At the end of the trading session on June 17, VN-Index increased by 9.58 points, equivalent to 0.72%, to 1,347.69 points. VN30-Index increased by 11.04 points; HNX-Index increased by 0.12 points; UPCoM-Index increased by 0.77 points.

VIC ( Vingroup ) stock leads the group of stocks that positively affect the index. In addition, two Vingroup "family" stocks, VHM (Vinhomes) and VPL (Vinpearl), are also present in this group.

The strong increase in Vingroup stocks has contributed significantly to raising the asset value of billionaire Pham Nhat Vuong to a record high. According to an update from Forbes, as of the afternoon of June 17, billionaire Vuong's assets had increased by 178 million USD, reaching a record high of 9.8 billion USD, bringing him to 297th place on the list of the world's richest people.

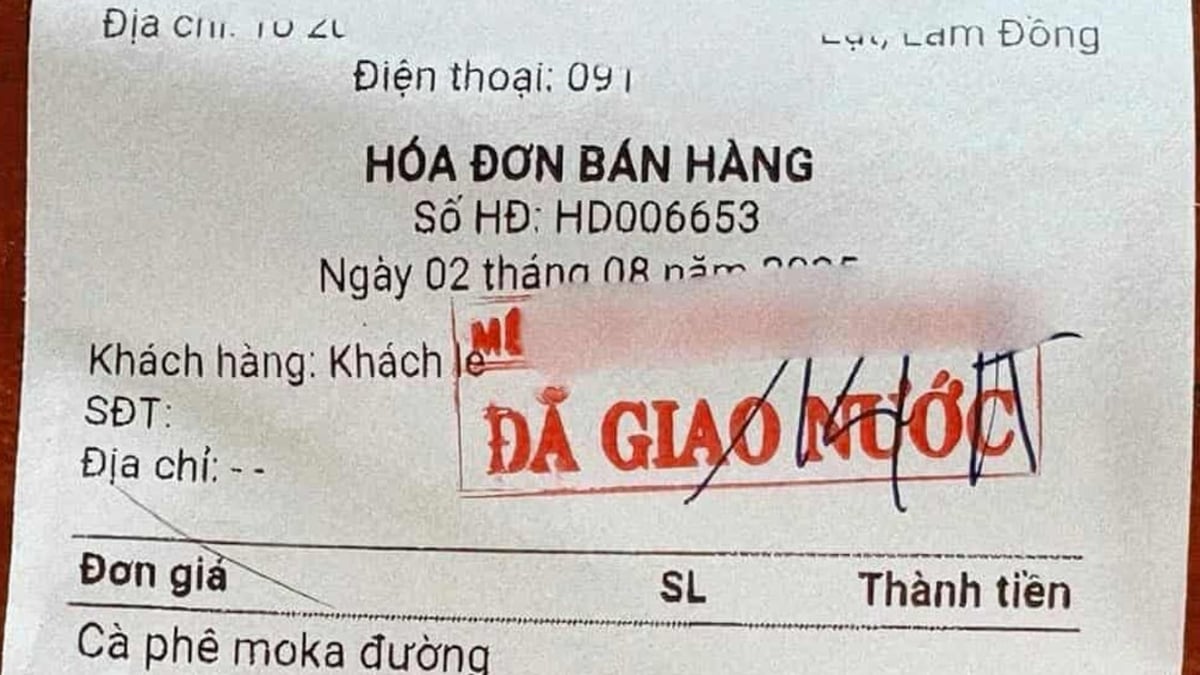

Billionaire Pham Nhat Vuong's assets increased by 178 million USD (Photo: Forbes).

In the whole market, the total value of matched transactions reached just over 18,000 billion VND. The board was strongly differentiated with 173 stocks increasing in price, 4 stocks hitting the ceiling; 53 stocks standing at the reference price and 133 stocks decreasing in price.

Foreign investors increased their net buying today. FPT was the stock that foreign investors bought the most with a value of more than 218 billion VND, followed by HPG, NVL, VCB, VCI, CTG... On the other hand, foreign investors sold net stocks such as STB, PVD, VIC, EIB, VHM...

Military tensions between Israel and Iran are escalating. Mr. Nguyen Viet Duc - Digital Business Director of VPBank Securities Joint Stock Company (VPBankS) - said that according to past statistics, geopolitical events do not affect the stock market too much. With geopolitical tensions in the past 50 years, if they only stop at the level of conflict, the impact on the stock market will only last 1-2 sessions.

According to the representative of the above securities company, the periods when the stock market declines the most are often not related to war, but to macro factors such as 2008 (debt crisis) in the US or 2022 (bond crisis) in Vietnam.

Macro factors, asset bubbles, economics, etc. can cause the market to fall sharply, while war is just an additional factor, which can coincide with macro fluctuations and has little direct impact on the stock market.

Source: https://dantri.com.vn/kinh-doanh/co-phieu-ho-vingroup-day-song-tai-san-ty-phu-vuong-tang-vot-20250617164340145.htm

Comment (0)