Domestic gold price today 7/22/2025

Gold price information as of 4:30 a.m. on July 22, 2025, domestic gold bar price according to yesterday's closing price, July 21. Specifically:

DOJI Group listed the price of SJC gold bars at 120-121.5 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 120-121.5 million VND/tael (buy - sell), an increase of 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.5-121.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 300 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 120-121.5 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119.2-121.2 million VND/tael (buy - sell), gold price increased by 500 thousand VND/tael in buying direction - increased by 200 thousand VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. on July 22, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.1-118.6 million VND/tael (buy - sell); the price increased by 200,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.3 million VND/tael (buy - sell); the gold price increased by 200 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 22, 2025 is as follows:

| Gold price today | July 22, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 120 | 121.5 | +300 | +300 |

| DOJI Group | 120 | 121.5 | +500 | +500 |

| Red Eyelashes | 120.5 | 121.5 | +300 | +300 |

| PNJ | 120 | 121.5 | +500 | +500 |

| Bao Tin Minh Chau | 120 | 121.5 | +500 | +500 |

| Phu Quy | 119.2 | 121.2 | +500 | +200 |

| 1. DOJI - Updated: 7/22/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 120,000 ▲500K | 121,500 ▲500K |

| AVPL/SJC HCM | 120,000 ▲500K | 121,500 ▲500K |

| AVPL/SJC DN | 120,000 ▲500K | 121,500 ▲500K |

| Raw material 9999 - HN | 108,800 ▲200K | 109,600 ▲200K |

| Raw material 999 - HN | 108,700 ▲200K | 109,500 ▲200K |

| 2. PNJ - Updated: July 22, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 115,100 ▲400K | 118,000 ▲400K |

| HCMC - SJC | 120,000 ▲500K | 121,500 ▲500K |

| Hanoi - PNJ | 115,100 ▲400K | 118,000 ▲400K |

| Hanoi - SJC | 120,000 ▲500K | 121,500 ▲500K |

| Da Nang - PNJ | 115,100 ▲400K | 118,000 ▲400K |

| Da Nang - SJC | 120,000 ▲500K | 121,500 ▲500K |

| Western Region - PNJ | 115,100 ▲400K | 118,000 ▲400K |

| Western Region - SJC | 120,000 ▲500K | 121,500 ▲500K |

| Jewelry gold price - PNJ | 115,100 ▲400K | 118,000 ▲400K |

| Jewelry gold price - SJC | 120,000 ▲500K | 121,500 ▲500K |

| Jewelry gold price - Southeast | PNJ | 115,100 ▲400K |

| Jewelry gold price - SJC | 120,000 ▲500K | 121,500 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 115,100 ▲400K |

| Jewelry gold price - Kim Bao Gold 999.9 | 115,100 ▲400K | 118,000 ▲400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 115,100 ▲400K | 118,000 ▲400K |

| Jewelry gold price - Jewelry gold 999.9 | 114,500 ▲300K | 117,000 ▲300K |

| Jewelry gold price - Jewelry gold 999 | 114,380 ▲300K | 116,880 ▲300K |

| Jewelry gold price - Jewelry gold 9920 | 113,660 ▲290K | 116,160 ▲290K |

| Jewelry gold price - Jewelry gold 99 | 113,430 ▲300K | 115,930 ▲300K |

| Jewelry gold price - 750 gold (18K) | 80,400 ▲220K | 87,900 ▲220K |

| Jewelry gold price - 585 gold (14K) | 61,100 ▲180K | 68,600 ▲180K |

| Jewelry gold price - 416 gold (10K) | 41,320 ▲120K | 48,820 ▲120K |

| Jewelry gold price - 916 gold (22K) | 104,770 ▲270K | 107,270 ▲270K |

| Jewelry gold price - 610 gold (14.6K) | 64,020 ▲180K | 71,520 ▲180K |

| Jewelry gold price - 650 gold (15.6K) | 68,700 ▲190K | 76,200 ▲190K |

| Jewelry gold price - 680 gold (16.3K) | 72,210 ▲200K | 79,710 ▲200K |

| Jewelry gold price - 375 gold (9K) | 36,530 ▲120K | 44,030 ▲120K |

| Jewelry gold price - 333 gold (8K) | 31,260 ▲100K | 38,760 ▲100K |

| 3. SJC - Updated: 7/22/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 120,000 ▲300K | 121,500 ▲300K |

| SJC gold 5 chi | 120,000 ▲300K | 121,520 ▲300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 120,000 ▲300K | 121,530 ▲300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,500 ▲300K | 117,000 ▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,500 ▲300K | 117,100 ▲300K |

| Jewelry 99.99% | 114,500 ▲300K | 116,400 ▲300K |

| Jewelry 99% | 110,747 ▲297K | 115,247 ▲297K |

| Jewelry 68% | 72,410 ▲204K | 79,310 ▲204K |

| Jewelry 41.7% | 41,793 ▲125K | 48,693 ▲125K |

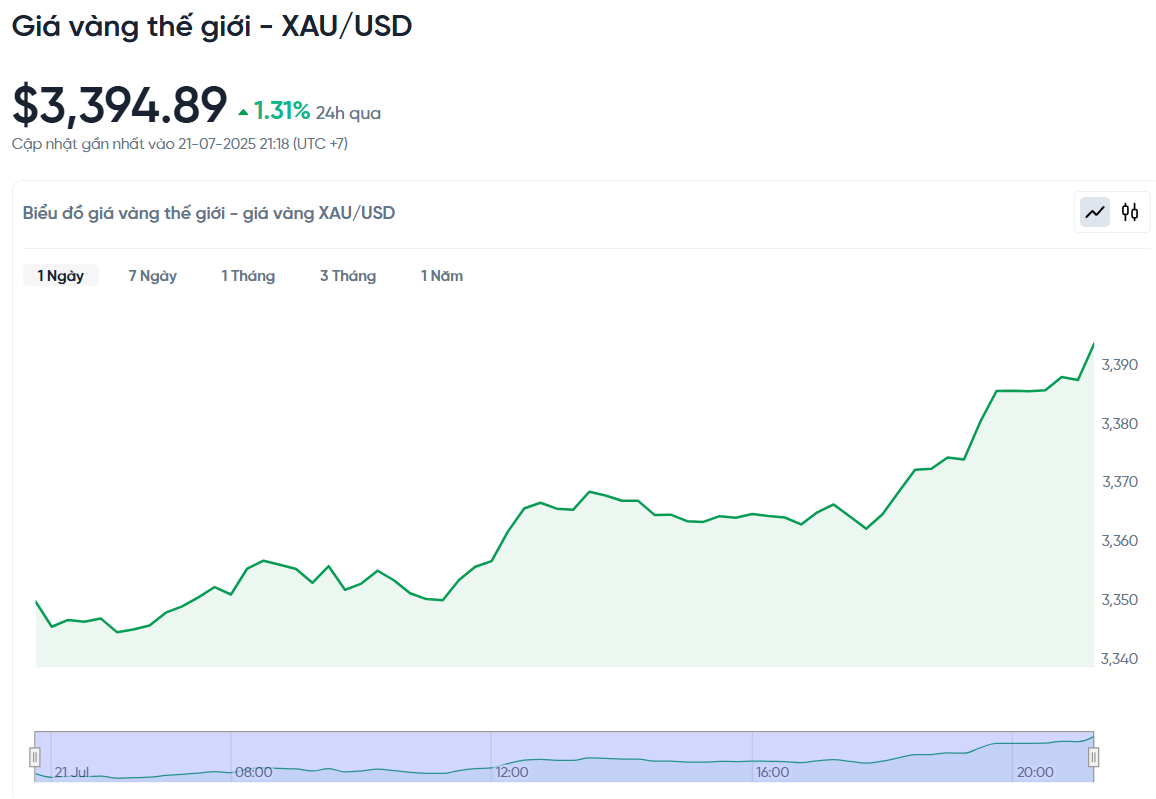

World gold price today 7/22/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 22, Vietnam time, was 3,394.89 USD/ounce. Today's gold price increased by 43.92 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,340 VND/USD), the world gold price is about 111.31 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.19 million VND/tael higher than the international gold price.

World gold prices rose sharply due to the decline of the US dollar and US government bond yields amid market concerns about trade negotiations. The US has set an August 1 deadline with no extension for countries to reach an agreement, otherwise they will face higher tariffs.

Specifically, spot gold prices increased by 1.31% to nearly 3,400 USD/ounce, while gold futures prices in the US also increased by 1.3% to 3,402.40 USD.

The DXY index fell 0.4%, making gold cheaper for investors using other currencies, while the yield on the benchmark 10-year US Treasury note also fell to its lowest level in more than a week.

The looming August 1 deadline is creating uncertainty in the market, which is supporting gold prices, said David Meger, director of metals trading at High Ridge Futures. The European Union (EU) is also considering countermeasures against the US as the prospects of a trade deal between the two sides become increasingly dim.

The market is pricing in a 63% chance of the US Federal Reserve cutting interest rates in September. Speculation about the replacement of Fed Chairman Jerome Powell and the restructuring of the Fed are also adding to the market uncertainty. Gold is often seen as a hedge against uncertainty and tends to rise in value when interest rates are low.

Data showed China, the world's largest gold consumer, imported just 63 tonnes of gold last month, the lowest since January. Its platinum imports in June also fell 6.1% from the previous month.

Besides gold, silver price increased 1.8% to 38.86 USD/ounce, platinum increased 2.2% to 1,453.17 USD and palladium increased sharply by 3.5% to 1,284.46 USD.

Gold Price Forecast

The world gold price may head towards the 3,425 USD/ounce mark in the short term. In the last 6 trading sessions, the gold price fluctuated between 3,326.10 and 3,389.30 USD/ounce. According to CPM's assessment, the gold price will likely continue to move between 3,320 and 3,400 USD in the next few sessions, but may surpass the 3,400 mark and approach the target of 3,425 USD.

Michael Moor, founder of Moor Analytics, is bullish on gold. He said that on longer time frames, gold has broken out from key multi-year resistance levels and is in a steady uptrend. In particular, recent technical signals suggest that the upside momentum still has a lot of room to run.

Specifically, Mr. Moor cited technical milestones showing that after each time the gold price breaks through a certain price range, the market usually continues to increase by about $40 to $150. Each such breakout creates clear price targets, and in fact, the gold price has achieved these forecasted milestones many times in the short term.

However, he also warned that if gold falls below $3,321.5 an ounce, there could be a correction of around $65.

While President Trump continues to push the Fed to cut interest rates, many central banks around the world are also likely to ease monetary policy. US tariffs are expected to prompt most of the 23 central banks tracked to adopt economic stimulus measures in the coming months, Bloomberg Economics said.

Technically, the bulls still have the short-term advantage in the gold market. Their next target is to push the price to close above the strong resistance at $3,400. The nearest resistance is at the July high ($3,389.20) and then $3,400.

Meanwhile, bears are aiming to push prices below the key support level at the June low of $3,250.50. First support is at the overnight low of $3,351, followed by last week’s low of $3,314.30. The Wyckoff Market Rating Index currently stands at 6.5/10.

Source: https://baonghean.vn/gia-vang-hom-nay-22-7-2025-gia-vang-trong-nuoc-va-the-gioi-tang-vuot-cuc-cao-nhat-2-tuan-qua-10302822.html

Comment (0)