ANTD.VN - Although deposit interest rates have decreased sharply, deposits in the banking system are still increasing, although the growth rate has slowed down.

According to data from the State Bank, by the end of August, total deposits in the banking system had reached over VND12,446 trillion. This figure increased by more than VND147,500 billion compared to the previous month and increased by 4.04% compared to the beginning of the year.

Of these, residential deposits continued to maintain their growth momentum and reached an all-time high of over VND6,433 trillion, an increase of VND44 trillion compared to July.

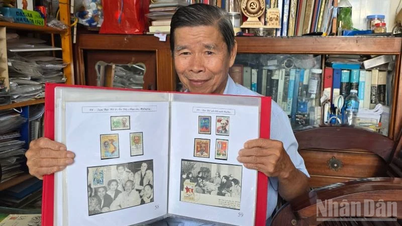

|

People are still actively depositing money into the banking system. |

Since the beginning of the year, residential deposits have increased sharply by 9.68%, equivalent to an increase of VND567,000 billion. In particular, people actively deposited money in banks in the first months of the year, when interest rates remained high. For example, residential deposits in January increased by VND177,300 billion; increased by VND137,000 billion in February; VND100,800 billion in March and increased by more than VND52,000 billion in April.

For the business sector, after a decline in July, businesses increased their deposits again in August. By the end of August, deposits from organizations reached VND6,013 trillion, an increase of VND103,500 billion compared to the previous month. However, due to continuous fluctuations, deposits from businesses and economic organizations have only increased by 1% since the beginning of the year.

Although deposits in the banking system have increased slowly, this is still a strange development when recently, deposit interest rates have continuously dropped very low.

Currently, the group of state-owned banks (accounting for nearly 50% of the deposit market share) are listing the lowest interest rates on the market. Of which, Vietcombank has just reduced its interest rate by another 0.2%, down to a maximum of 5.1%/year for terms of 12 months or more.

Three other state-owned banks, Agribank , VietinBank, and BIDV, still maintain the maximum interest rate of 5.3%/year for terms of 12 months or more.

The fact that interest rates are low but money is still flowing into banks can be explained by the fact that idle money lacks an effective investment channel. In particular, the real estate market is frozen, stocks have not really recovered, investing in gold is risky because domestic gold prices are much higher than world gold prices...

Source link

Comment (0)