With the explosive development of 4.0 technology and the popularity of smartphones in daily life, mobile payment is becoming more and more popular and preferred. Grasping this trend, MB is the pioneer bank to deploy payment via VietQR code, Apple Pay and Google Pay, allowing users to make quick payments with just one touch or scan the code.

On May 18, in Hanoi , the State Bank of Vietnam (SBV) organized the Banking Industry Digital Transformation Day 2023 event, attended by Deputy Prime Minister Le Minh Khai and representatives of leaders of ministries and branches.

|

Deputy Prime Minister Le Minh Khai and representatives of ministries and branches at the event |

Speaking at the event, Governor of the State Bank of Vietnam Nguyen Thi Hong said that digital transformation is an inevitable trend and is a development priority of most countries in the world .

In Vietnam, the 13th National Congress's 10-year Socio-Economic Development Strategy for 2021-2030 emphasized "Fast and sustainable development based mainly on science and technology, innovation and digital transformation".

The head of the State Bank also said that, to date, many banks have more than 90% of customer transactions conducted on digital channels; about 74.63% of adults in Vietnam have bank accounts.

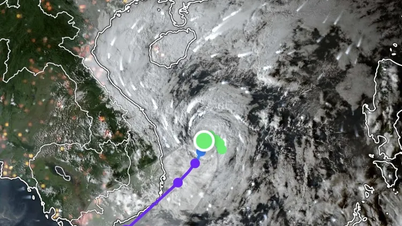

Compared to the same period in 2021, by the end of 2022, non-cash payment transactions increased by 89.05% in quantity and 32% in value. Of which, payments via QR code increased by 225.36% in quantity and 243.92% in value.

|

Mr. Luu Trung Thai, Chairman of MB Board of Directors attended the event. |

With the strength of digital transformation, Military Commercial Joint Stock Bank (MB) has pioneered in elevating cashless payments to a new level by early implementing payments via Google Pay, Apple Pay and VietQR codes.

At the exhibition, displaying simulations of outstanding and typical products and services in digital transformation (within the framework of the Banking Industry Digital Transformation Day event in 2023), MB representatives introduced and presented specifically about this modern form of payment as well as other outstanding products of MB such as the MB Hi Collection card collection (integrated 2 in 1 - credit card and ATM card).

“It only takes 10 seconds for a transaction”

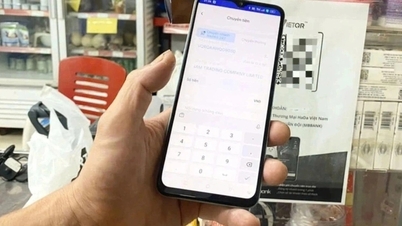

That is what the MB representative shared when talking about payment via Google Pay and Apple Pay. He said that Apple Pay and Google Pay use NFC (wireless short-range communication technology) for payment. Accordingly, customers only need to attach MB Visa card information to the Apple Pay or Google Pay application and bring their phone near the contactless payment device (also known as contactless), the transaction will be completed in seconds. In addition, customers can make convenient online payments through websites that accept Apple Pay and Google Pay.

In particular, this method has a high level of security and safety. When customers make transactions at POS, Apple Pay and Google Pay will require users to authenticate with TouchID (fingerprint), FaceID or PIN before payment is made. For online transactions, an OTP will be sent to the customer's phone number, then the bank will verify and process the payment.

|

It can be said that payment methods via Apple Pay and Google Pay promise to be a big boost for the "revolutionary shift" to cashless payments.

Also at the event, MB brought a payment solution using VietQR code on the MBBank App for small traders. This is a fast and convenient money transfer and receiving solution for shop owners and customers, as well as individuals who need to make frequent transactions.

In order to bring the most convenient experience to customers, MB launches many exclusive features such as sharing VietQR balance, convenient order tracking and management, super fast loan advance...

|

QR code scanning becomes a familiar payment method |

For the balance change sharing feature, the store owner can share the balance change to all employees. When there is a transaction to the master account, the balance change will be updated instantly and simultaneously on all shared devices.

Thanks to this, both employees and store owners can check customer payments without having to take photos, verify, and compare transactions. Customers also do not have to spend extra time waiting. Thanks to this, store owners can still ensure the safety and security of their accounts, avoid errors in transactions, and make it more convenient to manage revenue.

Source

![[Photo] Prime Minister Pham Minh Chinh receives President of Cuba's Latin American News Agency](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F01%2F1764569497815_dsc-2890-jpg.webp&w=3840&q=75)

Comment (0)