Domestic gold price today 5/11/2025

At the time of survey at 4:30 a.m. on May 11, 2025, domestic gold prices increased slightly. Specifically:

The price of SJC gold bars listed by DOJI Group is at 120-122 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 120-122 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 121-122 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1 million VND/tael for buying and 500 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 120-122 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119-122 million VND/tael (buy - sell), gold price increased by 1.3 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114.5-117 million VND/tael (buy - sell); the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, May 11, 2025 is as follows:

| Gold price today | May 11, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 120 | 122 | +500 | +500 |

| DOJI Group | 120 | 122 | +500 | +500 |

| Red Eyelashes | 121 | 122 | +1000 | +500 |

| PNJ | 120 | 122 | +500 | +500 |

| Vietinbank Gold | 122 | +500 | ||

| Bao Tin Minh Chau | 120 | 122 | +500 | +500 |

| Phu Quy | 119 | 122 | +1300 | +1300 |

| 1. DOJI - Updated: 11/5/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 120,000 ▲500K | 122,000 ▲500K |

| AVPL/SJC HCM | 120,000 ▲500K | 122,000 ▲500K |

| AVPL/SJC DN | 120,000 ▲500K | 122,000 ▲500K |

| Raw material 9999 - HN | 111,700 ▲500K | 114,500 ▲500K |

| Raw material 999 - HN | 111,600 ▲500K | 114,400 ▲500K |

| 2. PNJ - Updated: May 11, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,000 | 116,600 |

| HCMC - SJC | 120,000 ▲500K | 122,000 ▲500K |

| Hanoi - PNJ | 114,000 | 116,600 |

| Hanoi - SJC | 120,000 ▲500K | 122,000 ▲500K |

| Da Nang - PNJ | 114,000 | 116,600 |

| Da Nang - SJC | 120,000 ▲500K | 122,000 ▲500K |

| Western Region - PNJ | 114,000 | 116,600 |

| Western Region - SJC | 120,000 ▲500K | 122,000 ▲500K |

| Jewelry gold price - PNJ | 114,000 | 116,600 |

| Jewelry gold price - SJC | 120,000 ▲500K | 122,000 ▲500K |

| Jewelry gold price - Southeast | PNJ | 114,000 |

| Jewelry gold price - SJC | 120,000 ▲500K | 122,000 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,000 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,000 | 116,600 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,000 | 116,600 |

| Jewelry gold price - Jewelry gold 999.9 | 114,000 | 116,500 |

| Jewelry gold price - Jewelry gold 999 | 113,880 | 116,380 |

| Jewelry gold price - Jewelry gold 9920 | 113,170 | 115,670 |

| Jewelry gold price - Jewelry gold 99 | 112,940 | 115,440 |

| Jewelry gold price - 750 gold (18K) | 80,030 | 87,530 |

| Jewelry gold price - 585 gold (14K) | 60,800 | 68,300 |

| Jewelry gold price - 416 gold (10K) | 41,110 | 48,610 |

| Jewelry gold price - 916 gold (22K) | 104,310 | 106,810 |

| Jewelry gold price - 610 gold (14.6K) | 63,720 | 71,220 |

| Jewelry gold price - 650 gold (15.6K) | 68,380 | 75,880 |

| Jewelry gold price - 680 gold (16.3K) | 71,870 | 79,370 |

| Jewelry gold price - 375 gold (9K) | 36,340 | 43,840 |

| Jewelry gold price - 333 gold (8K) | 31,100 | 38,600 |

| 3. SJC - Updated: 11/5/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 120,000 ▲500K | 122,000 ▲500K |

| SJC gold 5 chi | 120,000 ▲500K | 122,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 120,000 ▲500K | 122,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,500 ▲500K | 117,000 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,500 ▲500K | 117,100 ▲500K |

| Jewelry 99.99% | 114,500 ▲500K | 116,400 ▲500K |

| Jewelry 99% | 110,747 ▲495K | 115,247 ▲495K |

| Jewelry 68% | 72,809 ▲340K | 79,309 ▲340K |

| Jewelry 41.7% | 42,193 ▲208K | 48,693 ▲208K |

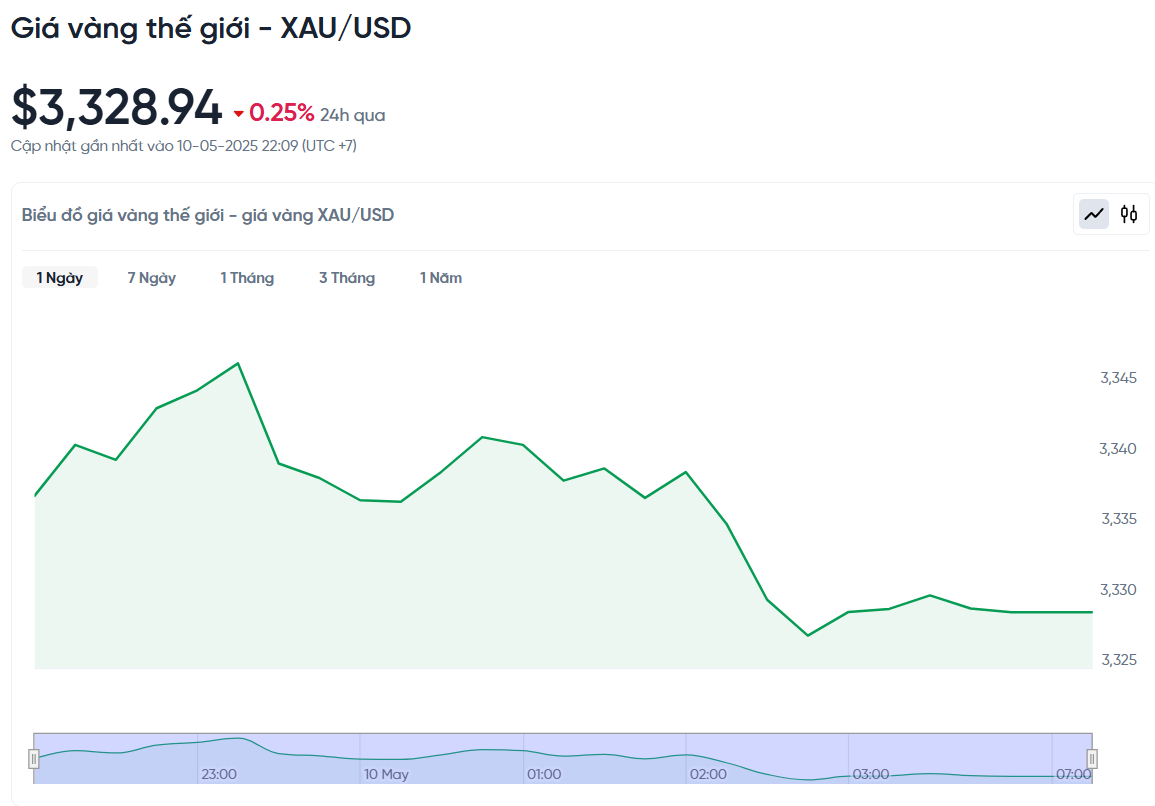

World gold price today 5/11/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,328.94 USD/ounce. Today's gold price decreased by 8.3 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,140 VND/USD), the world gold price is about 106.03 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 15.96 million VND/tael higher than the international gold price.

Gold prices are showing signs of a decent recovery after a recent sharp sell-off, as the dollar weakened and crude oil prices rose, but the recovery was capped by increased risk sentiment over the weekend and continued gains in U.S. Treasury yields, according to Kitco.

One factor that is putting pressure on gold prices is news of a trade deal between the US and China. According to Bloomberg, the volume of goods imported through the Port of Los Angeles has dropped by a third. A director in the transportation industry said that goods from China alone have dropped by 60%.

This situation is severely disrupting the supply chain in the US and has a knock-on effect on related industries such as loading and unloading, logistics and retail. Even if the US and China reach an agreement, the recovery of the supply chain will take time.

On the demand side, Asia continues to lead the global gold market. In addition to buying physical gold, the region is also stepping up investment in gold ETFs.

According to the World Gold Council (WGC), the total amount of gold held by global ETFs increased by 115 tons, equivalent to $11 billion, in April, bringing the total to 3,561 tons. This is the fifth consecutive month of capital inflows into these funds and also the highest level since August 2022, although still 10% lower than the peak set in 2020.

Notably, Asia accounted for 65% of total global net capital flows, a record high. North America also recorded a significant amount of investment, while Europe witnessed a trend of capital withdrawal from gold funds.

Although gold prices hit a historic peak of $3,500 an ounce last month, the WGC still believes that the precious metal has room for growth, especially in the context of volatile global financial markets and profit-taking activities that have not caused significant pressure.

According to this organization's assessment, the amount of gold held by Western funds is still 575 tons (equivalent to 15%) lower than the 2020 peak, showing that the potential for buying is still large if the unstable situation continues to last.

Gold Price Forecast

In a report cited by Kitco News on May 7, JP Morgan predicted that gold prices could reach $4,000/ounce within the next 12 months, with the US and global economies maintaining growth momentum.

This forecast was made in the context of global financial markets being under a lot of pressure and instability, causing gold to continue to be seen as a strategic defense tool.

The highlight of Ms. Peters’s assessment is that JP Morgan raised its gold price target from $3,500 to $4,000 an ounce. The main drivers of this bullish scenario are strong buying demand from central banks in emerging markets, along with capital flows into ETFs.

In addition, demand from the jewelry and technology industries is also expected to keep gold prices stable and possibly increase slightly in the coming time.

Gold investors are entering the new week with a cautious mindset, as the market focus is on the results of the US-China trade negotiations and important economic data from the US, especially the April inflation report.

According to analysts, gold prices could start the week with strong fluctuations, depending on the content of statements after negotiations between the US and China.

If the two sides reach an agreement to suspend or reduce tariffs on some goods and commit to continuing negotiations, this could reduce demand for safe-haven gold and put pressure on prices early on Monday.

Conversely, if there are no positive signs of trade tensions easing, gold could rebound as a hedge against uncertainty.

Source: https://baonghean.vn/gia-vang-hom-nay-11-5-2025-gia-vang-trong-nuoc-va-gia-vang-the-gioi-tang-nua-trieu-dong-10296987.html

Comment (0)