According to SSI Research, the history of the period 2010 - 2024 shows that the average increase of the index in the second half of the year tends to be lower than the first half of the year. On average, the VN-Index increased by 1.64% in the second half of the year, significantly lower than the increase of +6.42% recorded in the first half of the year. This trend reflects the seasonal decline in market dynamics.

However, there are exceptions. For example, in 2017, the market broke out after a period of sideways accumulation (2013-2016) with the driving force coming from strong foreign investment capital, or in the second half of 2020, when the VN-Index recovered strongly after a sharp decline in the first half of the year due to the Covid-19 pandemic. These exceptions show the importance of macro factors and liquidity dynamics in determining the market performance in the second half of the year.

SSI assessed that in the short term, the stock market may fluctuate strongly in the period of July - early August, however, in the long term, the analysis team still maintains a positive view on the market with the target of VN-Index reaching 1,500 points by the end of 2025.

The securities firm has pointed out the key drivers for the stock market in the second half of 2025.

First is the stable macroeconomic foundation. The government’s continued commitment to high economic growth, coupled with domestic drivers including infrastructure, a recovering real estate market, and the promotion of the private sector, can help Vietnam lay a solid foundation for sustainable economic growth.

Next is the prospect of sustainable profit growth. The total net profit of more than 79 stocks in SSI Research's research scope is estimated to increase by 14% year-on-year in 2025, and continue to maintain a growth momentum of 15% in 2026. The main contributing sectors include banking, real estate, raw materials and consumer goods. The 90-day US tax deferral has helped Vietnamese businesses boost exports of many types of goods in the second quarter, and have time to prepare to reduce the impact from this market in the following quarters.

At the same time, the uncertainty from tariffs has cooled down. Although the uncertainty about tariffs is still related to specific tax rates for each industry group, the tax gap between Vietnam and other countries is gradually narrowing, helping to reduce overall risks. In addition, the increase in exchange rate also helps Vietnamese goods remain relatively attractive compared to other countries.

The stock market is also supported by attractive valuations. The market's forward P/E has increased from 8.8x (April 9) to 11.9x as of July 9, but is still below the five-year average of 12.8x. Compared to regional markets, Vietnam has attractive valuations, strong ROE and favorable earnings prospects.

Another factor is the low interest rate environment. The 8.4% yield on the stock market is quite attractive compared to the average deposit interest rate of around 4.6% and the potential to attract a part of the population's deposits has tended to increase rapidly in recent quarters even though the deposit interest rate level remains low.

In particular, in the coming time, the prospect of market upgrade continues to be a positive supporting factor.

Vietnam has now met 7/9 criteria to upgrade from FTSE Frontier Market to FTSE Secondary Emerging Market, and is very close to completing the remaining 2 criteria, including: Payment Cycle (DvP) and Costs related to failed transactions. This encouraging result is thanks to the issuance of a series of important legal documents such as Circular 68/2024/TT-BTC, Circular 18/2025/TT-BTC, Circular 03/2025/TT-NHNN.

SSI expects the Government to continue to make efforts to implement necessary measures to fully meet the upgrading criteria, including: Amending Circular 17/2024/TT-NHNN on not requiring consular legalization when opening foreign currency accounts; Amending Decree 155/2020/NDCP on foreign ownership ratio. In addition, the draft implementation process of Omnibus Accounts (OTA) has also been developed under the coordination of the State Securities Commission (SSC), Vietnam Securities Depository (VSDC), exchanges and system providers KRX.

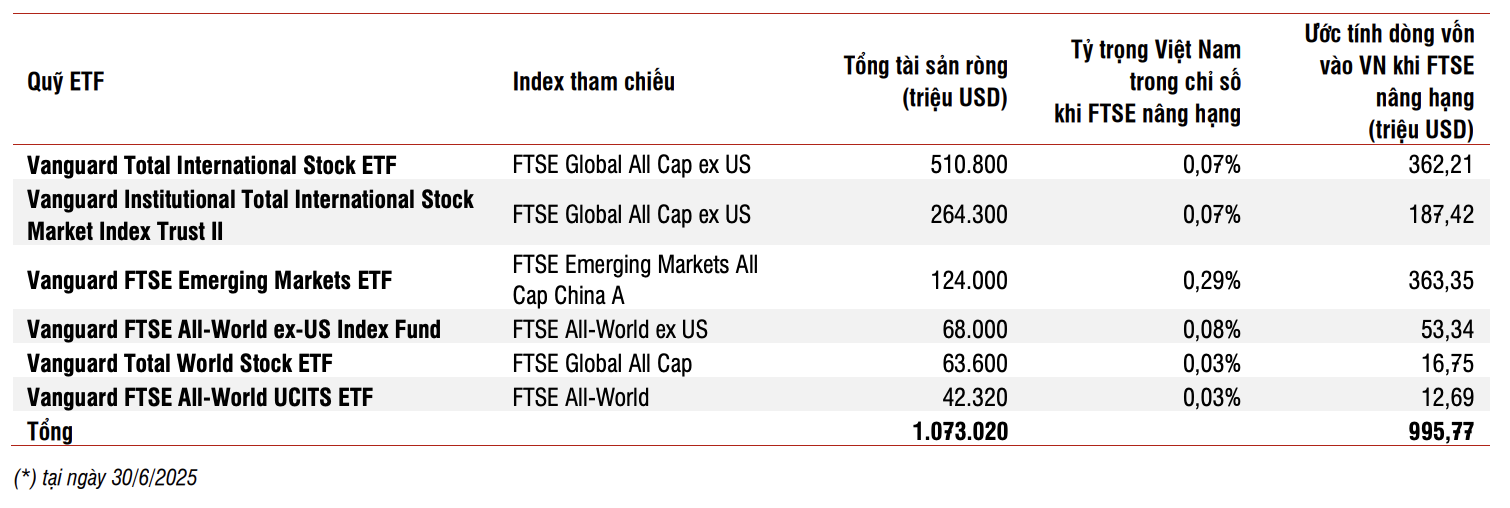

|

| Estimated capital flow from ETFs into Vietnam when FTSE is upgraded. Source: SSI Research |

“There is a 90% chance that Vietnam will be announced as an Emerging Market by FTSE Russell in October 2025. It is estimated that the upgrade by FTSE could attract about 1 billion USD from ETFs, not including active funds,” SSI analysis team commented.

Source: https://baodautu.vn/6-dong-luc-vung-chac-giup-vn-index-chinh-phuc-moc-1500-diem-d329493.html

![[Photo] National Assembly Chairman Tran Thanh Man receives First Vice Chairman of the Federation Council of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/3aaff46372704918b3567b980220272a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with First Secretary and President of Cuba Miguel Diaz-Canel Bermudez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/c6a0120a426e415b897096f1112fac5a)

![[Photo] Lao President Thongloun Sisoulith and President of the Cambodian People's Party and President of the Cambodian Senate Hun Sen visit the 95th Anniversary Exhibition of the Party Flag Lighting the Way](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/2/3c1a640aa3c3495db1654d937d1471c8)

Comment (0)