Possibility of retesting supply at 1.110 – 1.115 zone

Following the impressive growth of the previous week, the Vietnamese stock market continued to perform positively. Specifically, the optimistic sentiment helped the VN-Index increase strongly in the first two sessions of the week to surpass the psychological resistance level of 1,100 points.

The market continued to increase slightly in the fourth session before shaking strongly in the following session when the VN-Index decreased 0.7% and retreated close to the 1,100 point mark due to increased profit-taking pressure.

However, the demand for low-priced stocks was activated in the last session of the week and helped the VN-Index reverse and increase. At the end of the trading week, the VN-Index closed positively at 1,107.5 points, up 1.5% compared to the previous week. At the same time, the HNX-Index increased by 0.7% to 227.6 points and the UPCoM-Index increased by 0.3% to 84.2 points.

Liquidity increased sharply with the average transaction value of the 3 floors reaching 21,265 billion VND, an increase of 14.9% compared to the previous week. In the session of June 8 alone, liquidity increased dramatically, reaching more than 23,000 billion VND - the highest level since the beginning of the year.

In addition, foreign investors reduced their net selling value on the HoSE to VND483 billion, down 59.2% compared to the previous week, and increased their net buying value on the HNX-Index to VND91 billion. In contrast, foreign investors increased their net selling value on the UPCOM-Index to VND178 billion.

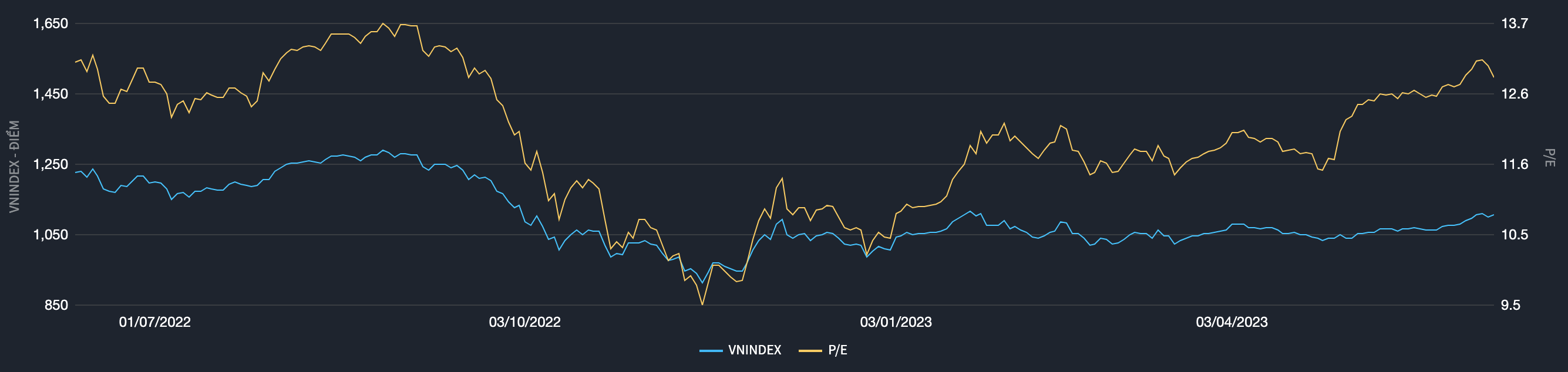

Market valuation chart over the past year (Source: Fiintrade).

Commenting on the milestone that VN-Index can reach in the new trading week, Yuanta Vietnam Securities commented that after encountering a difficult resistance at the 1,115 - 1,125 point range in early June, VN-Index may move towards 1,135 points, while long-term risks continue to decrease.

The analysis team believes that long-term investors can continue to increase their stock holdings and can pay attention to stock groups in June 2023 including electricity production and distribution, pharmaceuticals, technology and oil and gas services.

However, Rong Viet Securities commented that the market is likely to re-test the supply in the 1,110 - 1,115 point area in the next trading session. If the supply in this area shows signs of cooling down, the market can continue to gradually move towards the resistance area around 1,125 points.

Therefore, investors can hold or exploit short-term opportunities in stocks with good technical signals and attracting cash flow. However, it is necessary to consider taking profits in stocks that increase rapidly to the resistance zone or are under selling pressure from the resistance zone to realize the results.

Limit new purchases at this time

Commenting on the market in the coming time, Mr. Hoang Viet Phuong - Director of the Center for Analysis & Investment Consulting of SSI Securities Company said that, last weekend's session, strong cash flow support helped the VN-Index gradually recover at the end of the session and closed up 6.21 points, equivalent to 0.56% to 1,107.53 points. Liquidity reached 839 million matched units, lower than the previous session.

According to Mr. Phuong, the RSI indicator still maintains a strong consensus signal with the ADX indicator, while the VN-Index still maintains its position above the EMA 200 line at 1,096. With the above technical signals, the VN-Index is forecast to continue moving in an upward trend and towards the target range of 1,116 - 1,120.

In the long term, the VN-Index has escaped the sideways trend in the narrow range of 1,040 - 1,080 and entered an uptrend with a moderate increase and the target for June is towards the 1,150 - 1,160 range. As it is approaching the old peak, corrections and fluctuations are likely to occur with the index's support level of 1,160 points.

In terms of cash flow and technical trends, the expert from SSI recommends that investors can continue to follow this uptrend to seek profits, while at the same time it is necessary to manage risks well by diversifying the portfolio among industry groups and complying with the established discipline with short-term transactions.

In June, investment opportunities during correction periods were suggested by Mr. Phuong in some large-cap stocks, typically STB, MBB, MBS, KBC, NLG, PVS, KSB, MWG,..

Similarly, Mr. Dinh Quang Hinh - Head of Macro and Market Strategy Department, Analysis Department of VNDirect Securities Company commented that the VN-Index is gradually approaching the strong resistance zone of 1,120-1,140 points. This is the peak of this index since the beginning of 2023, so it is not easy for the VN-Index to overcome this resistance zone.

In that context, investors should limit new purchases at this time and can consider taking profits on some of the stocks purchased at low prices in previous weeks to realize profits. For investors with high leverage ratios, they should proactively reduce margin to control portfolio risks .

Source

![[Photo] General Secretary To Lam attends the 50th anniversary of the founding of the Vietnam National Industry and Energy Group](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/21/bb0920727d8f437887016d196b350dbf)

![[Photo] General Secretary To Lam presents the First Class Labor Medal to the Vietnam National Energy and Industry Group](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/21/0ad2d50e1c274a55a3736500c5f262e5)

Comment (0)