Although the industry is less volatile and often "overshadowed" by other attractive fields, the potential of the Vietnamese confectionery market is enormous. This has long been a billion-dollar playground for domestic and foreign "giants" - and now it is preparing to welcome another large manufacturer from Indonesia.

The billion-dollar playground is about to welcome another "big guy" Indonesia

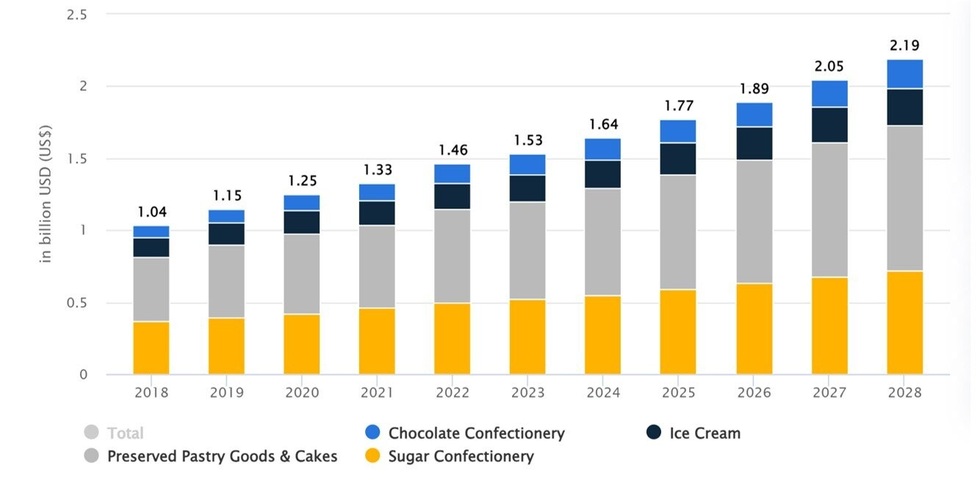

According to Statista, the revenue of Vietnam's confectionery market in 2025 is estimated to reach 1.77 billion USD and is expected to maintain a compound annual growth rate (CAGR) of 6.81% in the period 2025-2030.

Statista estimates that as the economy grows and living standards improve, demand for confectionery will increase accordingly. In addition, preferential government policies - such as tax incentives and infrastructure investment - are creating a favorable environment for businesses to expand their market share.

In addition, changes in consumer tastes, especially the trend of preferring high-end snacks, also contribute to the growth rate of the confectionery industry. This is clearly shown in the business picture of listed enterprises. Financial report statistics of Bibica (BBC), Huu Nghi (HNF), Kinh Do (KDC), Hai Ha (HHC)... show stable growth over the quarters.

Report on growth of Vietnam's confectionery market (Photo: Statista).

For example, in the third quarter, Bibica recorded revenue of nearly VND506 billion, up 5.4% over the same period; profit after tax reached VND44.6 billion, up 31%. Accumulated in the first 9 months of 2025, Bibica's revenue reached VND1,127 billion and profit after tax was VND70.9 billion, up 25.5% and 17.4% respectively.

Kinh Do also recorded positive results with net revenue in the third quarter reaching VND2,429 billion, up 8% over the same period; profit after tax reaching VND67 billion, 3 times higher than the same period. Accumulated in 9 months, revenue reached VND6,586 billion and profit after tax VND127 billion, up 14% and 135% respectively.

In the foreign business group, Orion Group announced its 9-month business results showing that the Vietnamese market grew by 14%, reaching about 1,800 billion VND - higher than both Russia and India. Revenue in Vietnam has maintained double-digit growth since 2020.

Domestic and foreign investors invest heavily to "win over" consumers

The fertile market always goes hand in hand with the fierce battle between domestic and foreign forces. Statista's report shows that, besides Vietnamese enterprises, many brands dominating the domestic confectionery and snack market share are owned by foreign giants. These include Oshi of Liwayway Holdings Company Limited (Philippines), Lay's of PepsiCo , Nestlé (Switzerland), Orion (Korea)...

In a new development, the market is about to welcome the Indonesian consumer goods group Sari Murni Abadi (SMA). SMA is a large enterprise in Indonesia, owning the snack brand Momogi. Through the acquisition of Bibica, SMA's CFO said this is a step in the ambition to expand its international footprint and consolidate its position in the global fast-moving consumer goods (FMCG) market.

This entry reflects the huge growth potential of the Vietnamese confectionery market, while creating stronger competitive pressure on existing businesses.

In that context, businesses are forced to implement new strategies: diversifying products, refining designs and adapting to consumer trends as users increasingly care about health, experiences and emotions.

According to observations, the prominent trend in the industry today is that consumers are moving towards green, natural, low-sugar and healthy products. The trend of “reduced sugar but still delicious” has become a priority for many families. Therefore, businesses are constantly innovating with products that reduce sugar by 50%.

The trend of green, healthy consumption also opens up new opportunities for the market (Photo: DT).

Coc Coc's survey shows that 4/5 consumers said they are more interested in healthy products, low in sugar, preservative-free or made from natural ingredients.

According to Coc Coc's report, this level of interest has increased by 3% compared to 2024. This is not just a number, but also a clear signal that the confectionery industry must innovate to meet increasing demand.

Additionally, the maturity of consumer behavior is evident: Young people prioritize deliciousness and affordability, while older people value safety, reliability and long-term value.

Source: https://dantri.com.vn/kinh-doanh/them-doi-thu-ngoai-canh-tranh-thi-truong-banh-keo-ty-usd-cua-viet-nam-20251120103509960.htm

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with South Korean National Assembly Chairman Woo Won Shik](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763629724919_hq-5175-jpg.webp&w=3840&q=75)

![[Photo] Lam Dong: Panoramic view of Lien Khuong waterfall rolling like never before](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763633331783_lk7-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong receives President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F20%2F1763629737266_ndo_br_1-jpg.webp&w=3840&q=75)

Comment (0)