Yeah1 (YEG) plans not to pay dividends in 2022

Recently, Yeah1 Joint Stock Company (Code YEG) has just announced the documents for the 2023 Annual General Meeting of Shareholders scheduled to be held on June 2, 2023 in Ho Chi Minh City.

In particular, the company announced its 2023 business plan with a revenue target of VND 425 billion, an increase of 35.3% compared to the performance in 2022. Profit after tax is expected to be VND 30 billion, an increase of 20.53% compared to last year.

Yeah1 (YEG) will not pay dividends in 2022, increasing short-term debt by 3.6 times in the first quarter of this year (Photo TL)

Yeah1's business orientation in 2023 will be to complete the restructuring of mainstream business segments, develop the television segment, produce high-quality programs and develop multi-channels.

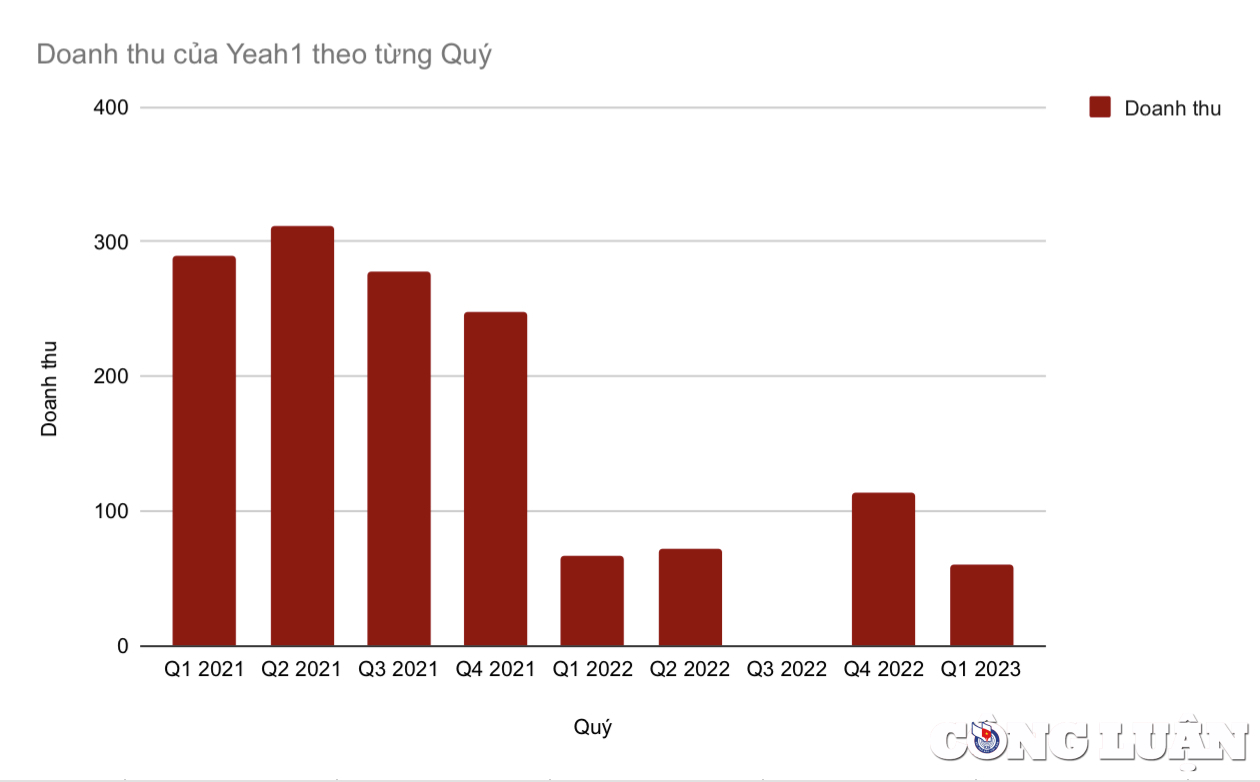

Regarding the dividend payment plan, in 2022, Yeah1's revenue only reached 314 billion VND, down 3 times compared to 2021, with profits reaching 25 billion VND. Although the business is profitable, the company still decided to retain profits and not pay dividends in 2022.

Revenue scale is increasingly narrowing, decreasing from several hundred billion VND per quarter to only several tens of billion VND.

According to Yeah1's consolidated business performance report, in the first quarter of 2023, the company recorded net revenue of VND 61 billion. Gross profit reached VND 28 billion, gross profit margin reached nearly 46%.

Notable expenses during the period include sales expenses, which were reduced from VND10 billion to only VND3 billion. However, business management expenses nearly doubled, from VND13 billion to VND24 billion.

The company's after-tax profit after deducting all expenses is 4 billion VND.

Regarding Yeah1's revenue, it can be seen that the company's revenue scale has been continuously decreasing in recent years. Since the first quarter of 2022, the company's quarterly revenue has decreased from hundreds of billions of VND to only a few tens of billions of VND. The profit scale has also decreased sharply since the first quarter of 2021.

Short-term debt tripled in the first quarter of the year alone, a large portion of assets are "on paper"

Regarding Yeah1's asset structure, as of the end of the first quarter of this year, the company's total assets reached VND1,462 billion, an increase of about 18%. The increase mainly came from short-term assets with investments in associated companies increasing from VND132 billion to VND365 billion. However, Yeah1 has not yet determined the fair value of these investments in its financial statements because the associated companies that Yeah1 invested in have not been listed on the stock exchange.

Another thing to note is that the company's short-term receivables currently account for VND423 billion, of which VND128 billion is short-term receivables from customers. Long-term receivables also account for VND475 billion. Thus, Yeah1's total receivables account for nearly VND900 billion, equivalent to 61.4% of the company's total assets. Thus, a large part of Yeah1's assets are still "on paper".

Regarding Yeah1's capital structure, in the first quarter, there was a large increase in liabilities, from VND334 billion to VND551 billion. Of which, short-term debt increased sharply from VND94 billion to VND335 billion, an increase of 3.6 times in just the first 3 months of the year. Loans at Vietnam Joint Stock Commercial Bank for Industry and Trade recorded the strongest increase, from VND77 billion to VND259 billion.

Yeah1's cash flow is still facing problems as the company's net cash flow from operating activities is negative at VND58 billion. Although it has decreased compared to the same period last year by VND159 billion, this is still a problem for the company's business operations because it shows that the company is not earning enough to cover expenses.

Source

Comment (0)