The workshop created an opportunity for management agencies, Stock Exchanges and market members to exchange and discuss, aiming to orient the development of a suitable legal framework, creating a foundation for the development of new products, contributing to promoting sustainable development and deep integration of the Vietnamese stock market.

Mr. Vu Chi Dung, Head of the Legal and External Affairs Department (State Securities Commission) said that after more than two decades of development, the Vietnamese stock market has made important strides in terms of scale, quality and depth. The 2019 Securities Law has created a legal foundation for the offering of securities by Vietnamese issuers abroad; Decree No. 155/2020/ND-CP detailing a number of articles of the Securities Law provides detailed guidance on the conditions and procedures for registering the offering and listing of securities abroad, including depository certificates; Circular No. 119/2020/TT-BTC of the Ministry of Finance also has regulations on the transfer of ownership of securities for the issuance or cancellation of depository certificates...

This is an important legal foundation for Vietnam to gradually deploy and develop overseas offerings and listings, including professional and systematic offerings and listings of depository certificates.

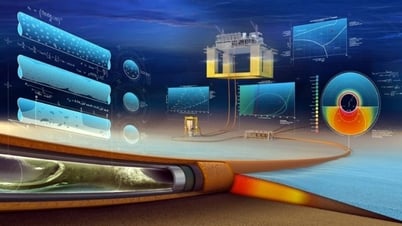

In the context of strong globalization, promoting the offering and listing of securities abroad, especially through tools such as Depository Reciept (DR), is an inevitable requirement, not only to expand international capital mobilization channels but also to help Vietnamese enterprises improve their position in the international financial market; at the same time, creating conditions for global investors to have easier access to Vietnamese enterprises.

“In the coming time, the State Securities Commission will continue to perfect the synchronous legal framework, closely coordinate with international financial institutions, major stock exchanges in the world , experts... to promote support for Vietnamese enterprises, ensuring that the DR offering and listing process takes place smoothly, transparently and effectively,” said a representative of the State Securities Commission.

According to Mr. Nguyen Quang Thuong, Deputy General Director of the Vietnam Stock Exchange (VNX), Vietnam has a legal basis for the issuance and listing of depository certificates on Vietnamese stocks abroad and in fact, the initial implementation has been successful. Currently, depository certificates on Vietnamese stocks have been issued in the Thai market. "In the coming time, VNX will continue to promote bilateral cooperation activities with SGX, cooperate to share experiences in developing new products and technologies and coordinate with SGX to deploy the issuance of DR on Vietnamese stocks in Singapore," said Mr. Nguyen Quang Thuong.

Ms. Bernice Tan, Vice President of Singapore Exchange, provided an overview of SGX stock market as well as shared experience in building legal and technical framework, implementing, operating and managing depository certificate products; coordination between SGX and Exchanges in the ASEAN region in issuing inter-exchange depository certificates.

“The issuance of inter-exchange depositary receipts will leverage existing market infrastructure to achieve liquidity connectivity across ASEAN markets. The depositary receipt model benefits the domestic ecosystem by expanding opportunities for retail investors, intermediaries and institutional issuers. At the same time, depositary receipts will promote liquidity in the domestic and underlying markets,” said Ms. Bernice Tan.

Source: https://doanhnghiepvn.vn/kinh-te/chung-chi-luu-ky-tao-co-hoi-moi-cho-nha-dau-tu-chung-khoan/20250722080906272

Comment (0)