Attending the Conference on the implementation of tasks of People's Credit Funds and Microfinance Institutions in 2025 were more than 100 delegates, including: Board of Directors, leaders of specialized departments, civil servants of the Management, Supervision and Inspection Department of the State Bank of Vietnam Region 3; representatives of the leadership of the Deposit Insurance of Vietnam and its Hanoi branch, the Northwest branch; the Cooperative Bank of Vietnam, Ha Tay branch and Yen Bai branch; Board of Directors, Board of Directors, Supervisory Board, heads of departments/functional units of People's Credit Funds and Microfinance Institutions in the area.

|

| Overview of the Conference |

At the conference, after the leaders of the State Bank Management and Supervision Department of Region 3 reported on the assessment of the performance of the People's Credit Funds and Microfinance Institutions in 2024 and the first 3 months of 2025, the directions and key tasks for the remaining months of 2025, the Conference focused on discussing and contributing opinions to continue strengthening the People's Credit Fund system in the area to ensure strict compliance with legal regulations, stable, safe, effective operations and sustainable development.

As of March 31, 2025, in Region 3, there are 54 credit institutions (CIs) and CI branches, including 14 branches of state-owned commercial banks, 20 branches of joint-stock commercial banks, 4 branches of the Social Policy Bank, 2 branches of the Development Bank, 13 People's Credit Funds and 1 branch of the Microfinance Institution M7. The network operates with 158 transaction offices and 668 transaction points. Of which, People's Credit Funds operate in 3/4 provinces in the region: Lai Chau province has 2 People's Credit Funds, Hoa Binh province has 4 People's Credit Funds and Son La province has 7 People's Credit Funds. The total capital of People's Credit Funds in the area as of March 31, 2025 reached VND 3,737 billion, of which: charter capital reached VND 166.8 billion, equal to 4.46% of total capital; Total outstanding loans as of March 31, 2025 reached VND 2,909 billion; total number of members is 34,543, an increase of 345 members compared to December 31, 2024.

M7 Microfinance Limited Liability Company - Mai Son Branch operates in 02 areas: Mai Son district and Phu Yen district. Total capital as of March 31, 2025 reached 71.6 billion VND, an increase of 8.1 billion VND (+12.7%) and total outstanding debt as of March 31, 2025 reached 50.2 billion VND, a decrease of 1.7 billion VND compared to December 31, 2024.

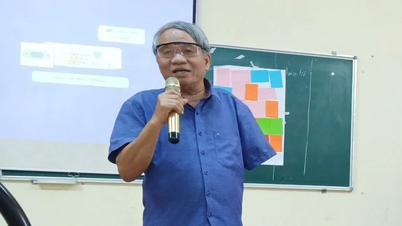

Also at this conference, comrade Nguyen Dinh Vinh - Deputy Director of the State Bank of Vietnam Region 3 thoroughly grasped and directed the key directions and tasks for the remaining months of 2025 and the following period for the People's Credit Funds and Microfinance Institutions in the area.

|

| Mr. Nguyen Dinh Vinh - Deputy Director of the State Bank of Vietnam Region 3 gave a speech at the Conference |

Speaking at the conference, the leaders of the State Bank of Vietnam (SBV) Region 3 emphasized the difficulties and challenges affecting the operations of the People's Credit Funds and Microfinance Institutions in the area, such as: Competition in capital mobilization is increasingly fierce; digital credit products, digitalization of services of the commercial banking system; changes in administrative boundaries, operating areas and legal procedures related to transactions; ... Along with that are the existing shortcomings and limitations within the People's Credit Funds and Microfinance Institutions that need to be urgently, promptly and seriously corrected and overcome. Faced with that situation, the State Bank of Vietnam (SBV) Region 3 requires the People's Credit Funds and Microfinance Institutions in the area to proactively and actively improve their management and operational capacity and professional expertise, control risks in all aspects of operations to ensure safety, stability, soundness and strict compliance with the provisions of law. In 2025, the State Bank of Region 3 will continue to strengthen inspection, examination, supervision, and closely coordinate with local authorities and relevant functional agencies to prevent, stop, and handle violations of the law, ensuring the People's Credit Fund and Microfinance Institutions system in the area.

Source: https://thoibaonganhang.vn/trien-khai-nhiem-vu-quy-tin-dung-nhan-dan-va-to-chuc-tai-chinh-vi-mo-tren-dia-ban-nhnn-khu-vuc-3-163189.html

![[Photo] General Secretary To Lam presents the First Class Labor Medal to the Vietnam National Energy and Industry Group](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/21/0ad2d50e1c274a55a3736500c5f262e5)

![[Photo] General Secretary To Lam attends the 50th anniversary of the founding of the Vietnam National Industry and Energy Group](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/21/bb0920727d8f437887016d196b350dbf)

Comment (0)