According to the State Bank of Vietnam, as of the end of April, household savings deposits reached a record high of over 7.53 million billion VND - Photo: LE THANH

In just four months, people deposited nearly half a trillion dong more into bank savings accounts.

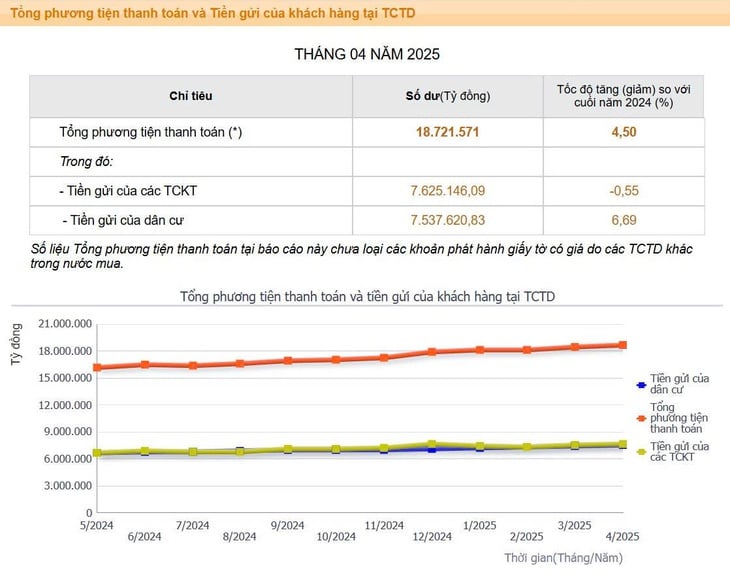

According to the latest statistics from the State Bank of Vietnam, as of the end of April, people's savings in banks reached 7,537 trillion VND. This represents a 6.69% increase compared to the end of last year, equivalent to nearly 500,000 billion VND.

Compared to the same period last year, the rate of deposit growth this year is three times higher. The balance of savings deposited by the public into banks increased by 857,000 billion VND.

Regarding institutional deposits, the State Bank of Vietnam also reported a slight decrease compared to the end of last year, but still maintained a level of 7.6 million billion VND.

Meanwhile, deposit interest rates have remained stable at many commercial banks. For some terms and deposit amounts, deposit interest rates have decreased slightly by 0.1-0.3% per year compared to the beginning of the year, depending on the bank.

Interest rates on savings deposits tend to decrease slightly.

According to Tuoi Tre Online , in the group of state-owned commercial banks, deposit interest rates at the beginning of July remained stable compared to the same period in June.

The highest deposit interest rate is 4.8%/year, offered by BIDV, VietinBank, and Agribank at the counter for individual customers with long-term deposits of 24 months or more. The 6- and 9-month terms are still listed at 3.0%/year by these banks.

As for joint-stock commercial banks, interest rates fluctuated but a slight downward trend was evident. For example, at VPBank , for deposits of 300 million VND or more for 6 months, from July 1st, the interest rate was only 5.4%/year instead of 5.7%/year.

NCB also uniformly reduced interest rates by 0.1%/year for traditional savings products and An Khang term deposits and An Phat Loc certificates of deposit with terms of 18 months, 24 months and 84 months, with interest paid every 6 months.

Interest rates of 6% per year or higher are quite rare in the market. Accordingly, Bac A Bank lists an interest rate of 6.1% per year for savings deposits of over 1 billion VND, with terms from 18-36 months.

HDBank offers interest at the end of the term at 6% per annum for an 18-month term. HDBank lists an interest rate of 6.1% per annum for online savings deposits with an 18-month term.

The State Bank of Vietnam also reported that the total balance of demand deposits held by individuals in current accounts at the end of the first quarter was over 1.3 trillion VND. The total balance has increased continuously over the past three years. Compared to the end of 2024, the balance increased by 56,241 billion VND.

Source: https://tuoitre.vn/tien-tiet-kiem-duoc-gui-vao-ngan-hang-vuot-15-trieu-ti-dong-20250706104454921.htm

![[Photo] Prime Minister Pham Minh Chinh attends the Conference on the Implementation of Tasks for 2026 of the Industry and Trade Sector](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F19%2F1766159500458_ndo_br_shared31-jpg.webp&w=3840&q=75)

Comment (0)