People can update their tax codes by using their CCCD on the eTax Mobile electronic tax application. Below are instructions for updating the CCCD number to a tax code, according to the guidance document of the Tax Department of Region 1.

Step 1: Access and log in to the Etax Mobile app.

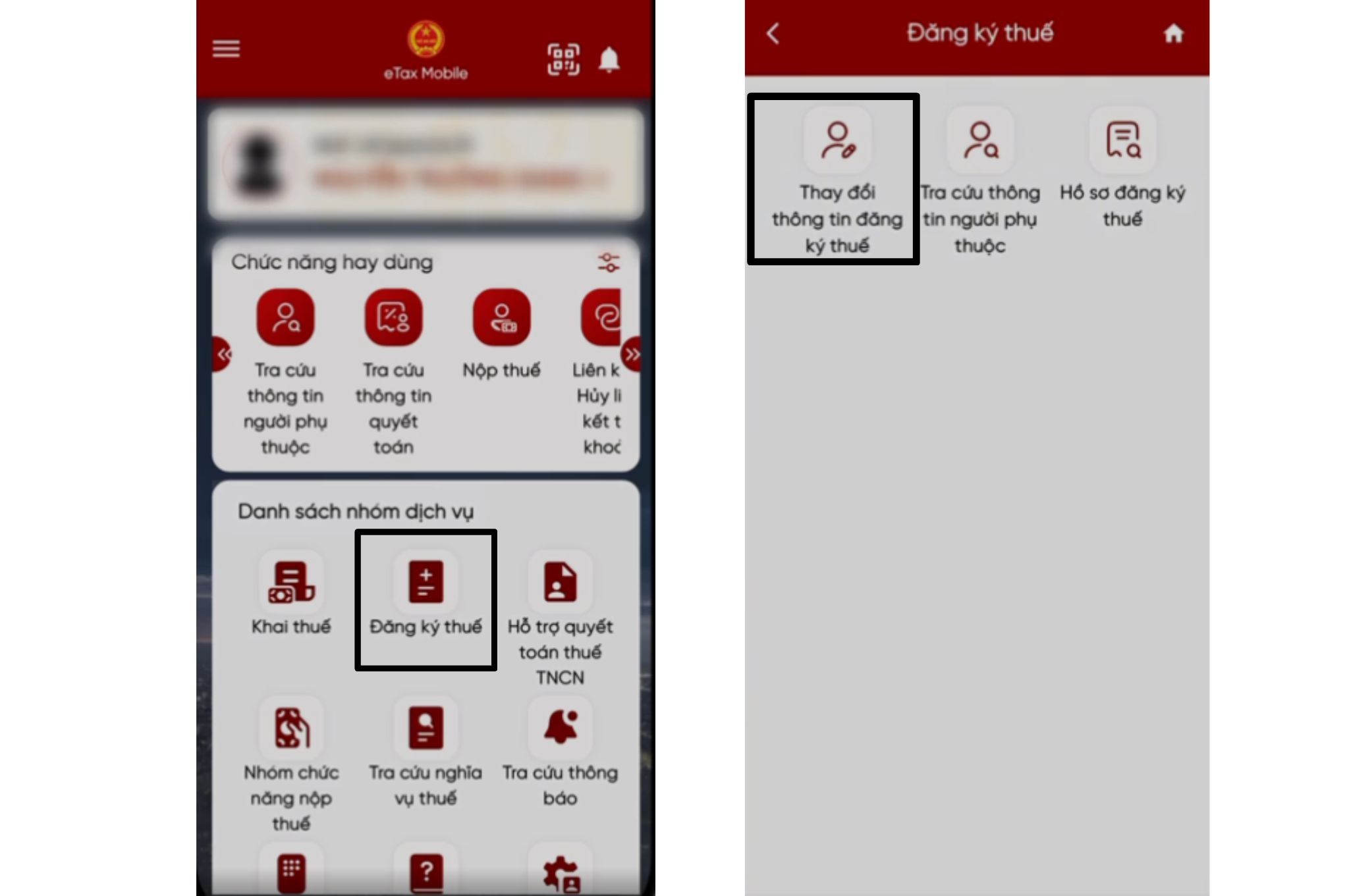

Taxpayers need to get data from the National Population Database. After successfully logging into the system, select the Tax Registration - Change Information menu.

|

Go to the app, tap Tax Registration. |

Step 2: The screen will display some information such as name, date of birth and some documents of the taxpayer. Enter the new CCCD number in the "New document number" box and click to get citizen information. The system will automatically query data from the National Population Database.

Step 3: After clicking "Get citizen information", there will be 2 cases that can happen

In case citizen information is not received from the National Population Database. The screen will display the message "Information of the taxpayer is not available in the National Population Database. The taxpayer should contact the police to update information in the National Population Database".

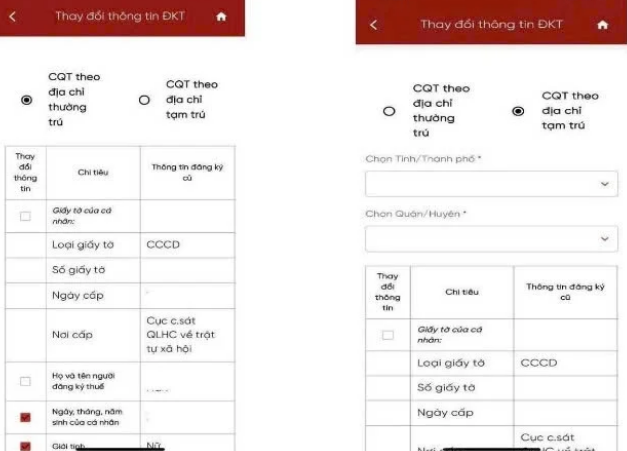

If the information is valid, the system will display the old and new tax registration information in parallel, retrieved from the National Tax Agency. The taxpayer chooses 1 of 2 tax authorities (CQT) to submit the declaration according to the permanent or temporary residence address.

|

Taxpayers can choose between CQT based on permanent or temporary residence address. |

If you select “CQT by permanent address”, 2 more cases will be presented. If you select to change the information of the permanent address, the declaration will be sent to the CQT corresponding to the district according to the newly registered tax information received from the National Population Registration Office, otherwise it will be sent to the old registration agency.

Conversely, choosing “CQT according to temporary address” will send the declaration to the tax authority according to the temporary address you have registered.

Step 4 : Select the indicators to change

Review the information and select the criteria that need to be changed. The system will ask for new registration information. Required fields include document number, date of issue, place of issue, phone number, email.

Step 5: Review and complete the declaration

The system will display a draft of the Information Change Declaration (Form 08-MST) for you to review again. When you are sure that all the information is correct, click continue.

Step 6: Save and share your draft

Click the Share button to save the declaration as a PDF to your phone or send it to social networks, or via other applications and click continue.

Step 7: Attach relevant documents

When the file attachment screen appears, the taxpayer needs to upload a photo of the front and back of the ID card by clicking the icon to download the attachment file available from the phone. If you have the documents in person, click the icon to use the phone camera to take a photo of the attachment file.

Step 8: Submit application and receive results

After attaching the documents, click Finish. The screen requires entering the OTP code sent to the registered phone number. When completed, the application will notify "The tax registration information change file has been successfully submitted. Please wait for processing!".

Source: https://znews.vn/day-la-cach-cap-nhat-so-cccd-thanh-ma-so-thue-post1565080.html

![[Photo] National Assembly Chairman visits Vi Thuy Commune Public Administration Service Center](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/1/d170a5e8cb374ebcae8bf6f7047372b9)

![[Photo] Standing member of the Secretariat Tran Cam Tu chaired a meeting with Party committees, offices, Party committees, agencies and Central organizations.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/1/b8922706fa384bbdadd4513b68879951)

Comment (0)