Coffee market is diversified.

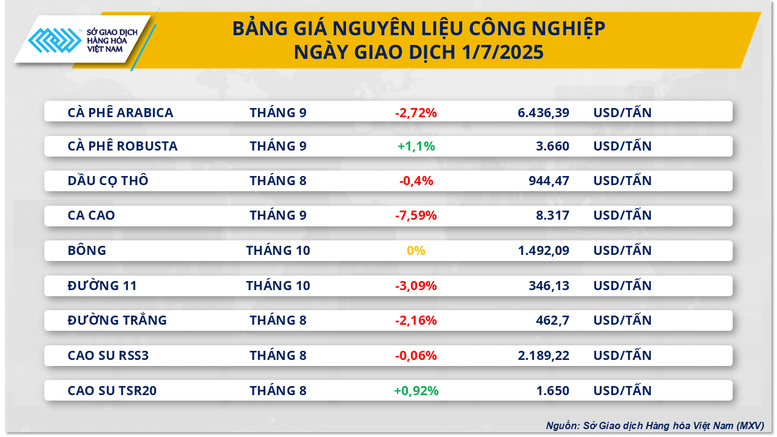

Closing yesterday's trading session, the industrial raw material market attracted attention when most items decreased in price. In particular, the prices of two coffee items recorded a divergent trend. While the price of Robusta coffee recorded an increase of more than 1.1% to 3,660 USD/ton, the price of Arabica coffee continued to weaken when it lost more than 2.7% to 6,436 USD/ton.

According to the latest semi-annual report on the global coffee market from the US Department of Agriculture (USDA), Brazil’s coffee production in the 2025-2026 crop year is expected to reach 65 million bags, up 300,000 bags from the previous crop. The increase is mainly due to Robusta coffee, with output forecast at 24.1 million bags, up 14.7% due to favorable rainfall conditions in the states of Espírito Santo and Bahia. In contrast, Arabica coffee production is expected to decrease by 6.4% to 40.9 million bags due to the impact of drought and high temperatures in Minas Gerais and São Paulo, which negatively affected flowering and fruit set.

In addition, the coffee harvest in Brazil continues to be supported by favorable weather conditions, with temperatures forecast to remain above 10 degrees Celsius and not expected to drop below that. Currently, coffee supplies from the new harvest, including Robusta, have begun to enter the market, creating downward pressure on prices in the short term.

In another coffee supply-related development, the Brazilian Coffee Exporters Council (Cecafé) said that capacity shortages and logistical bottlenecks at major ports are currently the biggest challenges facing the country’s coffee exports. Eduardo Heron, Cecafé’s technical director, said that overloaded infrastructure is leading to persistent delays in loading cargo onto ships. At Santos, Brazil’s largest port, the average waiting time for a ship to dock is 41 hours, according to data from MSC Mediterranean Shipping. Port storage yards are currently overloaded, making it difficult to accommodate new cargo and forcing shipping lines to adjust schedules or even skip some ports of call.

WTI oil prices turn up

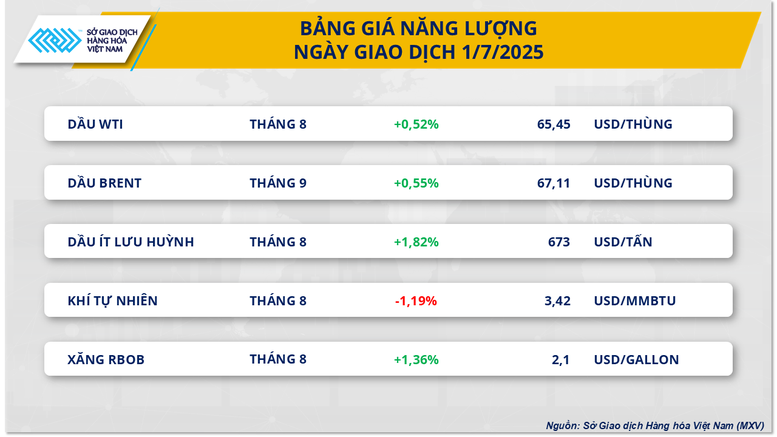

According to MXV, the energy market continued to fluctuate yesterday. In particular, there was positive buying pressure for two crude oil products. At the end of the session, Brent oil prices edged up slightly to 67.11 USD/barrel, equivalent to an increase of 0.55%. Similarly, WTI oil prices also increased by 0.52% to 65.45 USD/barrel. This increase mainly came from investors' expectations of global energy demand in the coming time, especially in China.

Accordingly, the Caixin PMI index of China's manufacturing sector published by S&P Global increased sharply to 50.4 points in June, surpassing the 50-point threshold and showing that manufacturing activities returned to expansion. The recovery of the world's second largest economy , which is also the world's second largest oil consumer, is expected to boost energy demand in the coming time.

In addition, the US economic situation also showed signs of improvement yesterday. The JOLTS job openings index increased in May, while the manufacturing PMI index released by S&P Global also recorded an increase in June. However, the manufacturing PMI index released by the Institute for Supply Management, although improved compared to May, remained below the 50-point threshold. On the contrary, oil prices continued to be pressured by the possibility of a sharp increase in supply from OPEC+ as well as concerns about economic instability after July 9.

In another development, natural gas prices on the NYMEX floor moved in the opposite direction compared to most other energy commodities. At the end of yesterday's trading session, natural gas futures fell 1.19% to $3.42/MMBtu. The downward pressure on prices mainly came from the continued weakening of electricity demand in the US. According to data from the Edison Electric Institute, total electricity production in the US in the week ending June 21 decreased by 3.1%, leading to a decrease in demand for natural gas at power plants.

Source: https://baochinhphu.vn/mxv-index-tiep-tuc-bien-dong-trong-bien-do-hep-10225070208442526.htm

Comment (0)