Domestic gold price today 5/3/2025

At the time of survey at 4:30 a.m. on May 3, 2025, domestic gold prices increased slightly for Mi Hong and Bao Tin Minh Chau gold. Specifically:

DOJI Group listed the price of SJC gold bars at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 2 million VND/tael for buying and 1 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 118.1-121 million VND/tael (buying - selling, slightly increased 100 thousand VND/tael in buying direction - unchanged in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.3-121.3 million VND/tael (buy - sell), gold price remains unchanged in both buying and selling directions compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114-116.5 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.4-119.7 million VND/tael (buy - sell); an increase of 100 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, May 3, 2025 is as follows:

| Gold price today | May 3, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 119.3 | 121.3 | - | - |

| DOJI Group | 119.3 | 121.3 | - | - |

| Mi Hong | 118 | 119.5 | +2000 | +1000 |

| PNJ | 119.3 | 121.3 | - | - |

| Vietinbank Gold | 121.3 | - | ||

| Bao Tin Minh Chau | 118.1 | 121 | +100 | - |

| Phu Quy | 118.3 | 121.3 | - | - |

| 1. DOJI - Updated: 5/3/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,300 | 121,300 |

| AVPL/SJC HCM | 119,300 | 121,300 |

| AVPL/SJC DN | 119,300 | 121,300 |

| Raw material 9999 - HN | 113,800 | 115,600 |

| Raw materials 999 - HN | 113,700 | 115,500 |

| 2. PNJ - Updated: May 3, 2025 04:30 - Website supply time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 114,000 | 117,000 |

| HCMC - SJC | 119,300 | 121,300 |

| Hanoi - PNJ | 114,000 | 117,000 |

| Hanoi - SJC | 119,300 | 121,300 |

| Da Nang - PNJ | 114,000 | 117,000 |

| Da Nang - SJC | 119,300 | 121,300 |

| Western Region - PNJ | 114,000 | 117,000 |

| Western Region - SJC | 119,300 | 121,300 |

| Jewelry gold price - PNJ | 114,000 | 117,000 |

| Jewelry gold price - SJC | 119,300 | 121,300 |

| Jewelry gold price - Southeast | PNJ | 114,000 |

| Jewelry gold price - SJC | 119,300 | 121,300 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,000 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,000 | 117,000 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,000 | 117,000 |

| Jewelry gold price - Jewelry gold 999.9 | 114,000 | 116,500 |

| Jewelry gold price - 999 jewelry gold | 113,880 | 116,380 |

| Jewelry gold price - 9920 jewelry gold | 113,170 | 115,670 |

| Jewelry gold price - 99 jewelry gold | 112,940 | 115,440 |

| Jewelry gold price - 750 gold (18K) | 80,030 | 87,530 |

| Jewelry gold price - 585 gold (14K) | 60,800 | 68,300 |

| Jewelry gold price - 416 gold (10K) | 41,110 | 48,610 |

| Jewelry gold price - 916 gold (22K) | 104,310 | 106,810 |

| Jewelry gold price - 610 gold (14.6K) | 63,720 | 71,220 |

| Jewelry gold price - 650 gold (15.6K) | 68,380 | 75,880 |

| Jewelry gold price - 680 gold (16.3K) | 71,870 | 79,370 |

| Jewelry gold price - 375 gold (9K) | 36,340 | 43,840 |

| Jewelry gold price - 333 gold (8K) | 31,100 | 38,600 |

| 3. SJC - Updated: 5/3/2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,300 | 121,300 |

| SJC gold 5 chi | 119,300 | 121,300 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,300 | 121,300 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 | 116,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 | 116,600 |

| 99.99% jewelry | 114,000 | 115,900 |

| 99% Jewelry | 110,752 | 114,752 |

| Jewelry 68% | 72,969 | 78,969 |

| Jewelry 41.7% | 42,485 | 48,485 |

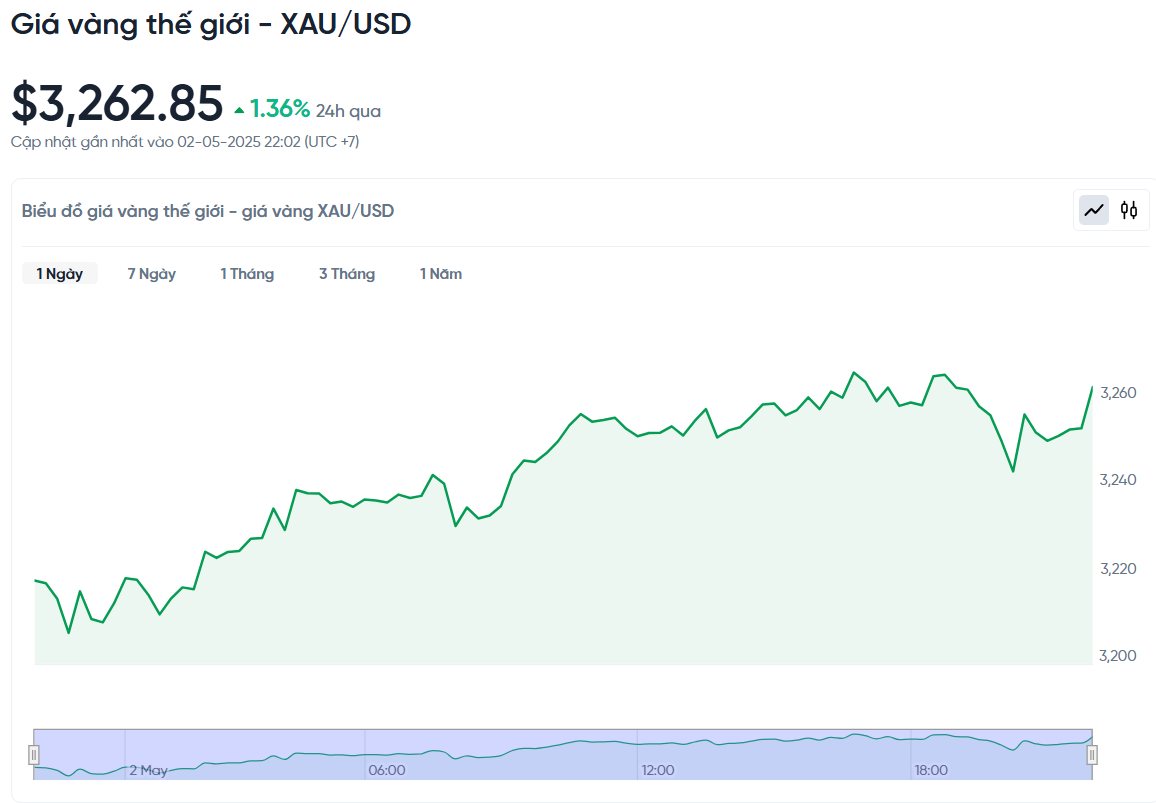

World gold price today May 3, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,262.85 USD/ounce. Today's gold price increased by 43.93 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,180 VND/USD), the world gold price is about 101.63 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 19.67 million VND/tael higher than the international gold price.

The world gold price increased slightly 'technically' as investors took advantage of buying when the price was at its lowest level in the past 2 weeks. However, the gold price faced the second consecutive week of decline, compared to the beginning of the week, the price was still down about 2.1%. The US gold futures contract also increased by 1.3%, to 3,262.10 USD/ounce.

Gold prices this week were largely driven by more positive news on trade relations between the US and China. China’s Ministry of Commerce said the US has repeatedly expressed its desire to resume tariff negotiations, and Beijing is open to dialogue.

According to Daniel Pavilonis of RJO Futures, the $3,500 level could be a near-term top, especially if trade deals start to take shape and risk appetite returns to the market. He believes that the recent gold price action has been somewhat exaggerated by trade war concerns, but the situation is gradually calming down.

The US Department of Labor's employment report showed that the labor market is still growing well. The number of non-farm jobs in April increased by 177,000, higher than the previous forecast of 133,000. However, the March figure was revised down, from an increase of 228,000 to 185,000 jobs. The unemployment rate in April was unchanged from the previous month, remaining at 4.2%. This is a factor that helps gold prices maintain a relatively stable state after yesterday's sharp decline.

In terms of external factors affecting gold prices, the US dollar index is slightly down on the day, while WTI crude oil prices are also weakening and trading around $59/barrel. The yield on the 10-year US government bond is currently at 4.271%. These factors can all affect the direction of the precious metal market in the short term.

Next Monday, the US financial markets will be looking forward to the ISM Services PMI report for April. If the index falls below 50, the USD may lose its appeal, which will create favorable conditions for the recovery of gold prices (XAU/USD).

However, many investors will still be cautious and not rush to react immediately, but will wait for official information from the US Federal Reserve's monetary policy meeting on May 6 and May 7, as well as the statements of Fed Chairman Jerome Powell in the press conference that follows.

Other precious metals also saw slight movements. Spot silver fell 0.1% to $32.35 an ounce, while platinum rose 1% to $967.70 and palladium rose 0.9% to $949 an ounce. However, all three metals were headed for a weekly decline.

Gold price forecast

Chris Zaccarelli, chief investment officer at Northlight Asset Management, said the risks from the tariff dispute remain. If the US administration continues to pursue its tariff plans after the 90-day reprieve ends in July, gold prices could react negatively as they did in early April.

The Fed is expected to keep interest rates unchanged in the 4.25%–4.5% range. However, what the market is more interested in is the content of the comments from Fed Chairman Jerome Powell.

If Chairman Powell hints that the Fed's current priority is to support the labor market, many investors may bet on an early rate cut, which would support gold. However, if Powell expresses concerns that inflation will persist longer than expected, the likelihood of the Fed maintaining higher interest rates could put further downward pressure on gold.

Some analysts believe that gold prices may continue to correct further. However, many still believe that these corrections are only temporary, and that buying will continue as the upward trend that has lasted for nearly two years has not been broken.

David Morrison from Trade Nation believes that the $3,200 price zone is not a solid support for buyers. He said that the MACD technical indicator has turned down, while gold is still in an overbought state. This shows that the downtrend is still dominant. The $3,200 mark is only symbolic, not a strong barrier. If selling pressure continues to increase, gold prices may retreat to $3,150 or even $3,000/ounce to retest the market's durability.

The Relative Strength Index (RSI) on the daily chart is currently slightly above 50, indicating that the gold price trend is still in a neutral state. This means that the bearish reversal signal has not yet been confirmed, and the market has not entered a clear downtrend.

On the downside, the $3,200/ounce level is seen as a temporary support level. If gold continues to weaken and breaks this level, the market could retreat to the $3,150-$3,160/ounce area. This price zone coincides with the 38.2% Fibonacci correction of the recent rally and is also the lower limit of the uptrend channel that started last December.

On the upside, the $3,290-$3,300/ounce zone is seen as the closest resistance. This is the intersection between the 23.6% Fibonacci correction and the center of the uptrend channel. If gold breaks through this zone, the next target will be the $3,400/ounce zone.

Source: https://baonghean.vn/gia-vang-hom-nay-3-5-2025-gia-vang-trong-nuoc-va-the-gioi-tang-nhe-do-luong-mua-vao-nhieu-10296422.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Infographic] What are the growth targets of Dong Nai province in the first 9 months of 2025?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/45f9330556eb4c6a88b098a6624d7e5b)

Comment (0)