SGGPO

Heavy selling pressure after the VN-Index reclaimed the 1,200-point mark caused the index to reverse and fall. Market liquidity surged in both volume and value, but the VN-Index failed to hold the 1,200-point level.

|

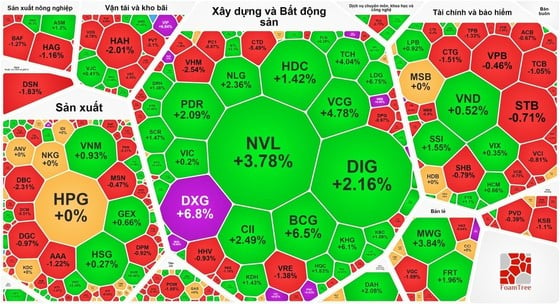

| Real estate stocks surged, but the VN-Index still fell below the 1,200-point mark. |

The Vietnamese stock market experienced significant volatility on July 27th due to strong profit-taking pressure from investors. While investors were expected to react positively to the Fed's 0.25 percentage point interest rate hike, this information did not seem to significantly impact the market. The VN-Index briefly fell by 10 points, but strong buying pressure, particularly in the real estate sector, caused many stocks to rebound sharply. Several stocks hit their upper limit, including DXG, ITC, NBB, and SJC; other stocks with strong gains such as NVL (up 3.78%), VCG (up 4.78%), NLG (up 2.36%), PDR (up 2.09%), CII (up 2.49%), BCG (up 6.5%), and DIG (up 2.1%) helped to mitigate the VN-Index's decline.

Meanwhile, the banking sector stocks were mostly in the red. Specifically, STB, VPB,SHB , TCB, CTG, VCB, OCB… all fell by nearly 1 to 1.5%. Although many stocks in the securities sector declined, a few also rose, such as SSI up 1.55%, FTS up 1.1%, and VND, VIX, and HCM all up nearly 1%.

At the close of trading, the VN-Index fell 3.51 points to 1,197.33 points (0.29%) with 262 declining stocks, 193 rising stocks, and 90 unchanged stocks. On the Hanoi Stock Exchange, the HNX-Index also fell 0.56 points (0.24%) to 235.64 points with 95 declining stocks, 73 rising stocks, and 164 unchanged stocks. Market liquidity surged with over 1.1 billion shares traded on the HOSE exchange, totaling nearly 22,700 billion VND in transaction value. If considering the entire market, the total transaction value reached nearly 25,200 billion VND (equivalent to 1.1 billion USD).

While domestic investors were selling off shares en masse, foreign investors made net purchases of nearly 330 billion VND on the HOSE exchange.

Source

![[Photo] Prime Minister Pham Minh Chinh attends the Conference on the Implementation of Tasks for 2026 of the Industry and Trade Sector](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F19%2F1766159500458_ndo_br_shared31-jpg.webp&w=3840&q=75)

Comment (0)