This year's economy grew by about 5%, lower than the original plan but still quite high compared to the region and the world, according to Deputy Prime Minister Le Minh Khai.

Speaking at the financial sector's summary conference on the afternoon of December 27, Deputy Prime Minister Le Minh Khai assessed that the macro economy will continue to be maintained stable in 2023. "GDP for the whole year is estimated to increase by about 5%, this is a high growth rate compared to the region and the world ," he said.

According to the Deputy Prime Minister , inflation is under control, the average consumer price index (CPI) is estimated to increase by about 3.5%. The trade surplus is at a record level, with an estimated trade surplus of about 26 billion USD for the whole year. The state budget revenue is 3-4% higher than estimated.

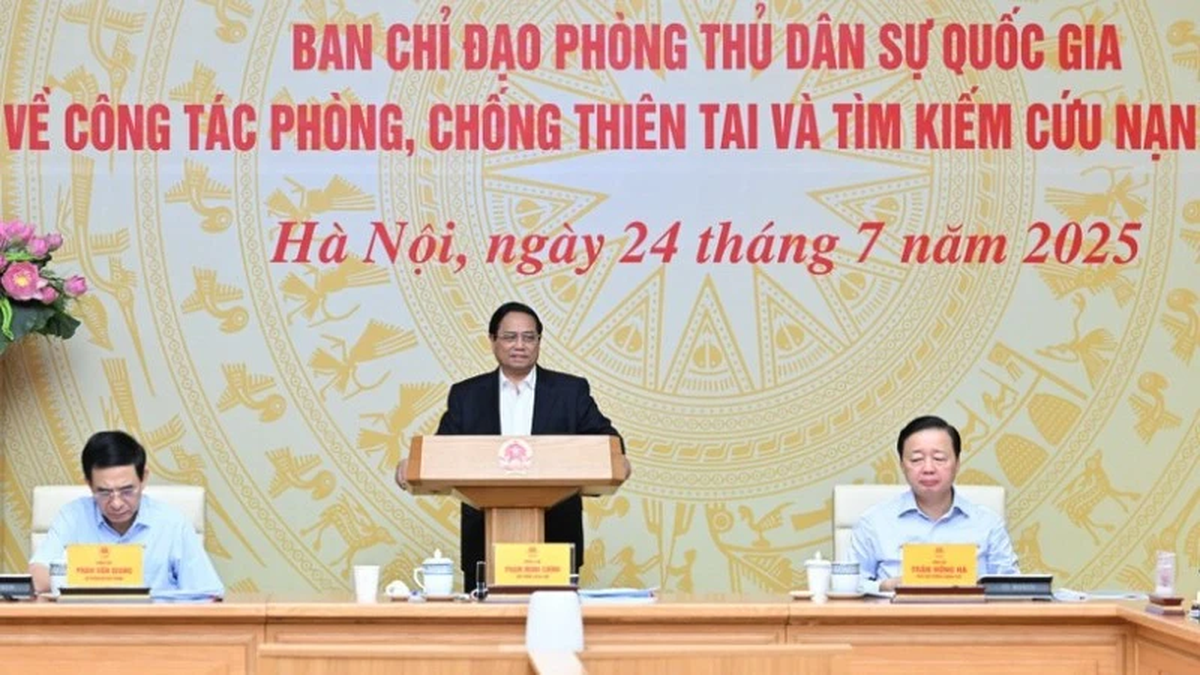

Deputy Prime Minister Le Minh Khai attended and spoke at the financial sector conference on the afternoon of December 27. Photo: VGP

The GDP results were forecast by the Government when reporting to the National Assembly in October. Prime Minister Pham Minh Chinh said that the economy has suffered unprecedented double impacts, despite efforts to resolve the situation. The Government has also continuously prioritized promoting growth, maintaining macroeconomic stability, controlling inflation and ensuring major balances of the economy.

In fact, last year, when the economy was in difficulty, the Government implemented solutions to support businesses and people such as reducing 2% of value added tax, reducing 50% of environmental protection tax on gasoline, reducing 10-50% of 36 fees and charges in the last 6 months of 2023.

The total amount of tax, fee, charge and land rent exemptions, reductions and extensions for businesses and people, according to the Ministry of Finance's report today, is about 193,400 billion VND. Of which, about 78,400 billion VND is exempted and reduced; about 115,000 billion VND is extended. The Ministry of Finance alone estimates that the policy of reducing 36 fees and charges will reduce revenue by about 700 billion VND.

Budget revenue as of December 25 reached VND1,690 trillion, exceeding the estimate by 4.5%. Of which, revenue from crude oil increased sharply by 44.6% due to high oil prices during the year. However, the balance of revenue from import-export activities decreased, reaching only 92.1% of the estimate, leading to a total budget revenue decrease of 4.2% this year compared to the same period in 2022.

Meanwhile, total budget expenditure was 83.4% of the estimate, about 1.73 million billion VND. Development investment expenditure increased by 144,000 billion VND, about 33% higher than the same period in 2022. However, this expenditure did not meet the plan, only reaching 79.8% of the estimate decided by the National Assembly, equal to 81.9% of the plan assigned by the Prime Minister.

It is estimated that in 2023, the state budget deficit will be about 4% of GDP, a decrease of VND 40,300 billion compared to the estimate, lower than the previous estimate of 4.42% by the Ministry of Finance, but marking an increase after the Covid-19 pandemic.

To ensure payment sources and repayment of principal debts due, by December 25, the amount of government bonds issued reached VND296,700 billion, equal to 74.2% of the plan at the beginning of the year. In 2023, the Government will complete negotiations and sign 17 ODA loan agreements and foreign preferential loan agreements with a total value of about 1.87 billion USD. New loans negotiated and signed since 2022 have higher interest rates, closer to the market. This reflects changes in lending policies of donors with Vietnam's status as a lower middle-income country.

The Ministry of Finance also said that state budget loans were fully repaid on time as committed. It is expected that by the end of 2023, public debt will be about 37% of GDP and government debt will be about 34% of GDP, lower than the ceiling and warning threshold allowed by the National Assembly.

In 2024, the Government leader requested the Ministry of Finance to consider supplementing tax laws to expand the collection base , including tax exploitation from e-commerce activities, land, infrastructure, food and beverage services, entertainment, etc. The Deputy Prime Minister also assigned the Ministry of Finance to research and apply appropriate data analysis solutions and tools to detect, prevent and strictly handle acts of forgery and fraud regarding invoices.

Besides, the Ministry of Finance needs to have appropriate tax, fee and charge policy solutions to continue supporting and removing difficulties for businesses and people.

According to the Deputy Prime Minister, the Ministry of Finance must also review the payment capacity of organizations issuing corporate bonds, especially bonds due in 2024. The Ministry needs to develop a contingency scenario to handle and ensure the legitimate rights and interests of investors and related entities.

Phuong Dung

Vnexpress.net

Source link

Comment (0)