How do businesses pay taxes?

Mr. H. (Binh Chanh District, Ho Chi Minh City) said that he is in the business of renting performance costumes, canvas, and loudspeakers. He registered to pay taxes according to the declaration method, with a value added tax (VAT) rate of 5% and a personal income tax rate of 2%, a total of 7% of revenue, because his rental service does not include supplies or materials.

"I keep clear records, declare everything fully, and pay taxes on all my income. If I earn 100 million VND a month, paying 7 million VND is in accordance with regulations," Mr. H. said.

According to him, although switching to monthly declarations adds more work, in return, it helps businesses manage their finances more clearly and makes it easier to work with corporate customers. At the same time, thanks to transparent books, he can easily calculate profits and losses, plan reasonable import plans and monitor business performance.

Mr. T. (a business owner in Go Vap, Ho Chi Minh City) said that his restaurant was determined by tax officials to have a fixed revenue of 1 billion VND/year. In the food and beverage industry, his business must pay a value added tax (VAT) of 3% and a personal income tax of 1.5%. This corresponds to a tax he must pay of 45 million VND/year.

Mr. T. said that initially, when he switched to filing taxes, he encountered many obstacles. However, this filing process brought some clear benefits. With complete records, he had better control over his cash flow and a firm grasp of his daily revenue instead of just selling as much as he could, as he did before.

Thanks to transparent accounting records, he can easily calculate profits and losses, plan inventory effectively, and monitor business performance. In the long run, operating in a systematic manner also helps him build credibility with suppliers and opens up the possibility of scaling up if needed.

“In the coming time, the tax I have to pay will be calculated monthly, equal to 4.5% of total revenue,” said Mr. T., adding that he is waiting for the end of the month to receive a notice to pay tax according to the new calculation method.

Last year, there were more than 4,000 business households with revenue of over 10 billion VND (Photo: Thanh Dong).

Previously, from June 1, according to Decree 70/2025, about 37,000 households with revenue of over 1 billion VND per year in a number of industries (food and beverage, hotels, retail, passenger transport, beauty, entertainment...) must use electronic invoices via cash registers connected to tax authorities.

In 2024, there will be more than 4,000 business households with revenue of over VND10 billion, but more than half of them will still pay lump-sum tax at a very low rate, only about 0.4% of revenue, while the declaring households will have to pay tax up to 25-30% of revenue, according to the content of the report to the Government on the proposal to build the Tax Administration Law project (replacement).

However, according to tax expert Nguyen Ngoc Tu, former Editor-in-Chief of Tax Magazine, the actual declaring household only has to pay a maximum tax of 10% on total revenue (for households that rent out houses, land, and warehouses) plus the current business license tax at a very low level - a maximum of 1 million VND for business households with revenue of 500 million VND according to current regulations.

Accordingly, after the elimination of the lump-sum tax, business households will pay taxes based on actual revenue, including business license tax, personal income tax, and value-added tax (VAT).

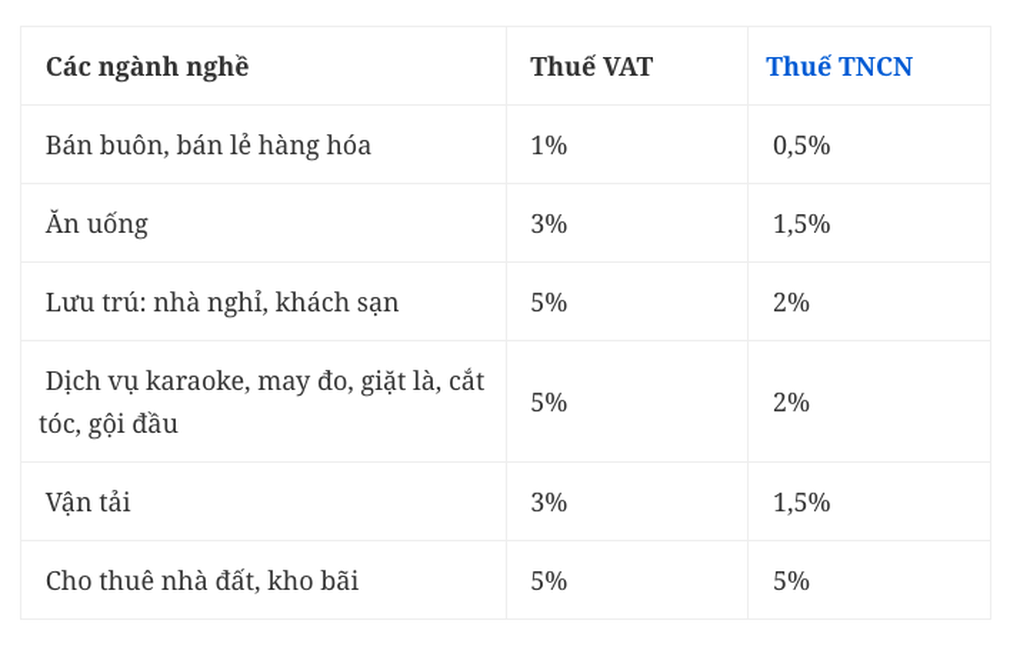

Tax rates that businesses must pay according to industry (Photo: My Tam).

Why tax on revenue and not profit?

Economist Nguyen Tri Hieu said that abolishing lump-sum tax and switching to the form of declaring and paying tax based on revenue is a reasonable trend, creating fairness between business types. However, to implement effectively, a transition period of at least one year is needed.

“Instead of a fixed lump-sum tax, paying tax based on revenue will more accurately reflect business activities, avoiding over-declaration or tax evasion. However, many small businesses such as pho restaurants and grocery stores are now used to paying lump-sum tax - simple, easy to understand and convenient for both taxpayers and tax authorities,” said Mr. Hieu.

He emphasized that the major drawback of lump-sum tax is that many households deliberately declare low revenue to only pay a very small tax, even though the actual revenue is much larger. Therefore, switching to revenue-based declaration is reasonable, but it requires supporting infrastructure such as an electronic invoice system and bank payments to create a clear "trace" for tax authorities.

Citing the US as an example, Mr. Hieu said that all transactions at stores are directly linked to tax authorities, helping to manage revenue transparently and accurately. If Vietnam wants to move towards that model, it needs time to prepare and convert step by step.

Regarding the current tax rate for business households, which ranges from 1.5% to a maximum of 10% of revenue, plus a maximum business license tax of VND1 million, Mr. Hieu said that this is still quite low. "Businesses are normally taxed at a rate of about 20% of total revenue. However, to support small businesses and retailers, the above tax rate is reasonable," he said.

When lump-sum tax is abolished, business households must pay according to actual revenue, keep accounting books, create invoices and invest in machines to connect with tax authorities (Illustration: Thanh Dong).

Associate Professor Dr. Nguyen Huu Huan, Lecturer at the University of Economics Ho Chi Minh City (UEH), commented that calculating business household tax based on revenue instead of profit is a reasonable solution in the current context. This method is both simple, reduces pressure on costs and procedures for taxpayers, and is suitable for the management level of the majority of small businesses.

He explained that, in order to calculate taxes based on profits, business households are required to fully declare input costs, including salaries, raw materials, rent, utilities, and many other incidental expenses.

However, most of the businesses today do not have proper accounting skills, nor do they have enough resources to make regular financial reports. If they are forced to declare based on profits, they will have to hire accounting services or hire additional staff, which will incur unnecessary costs, especially for small-revenue businesses.

Meanwhile, applying a fixed tax rate on revenue from 1.5% to a maximum of 10%, along with a business license tax from VND300,000 to VND500,000, according to Mr. Huan, is a feasible and reasonable calculation method. Although this calculation method does not accurately reflect actual profits, it helps simplify tax procedures, making it convenient for both management agencies and taxpayers.

He also argued that the shift to profit-based taxation should only be implemented when business households are supported in improving their management capabilities, gaining a thorough understanding of finance and accounting, and when the tax infrastructure is strong enough to effectively monitor and verify information.

Source: https://dantri.com.vn/kinh-doanh/chuyen-gia-ho-kinh-doanh-dong-thue-cao-nhat-10-tong-doanh-thu-20250618232828234.htm

![[Video] The craft of making Dong Ho folk paintings has been inscribed by UNESCO on the List of Crafts in Need of Urgent Safeguarding.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/10/1765350246533_tranh-dong-ho-734-jpg.webp)

Comment (0)