the transferring bank for instructions on the procedure to request a recall of the mistakenly transferred money. If the express transfer fails, immediately contact the transferring bank to confirm the final transaction status before re-transferring" - said a representative of S. Bank.

In addition, if there are signs of fraud, users should immediately contact the transferring bank for support in blocking the account, fixing it or limiting further damage. At the same time, contact the authorities to report the incident and handle it according to the law.

According to the general procedures of banks and regulations of Napas member organizations, in case of an erroneous money transfer, customers need to contact the bank that opened the account/the bank that transferred the money to request information verification as soon as they discover the erroneous transaction. These banks are responsible for checking and responding within a maximum of 30 days from the date of receiving the request.

Source

Comment (0)