Vietnam lacks a flexible and effective mechanism to channel money to the right places. First, it is necessary to remove the bottleneck of public investment disbursement, followed by reorienting the credit flow: prioritizing production, green technology, and social housing instead of continuing to nurture speculative channels.

|

| Some wooden furniture export manufacturing enterprises are facing difficulties due to a decrease in orders. Illustration photo: H.Nhu |

“We used to plan to borrow money to open another production line, but now we don’t dare take the risk anymore. No one borrows money to make products when there are no buyers,” he said.

Hai’s story is not an isolated one. It reflects a worrying reality: money has been pumped out in large quantities, but its flow is being choked. And when money does not go to the right places, it can create asset bubbles instead of restoring production.

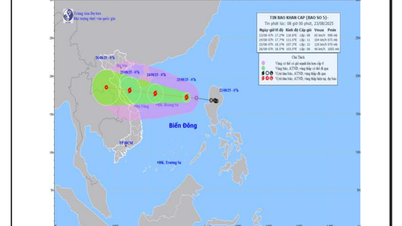

In the first five months of the year, more than one quadrillion dong was pumped into the economy through credit channels. Credit growth reached more than 6%, showing that the State Bank has loosened monetary policy to the maximum to save growth. Interest rates have been lowered, exchange rates have been kept flexible - all conditions have been created for cheap capital to flow into the economy.

But the expectation has not happened. Cash flows mainly into real estate, stocks and short-term consumption – where it is easy to make a profit and has low risk. Meanwhile, manufacturing enterprises – especially small and medium enterprises – have difficulty accessing capital. It is not that banks refuse, but because enterprises do not dare to borrow: there is no output, orders are down, market confidence is weak.

Key export industries such as textiles, wood, and electronics are all running out of steam. Some businesses are losing orders because of technical barriers – from ESG to CBAM carbon border tax – which are putting Vietnamese businesses at the door of a new globalization, but without enough “keys” to enter. That’s not to mention the instability of US tariff policies and the conflict breaking out in the Middle East.

On another axis, public investment – an important channel for State capital – is lagging behind. Ho Chi Minh City, the country’s largest economic center, has only disbursed more than 10% of the public investment plan in the first 5 months of the year. A series of traffic projects, canals, schools, hospitals, etc. are still on paper due to legal issues, land issues, or lack of coordination between departments and branches.

Budget funds are available, political determination is clear, but the implementation apparatus is still confused in the administrative cycle. Meanwhile, many projects have started but have not yet created a spillover effect to the private sector.

Another sign that the economy is not yet back on its feet is the number of businesses leaving the market. More than 111,000 businesses suspended operations or dissolved in the first five months of the year, up more than 14% over the same period last year. Most of them are small, agile businesses – which are considered the driving force of the economy.

That means while cash is being pumped out at a record pace, tens of thousands of businesses are having to leave the game because they cannot access capital, or because they no longer have a reason to exist in a weak consumer market.

Not only businesses, self-employed workers, small traders and micro-businesses – the pillars of domestic consumption – are also under new pressure from tax policies. The fact that some localities are accelerating the elimination of lump-sum tax and switching to tax declaration has created great concern among the small business community.

For small traders, without full invoices and documents, monthly declaration is impossible. In that context, Deputy Prime Minister Ho Duc Phoc's proposal to continue applying the simple contract form for business households with less than 1 billion VND in revenue is reasonable and necessary.

If not adjusted promptly, tax policies may inadvertently destroy the economic vitality of sidewalks – which create livelihoods for millions of people and absorb most of the daily consumer cash flow.

From a macro perspective, when there is more money than goods, inflation is inevitable. Last May, the consumer price index increased by 3.24%, the highest level in the past 4 months. Prices of essential goods have been climbing silently, while people's incomes have remained unchanged.

The personal income tax family deduction has been "frozen" for the past 11 years, causing increasing spending pressure on middle- and low-income earners.

The core problem is that the monetary policy has been loosened to its full extent, but the fiscal policy, despite being boosted, has not yet created a strong rebound due to construction delays and disbursement problems. When consumption, private investment and exports are all weak, the fiscal policy needs to be more proactive in stimulating demand and channeling money to where it is needed most.

We are not short of money. Vietnam is lacking a flexible and effective mechanism to put money in the right place. First of all, we need to remove the bottleneck of public investment disbursement, from legal procedures, bidding to assigning individual responsibilities. Next, we need to reorient credit flows to prioritize production, green technology, and social housing instead of continuing to nurture speculative channels.

And equally important is reforming personal income tax policy, while also stabilizing small businesses – those who carry the economy every day but are not adequately supported.

Without a timely and synchronous policy shift, the economy will continue to depend on the flow of money pumped out without being able to absorb it, creating inflationary risks and easily creating instability.

The money has been pumped out. The question is no longer whether to pump more, but how to get the money to where it is needed most.

( According to )

Source: https://baoapbac.vn/su-kien-binh-luan/202506/tien-duoc-bom-ra-nhieu-nhung-lieu-co-den-dung-cho-1046354/

![[Photo] National Assembly Chairman Tran Thanh Man receives First Vice Chairman of the Federation Council of the Federal Assembly of the Russian Federation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764648408509_ndo_br_bnd-8452-jpg.webp&w=3840&q=75)

Comment (0)