Domestic gold price today 7/22/2025

Gold price information as of 10:30 a.m. on July 22, 2025, domestic gold bar prices increased sharply, reaching a peak in the past month. Specifically:

DOJI Group listed the price of SJC gold bars at 120-122 million VND/tael (buy - sell), the price remained unchanged in the buying direction - increased 500 thousand VND/tael in the selling direction compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 120-122 million VND/tael (buy - sell), the price remained unchanged in the buying direction - increased by 500 thousand VND/tael in the selling direction compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.8-121.8 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 300 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 120-122 million VND/tael (buy - sell), the price remains unchanged in the buying direction - increased 500 thousand VND/tael in the selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119.5-122 million VND/tael (buy - sell), gold price increased by 300 thousand VND/tael in buying direction - increased by 800 thousand VND/tael in selling direction compared to yesterday.

As of 10:30 a.m. on July 22, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.6-119.1 million VND/tael (buy - sell); the price increased by 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.3 million VND/tael (buy - sell); the gold price increased by 200 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 22, 2025 is as follows:

| Gold price today | July 22, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 120 | 122 | - | +500 |

| DOJI Group | 120 | 122 | - | +500 |

| Red Eyelashes | 120.8 | 121.8 | +300 | +300 |

| PNJ | 120 | 122 | - | +500 |

| Bao Tin Minh Chau | 120 | 122 | - | +500 |

| Phu Quy | 119.5 | 122 | +300 | +800 |

| 1. DOJI - Updated: 7/22/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 120,000 | 122,000 ▲500K |

| AVPL/SJC HCM | 120,000 | 122,000 ▲500K |

| AVPL/SJC DN | 120,000 | 122,000 ▲500K |

| Raw material 9999 - HN | 109,300 ▲500K | 110,100 ▲500K |

| Raw material 999 - HN | 109,200 ▲500K | 110,000 ▲500K |

| 2. PNJ - Updated: July 22, 2025 10:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| HCMC - SJC | 120,000 | 122,000 ▲500K |

| Hanoi - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Hanoi - SJC | 120,000 | 122,000 ▲500K |

| Da Nang - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Da Nang - SJC | 120,000 | 122,000 ▲500K |

| Western Region - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Western Region - SJC | 120,000 | 122,000 ▲500K |

| Jewelry gold price - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Jewelry gold price - SJC | 120,000 | 122,000 ▲500K |

| Jewelry gold price - Southeast | PNJ | 116,000 ▲900K |

| Jewelry gold price - SJC | 120,000 | 122,000 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 116,000 ▲900K |

| Jewelry gold price - Kim Bao Gold 999.9 | 116,000 ▲900K | 119,000 ▲1000K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 116,000 ▲900K | 119,000 ▲1000K |

| Jewelry gold price - Jewelry gold 999.9 | 115,000 ▲500K | 117,500 ▲500K |

| Jewelry gold price - Jewelry gold 999 | 114,880 ▲500K | 117,380 ▲500K |

| Jewelry gold price - Jewelry gold 9920 | 114,160 ▲500K | 116,660 ▲500K |

| Jewelry gold price - Jewelry gold 99 | 113,930 ▲500K | 116,430 ▲500K |

| Jewelry gold price - 750 gold (18K) | 80,780 ▲380K | 88,280 ▲380K |

| Jewelry gold price - 585 gold (14K) | 61,390 ▲290K | 68,890 ▲290K |

| Jewelry gold price - 416 gold (10K) | 41,530 ▲210K | 49,030 ▲210K |

| Jewelry gold price - 916 gold (22K) | 105,230 ▲460K | 107,730 ▲460K |

| Jewelry gold price - 610 gold (14.6K) | 64,330 ▲310K | 71,830 ▲310K |

| Jewelry gold price - 650 gold (15.6K) | 69,030 ▲330K | 76,530 ▲330K |

| Jewelry gold price - 680 gold (16.3K) | 72,550 ▲340K | 80,050 ▲340K |

| Jewelry gold price - 375 gold (9K) | 36,710 ▲180K | 44,210 ▲180K |

| Jewelry gold price - 333 gold (8K) | 31,430 ▲170K | 38,930 ▲170K |

| 3. SJC - Updated: 7/22/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 120,000 | 122,000 ▲500K |

| SJC gold 5 chi | 120,000 | 122,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 120,000 | 122,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 115,000 ▲500K | 117,500 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 115,000 ▲500K | 117,600 ▲500K |

| Jewelry 99.99% | 115,000 ▲500K | 116,900 ▲500K |

| Jewelry 99% | 111,242 ▲495K | 115,742 ▲495K |

| Jewelry 68% | 72,750 ▲340K | 79,650 ▲340K |

| Jewelry 41.7% | 42,002 ▲208K | 48,902 ▲208K |

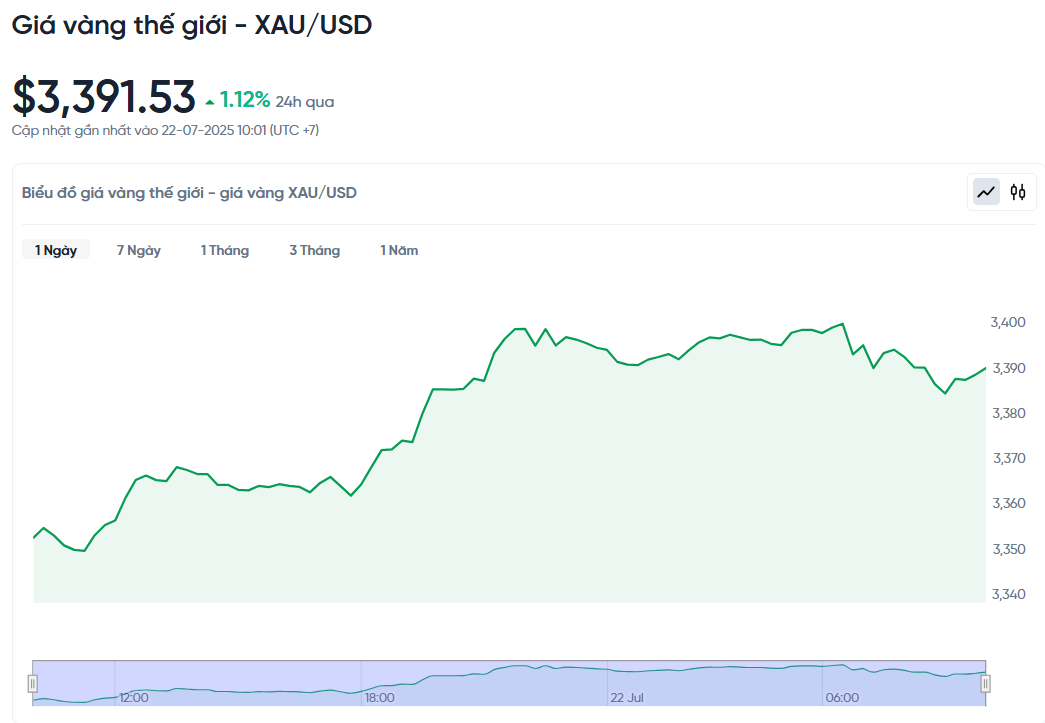

World gold price today 7/22/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 10:30 a.m. on July 22, Vietnam time, was 3,391.53 USD/ounce. Today's gold price increased by 37.5 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,340 VND/USD), the world gold price is about 111.11 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.89 million VND/tael higher than the international gold price.

World gold prices rose more than 1%, reaching a one-month high as the dollar and US bond yields weakened amid uncertainty ahead of the US August 1 deadline, forcing countries to reach trade deals with Washington or face higher tariffs.

Specifically, spot gold prices increased by 1.12% to nearly $3,400/ounce, recording the highest level since June 17. US gold futures increased by 1.4% to $3,406.40/ounce.

The U.S. dollar index (.DXY) fell 0.6%, making dollar-denominated gold cheaper for buyers using other currencies, while benchmark 10-year U.S. Treasury yields hit their lowest in more than a week.

Uncertainty surrounding the trade deadline is providing strong support for gold prices, according to David Meger, director of metals trading at High Ridge Futures.

The European Union is considering a range of possible countermeasures against the United States as the prospects of reaching an acceptable trade deal with Washington fade, EU diplomats said.

Another important factor is the expectation that the US Federal Reserve (Fed) will cut interest rates in September. According to data from the CME FedWatch Tool, the market is currently predicting a 59% probability of the Fed cutting interest rates.

In addition, speculation about the replacement of Fed Chairman Jerome Powell and the restructuring of the Fed also made investors more cautious. Gold is considered a hedge against uncertainty and tends to rise when interest rates are low.

However, demand for gold from China has fallen sharply. Data shows that gold imports into the country last month were just 63 tonnes, the lowest since January. Platinum imports also fell 6.1% from the previous month.

Not only gold, other precious metals also increased in price. Silver increased 2.1% to 38.99 USD/ounce, platinum increased 1.4% to 1,440.75 USD, and palladium increased 2.1% to 1,266.04 USD.

Gold Price Forecast

The forecast for gold prices in the coming weeks will depend largely on the Fed’s actions. If the Fed signals a rate cut or the USD continues to depreciate, the world gold price is likely to surpass the threshold of 3,400 USD/ounce. This means that domestic gold prices will also be under upward pressure.

The world gold price may head towards the 3,425 USD/ounce mark in the short term. In the last 6 trading sessions, the gold price fluctuated between 3,326.10 and 3,389.30 USD/ounce.

According to CPM's assessment, gold prices will likely continue to move between 3,320 and 3,400 USD in the next few sessions, but may surpass the 3,400 mark and approach the target area of 3,425 USD.

Michael Moor, founder of Moor Analytics, is bullish on gold. He said that on longer time frames, gold has broken out from key multi-year resistance levels and is in a steady uptrend. In particular, recent technical signals suggest that the upside momentum still has a lot of room to run.

Specifically, Mr. Moor cited technical milestones showing that after each time the gold price breaks through a certain price range, the market usually continues to increase by about $40 to $150. Each such breakout creates clear price targets, and in fact, the gold price has achieved these forecasted milestones many times in the short term.

However, he also warned that if gold prices fall below $3,321.5 an ounce, there could be a correction of about $65.

While the world market is bustling, domestic gold trading is quite quiet as buyers and sellers are waiting for new management moves from the management agency. Currently, the gap between domestic and world gold prices is still high, causing many investors to choose 99.99% gold rings or jewelry instead of SJC gold bars to save costs.

According to experts, the reason why domestic gold prices are higher than world prices is mainly due to the impact of the USD/VND exchange rate. In addition, the policy of strictly managing the import of raw gold and focusing on domestic production also limits supply, pushing prices up.

Vietnam is gradually eliminating its monopoly on gold imports, a move that is highly appreciated by experts and is expected to help narrow the price gap with the world. The establishment of a national gold exchange is also considered an important solution to make prices transparent and create downward pressure on domestic prices.

Source: https://baonghean.vn/cap-nhat-gia-vang-22-7-2025-gia-vang-trong-nuoc-va-the-gioi-tang-manh-cham-dinh-1-thang-qua-10302840.html

Comment (0)