|

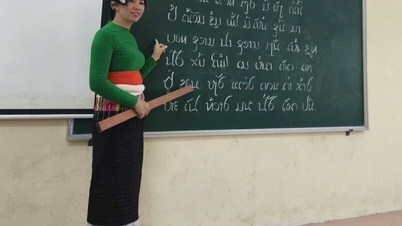

| Removing the credit room will help banks be more proactive in making credit plans and optimizing profits. Photo: D.T |

Which banks benefit from removing credit room?

Regarding the Prime Minister 's directive to remove the administrative tool "credit room", Mr. Do Bao Ngoc, Deputy General Director of Kien Thiet Securities Company, said that removing the credit room helps Vietnam approach international standards, in line with the goal of upgrading the financial market. "More importantly, removing the credit room forces commercial banks to increase their responsibility and autonomy. Accordingly, instead of 'asking for room', commercial banks must decide on increasing credit based on their financial health and risk management capabilities," Mr. Ngoc commented.

For commercial banks, removing credit room will help them be more proactive in making credit plans, optimizing profits, especially during the peak capital demand season at the end of the year. The stock market is also expected to benefit indirectly when the credit flow is flexible, supporting businesses to expand their operations.

However, to avoid repeating the “mistake”, experts say that effective “brakes” are needed. Otherwise, when the credit room is removed, credit will flow massively into real estate, banks will compete with interest rates, bad debt will increase, causing macroeconomic instability, affecting the Government’s target of rapid but sustainable growth.

According to Dr. Pham The Anh, Head of the Faculty of Economics (National Economics University), the State Bank of Vietnam can only remove the credit room after completing and publicizing a system of criteria to ensure system safety based on the international standards on banking risk management and capital safety (Basel III). Accordingly, any bank that meets 100% of the criteria can have its credit room completely removed. Banks that do not meet the conditions will have their credit controlled at appropriate limits.

In fact, since the beginning of this year, the State Bank has removed the credit room for a group of banks (foreign banks, joint venture banks, Cooperative Banks and non-bank credit institutions). Currently, the credit room mechanism is only maintained for the group of domestic commercial banks.

Mr. Le Thanh Tung, member of the Board of Directors of VietinBank, said that eliminating credit room is an inevitable trend. Currently, the State Bank has quite synchronous regulations on risk management and is amending a number of regulations to help banks approach international risk management standards (such as Basel III). These are tools that the State Bank can apply, forcing commercial banks to increase their capital accordingly if they want to increase capital supply to the economy.

Most likely, the State Bank will not be able to immediately remove the credit room this year. However, when this possibility occurs, the credit market share picture of banks will change. "Removing the credit limit mechanism will benefit banks with strong capital buffers, because they have better ability to expand lending," SSI Research analyst assessed.

Keep the “brakes” safe when removing the credit “barrie”

For a long time, the credit room has been an effective tool that helps the State Bank easily control the money supply in the economy. The biggest limitation of this tool is that it creates a mechanism of asking and giving, causing capital flow congestion, distorting the market and hindering business opportunities for commercial banks. Therefore, although supporting the removal of the credit room, experts warn that risks will increase when the market no longer has a safe "barrie", forcing the State Bank to have effective monitoring tools.

Removing the credit room may lead to excessive lending, especially at weak banks, leading to increased bad debt. In addition, controlling total credit demand will be more difficult, requiring the State Bank to have a flexible and strong macroeconomic management mechanism.

Removing the credit room may lead to excessive lending, especially at weak banks, leading to increased bad debt. In addition, controlling total credit demand will be more difficult, requiring the State Bank to have a flexible and strong macroeconomic management mechanism.

- Mr. Do Bao Ngoc, Deputy General Director of Kien Thiet Securities Company

Mr. Phan Linh, CEO of TechProfit Joint Stock Company, said that if the room is removed without alternative control tools, banks will compete to lend to maximize profits, capital will easily flow into risky areas such as real estate and securities. At that time, inflationary pressure and exchange rates may return, and asset bubbles will easily form. "Removing the credit room is the right trend, but it must be accompanied by strong enough management discipline and supervision. Otherwise, the risk of returning to the hot credit period is entirely possible," Mr. Linh warned.

According to SSI Research, the State Bank of Vietnam has issued a draft circular on CAR, updating new regulations in Basel III standards (2017) and is seeking comments from banks.

However, with the current state of the banking system's health being strongly differentiated, how to put in place a "brake" to ensure the market is not congested while still being able to encourage healthy banks is a difficult problem.

Not to mention, even when applying Basel II and Basel III standards, controlling credit growth without "room" tools will be very difficult, especially when the system still has many weak banks.

Speaking to the press earlier this week, Mr. Pham Chi Quang, Director of the Monetary Policy Department (SBV), said that the credit room mechanism has been applied by the SBV since 2012, when credit growth in the entire industry was hot (in some years it increased by 54%), some credit institutions were on the brink of bankruptcy, interest rates in the market increased, and banks fell into a spiral of unhealthy competition. Up to now, the consequences of the past hot growth still exist. Therefore, the removal of the credit room must be suitable to the specific conditions of Vietnam. "In the coming time, the SBV will carefully study and evaluate the policy impact to have the premise to completely remove the credit room," Mr. Quang said.

Meanwhile, according to international experts, to implement the current multi-target monetary policy and remove the credit room without causing consequences such as competition in deposit interest rates and hot credit growth, the State Bank must be highly proactive, especially in interest rate management.

Source: https://baodautu.vn/cuoc-dua-thi-phan-nong-hon-khi-bo-room-tin-dung-d327968.html

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

Comment (0)