Gold loses momentum to increase price

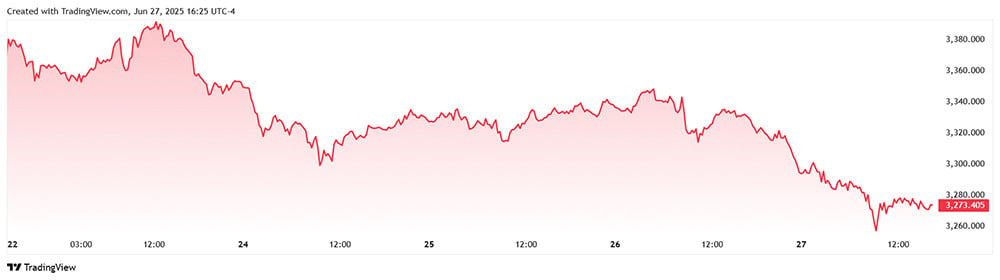

The gold market has just experienced a week of strong fluctuations, when the price of this precious metal fell sharply from a peak of 3,391 USD/ounce to 3,256 USD/ounce.

Gold opened the week at $3,380 an ounce. Gold tested support around $3,350 an ounce and then rebounded, hitting a weekly high of $3,391 an ounce by midday on Monday. However, support at $3,350 quickly turned into resistance within hours.

By Tuesday's session, gold prices plunged below $3,320 an ounce, breaking through the $3,300 an ounce mark for the first time this week when North American markets opened.

Despite efforts to recover in the next two days, maintaining in the range of 3,315-3,350 USD/ounce, the price of gold still could not overcome the resistance level. By the end of Thursday, the price of this precious metal fell back below 3,300 USD.

The biggest decline came on Friday, when gold continued to fall in Asian and European trading sessions, hitting a weekly low of $3,256 an ounce just before the North American market opened.

Despite a slight recovery to $3,275, gold prices then fluctuated within a narrow $10 range throughout the session, ending a turbulent week.

Gold's sharp decline last week was due to two main factors: geopolitical cooling and gloomy economic data.

Geopolitical concerns have not materialized, reducing the demand for safe haven gold, which has been the main driver of recent increases in gold prices.

In addition, economic data continues to show weakness, signaling a less optimistic outlook for global growth. In this environment, although gold is often viewed as a safe-haven asset, selling pressure from speculators as bond yields and the US dollar tend to stabilize has prevailed.

The decline continues

The gold market could be in for another challenging week as experts predict further declines.

Daniel Pavilonis, senior commodities broker at RJO Futures, said the gold market is witnessing a significant shift as factors that have supported the price of this precious metal gradually weaken.

Geopolitical and tariff concerns will continue to recede, Pavilonis said, even as expectations for Federal Reserve rate cuts and concerns about the agency's independence grow.

“I think a lot of the recent drivers of gold demand will start to subside and we could see lower oil prices. This suggests that gold’s safe-haven status is fading as global tensions ease,” Pavilonis said.

Pavilonis noted that he hasn’t seen strong gold buying in recent months. Instead, he’s starting to see some profit-taking, particularly as money flows into other metals like platinum and silver.

Gold prices have been moving sideways for the time being and rotation to other metals has become more dominant. Investor appetite has changed, they are looking for returns in other assets with higher growth potential.

"What drives money into and out of the dollar is the same reason that money flows into and out of gold as a safe haven. Things are becoming more normal and less money will flow into gold and into the dollar. The biggest driver of gold's recent rise has been the potential for an escalation of the conflict between Israel and Iran," he analyzed.

Regarding President Trump's recent comments about Fed Chairman Jerome Powell, Pavilonis downplayed the impact on gold or the dollar, calling it "political" and not really meaningful. Instead, he emphasized the importance of watching the yield curve.

Pavilonis expects gold prices to return to the 200-day moving average. The next downside target for gold would be around the 100-day moving average, which is around $3,175 or just below $3,200. This sets up a bearish scenario for the precious metal in the short term.

Alex Kuptsikevich, senior market analyst at FxPro, said that the many clear signs of weakness make it difficult for gold to recover in the short term. With sellers in control and momentum waning, it is likely that gold will continue to face downward pressure before any new gains.

Gold prices broke below key technical support at the 50-day moving average and are struggling to stay above $3,300. The failure to break above $3,500 and the lack of upside momentum have reinforced the bearish outlook in the short term.

Source: https://vietnamnet.vn/gia-vang-the-gioi-lao-doc-du-bao-sap-toi-ra-sao-2415999.html

![[Photo] Fall Fair 2025 - An attractive experience](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761791564603_1761738410688-jpg.webp)

![[Photo] Standing member of the Secretariat Tran Cam Tu visits and encourages people in the flooded areas of Da Nang](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761808671991_bt4-jpg.webp)

![[Photo] New-era Party members in the "Green Industrial Park"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/30/1761789456888_1-dsc-5556-jpg.webp)

Comment (0)