On June 13, Israel launched a large-scale airstrike campaign targeting Iran's nuclear and military facilities, marking a strategic turning point in the Middle East.

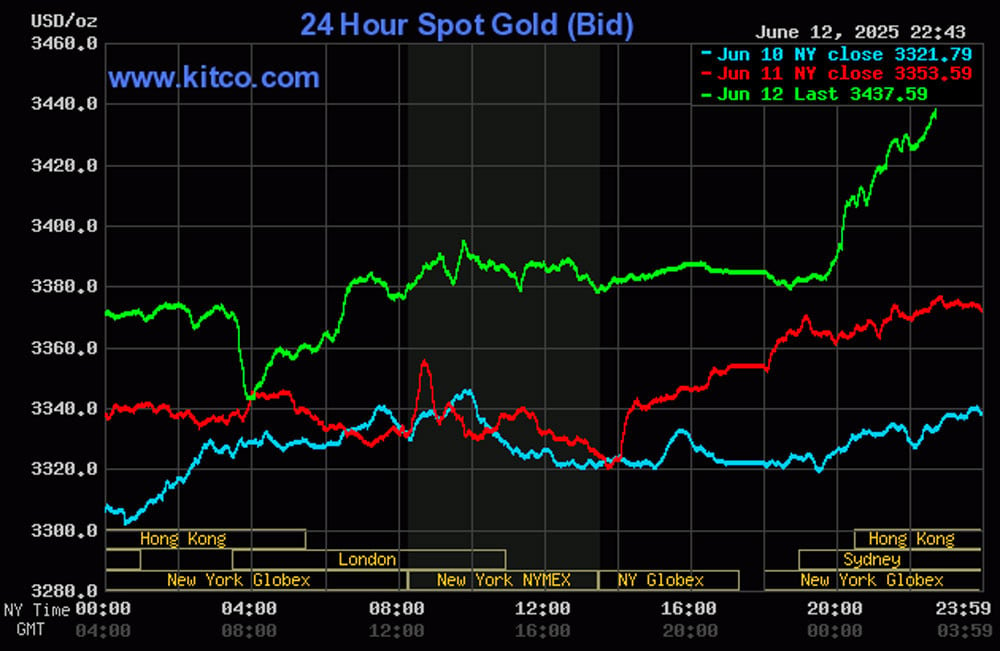

The event immediately impacted global financial and commodity markets. The price of gold, a safe haven asset, jumped more than $45, or 1.3%, to over $3,430 an ounce on the morning of June 13 in the Asian market.

Meanwhile, WTI crude oil prices increased nearly 8% to $73.4/barrel, reflecting concerns about disruptions in oil supplies, especially in the Strait of Hormuz, through which about 20% of global oil flows.

Riskier assets, on the other hand, were under pressure. Japan’s Nikkei 225 fell nearly 1.5%, Hong Kong’s Hang Seng fell 0.3%, and U.S. and European stock futures also fell. Bitcoin, a speculative asset, fell 4.3% to $103,800 per BTC.

A sharp rise in oil prices could increase transportation and production costs, pushing up global inflation. Meanwhile, the shift of money into gold and the US dollar shows that investors are looking for safety amid uncertainty.

The attack comes amid sensitive negotiations between the US and Iran over a nuclear deal. President Donald Trump has expressed concern that Israel’s actions could damage the chances of a diplomatic deal in the works, complicating efforts to stabilize the region.

Iran has previously vowed “merciless revenge,” possibly through missile or drone attacks on northern Israel or US bases in Iraq and Syria. Israel is expected to continue limited air strikes, avoiding escalating into all-out war unless Iran crosses a “red line.”

How is the global economy doing in the face of this very 'hot' development?

In the short term, financial markets are expected to continue to fluctuate, with gold, oil and USD prices strongly supported, while stocks and Bitcoin are under downward pressure.

International diplomatic efforts, involving the US, Russia and China, could push for a “temporary ceasefire” if the conflict spreads. Gulf states such as Saudi Arabia and the UAE, concerned about Iran’s expanding influence, could quietly back Israel.

However, Iranian proxies such as Hezbollah and the Houthis can still wage guerrilla warfare, causing prolonged instability in Lebanon, Syria and the Red Sea region.

Oil prices are at risk of continuing to climb due to disruptions in the Strait of Hormuz, pushing global inflation higher. Global stocks will continue to be under pressure, while gold could hit $3,500 an ounce as previously predicted by several major financial institutions.

If the situation does not “cool down,” the global economy will face persistent inflation due to rising energy prices, affecting supply chains and production costs. Asian economies such as China and India, which are heavily dependent on Middle Eastern oil, will be hit hard.

Source: https://vietnamnet.vn/gia-vang-va-dau-du-bao-len-bao-nhieu-sau-khi-israel-tan-cong-iran-2411103.html

Comment (0)