According to Reuters , Governor Michelle Bowman (a member of the Fed's Executive Board) spoke at a conference in Frankfurt (Germany) saying that if inflation remains high and the labor market continues to struggle, the US central bank may need to further tighten monetary policy.

The Fed may need to raise rates further if inflation does not ease significantly in the coming weeks, the official added. Bowman’s comments put her in the camp that favors further rate increases by the central bank.

Since March 2022, the Fed has raised interest rates 10 times in a row to curb US inflation, which is still much higher than the 2% target. Most recently, on May 3, the Fed raised the base interest rate to 5-5.2%, the highest level in about 16 years.

The Fed headquarters in Washington, US. (Photo: Leah Millis/Reuters)

According to CNN Business , US economists say the Fed is unlikely to cut interest rates anytime soon, at least not until the economy is strong. The two main reasons cited for the Fed's difficulty in cutting interest rates soon include high inflation and the world's number one economy still being resilient to interest rate hikes.

Prices in the US are stabilizing, but inflation is still well above the Fed's 2% target. The personal consumption expenditures (PCE) price index, the Fed's preferred measure of inflation, rose 4.2% in March from a year earlier.

Meanwhile, unemployment in the United States is at a record low. Last week’s Labor Department report showed that the unemployment rate had fallen to just 3.4%. In other words, there is nothing at the moment that would convince the Fed to move toward rate cuts. However, all of this could go wrong if the US government defaults.

From the Fed's perspective, Ms. Bowman assessed that the employment reports and the consumer price index (CPI) did not clearly show that inflation was on the decline.

She added that banks will continue to tighten lending conditions amid rising funding costs and fewer sources of funding following recent turmoil.

Ms. Bowman said she will continue to closely monitor incoming data as she considers appropriate monetary policy in preparation for the Fed's next meeting scheduled for June.

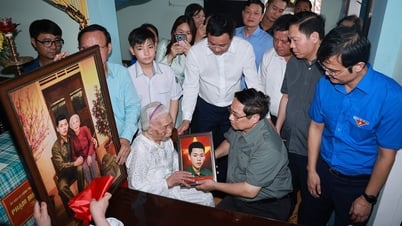

Fed Governor Michelle Bowman speaks at the American Bankers Association conference in San Diego, California. (Photo: Ann Saphir/Reuters)

Fed leaders are trying to assess the impact on credit markets and the overall outlook from recent bank failures, Bloomberg reported.

Last week, the Fed said banks reported tighter credit conditions and weaker lending demand in the first quarter, suggesting the overall U.S. banking system is becoming more cautious about lending.

A recent survey by CME Group cited on the WSJ also said that only about 10% of investors in the futures market predict the Fed will raise interest rates in the near future.

(Source: Zing News/Reuters)

Useful

Emotion

Creative

Unique

Wrath

Source

Comment (0)