Up to 86% of buyers hold real estate for less than 1 year. They buy and sell in a short time to make a profit. This partly pushes the real estate price higher than the real value, causing market disturbance.

Many plots of land in lane 3, Thanh Than village, Thanh Cao commune, Thanh Oai district, Hanoi were publicly sold by brokers right after the auction - Photo: B.NGOC

Low income taxes do not deter speculation

The information was provided by Batdongsan.com.vn in a report on the overview of the Vietnamese real estate market in 2024, looking to the world .

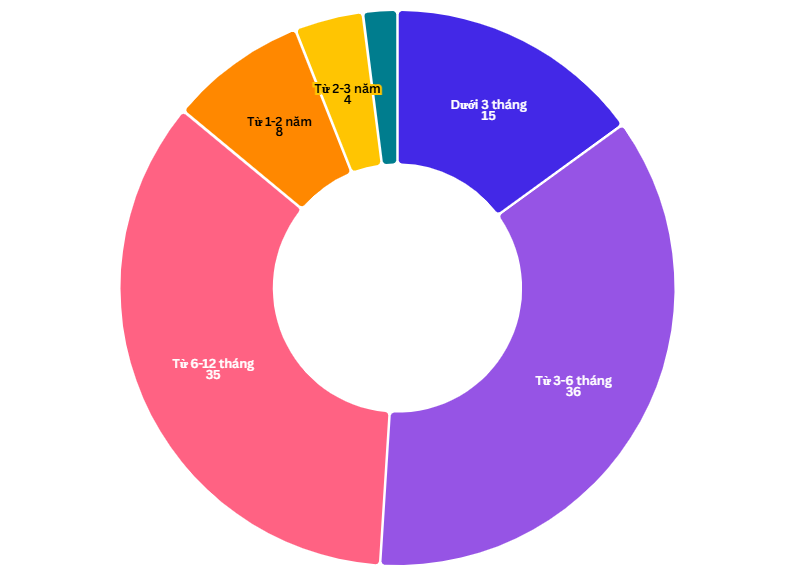

Batdongsan.com.vn's survey results on the time of holding real estate before selling in Vietnam also recorded that in 2023: 15% of buyers hold real estate for less than 3 months, 36% hold from 3-6 months, 35% hold from 6-12 months, 8% hold 1-2 years, 4% hold 2-3 years, 2% hold longer.

"Up to 86% of people buy real estate to flip for profit, holding it for less than 1 year," said Mr. Nguyen Quoc Anh, deputy general director of Batdongsan.com.vn.

Real estate holding time before sale in Vietnam (Unit:%)

Meanwhile, in Europe, the time of holding real estate before selling is as follows: 7% of buyers hold real estate from 1-3 years, 23% hold 3-5 years, 33% hold 5-10 years, 38% hold over 10 years.

Part of the reason is that income tax on real estate transfer and rental activities in our country is too low.

When transferring real estate, investors only have to pay 2% income tax, income tax on real estate business rental is equivalent to 5% of revenue (applied to revenue over 100 million VND).

And to prevent the situation of "surfing" real estate trading, many countries in the world are using income tax from real estate trading and leasing to regulate market behavior.

In China: income tax on land sales is 30-60%, on other real estate 20%, on residential real estate rentals 24%, on other real estate 32%.

In Japan: income tax when selling land held for more than 5 years is 20.3%, selling land held for less than 5 years is 39.6%, when renting real estate is from 5-45%.

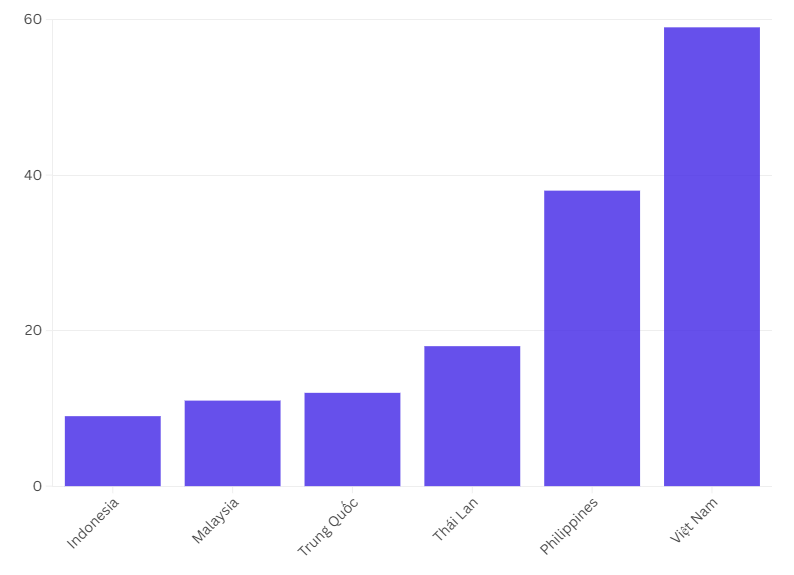

Real estate price increase in some countries from 2020-2024 (Unit: %)

Also according to Mr. Anh: in the past 5 years, domestic real estate prices have increased by 59%, higher than the same period in many countries in the region such as: Indonesia increased by 9%, Philippines increased by 38%, Thailand increased by 18%, China increased by 12%, Malaysia increased by 11%.

If considered in a 10-year period (2015-2024), an investor who invests 100 VND in apartments will earn 297 VND, land will earn 237 VND, gold will earn 230 VND, stocks will earn 209 VND, savings will earn 159 VND, and foreign currency will earn 121 VND.

Real estate investment profits are superior to other investment channels partly because the real estate tax policy in Vietnam is lower than many countries in the region.

A broker sells land lots after auction - Photo: B.NGOC

Comprehensive tax policy is needed to regulate market behavior.

According to Batdongsan.com.vn, the proportion of real estate tax in Vietnam's GDP structure is much lower than many countries in the region.

Vietnam's rate is 0.03%, while countries like Indonesia 0.2%, Thailand 0.2%, Philippines 0.5%, Cambodia 0.9%, China 1.5%, Singapore 1.5%, South Korea 4%.

There are currently 5 types of real estate taxes in the world: property tax, income tax, registration tax, vacant land tax, and real estate development tax.

Countries usually apply 4 of the 5 types of taxes above, which are property tax, income tax, registration tax, and tax on vacant land.

For example, in Singapore, real estate ownership tax is 16%, income tax when selling is 0%, rental is 15%, registration tax is 35%, and tax on vacant land is 20%.

Similarly, in the Philippines: real estate ownership tax 1.2%, income tax on real estate sales 6%, rental 25%, registration tax 1.4%.

China: real estate ownership tax 1.2%, income tax on real estate sales 60%, rental 32%, registration tax 5.5%.

Indonesia: real estate ownership tax 0.3%, income tax on real estate sale 30%, rental 35%, registration tax 5%.

Meanwhile in Vietnam, real estate ownership tax is 0.03 - 0.2% (non- agricultural land tax, residential land tax), income tax on real estate sales is 2%, rental is 5%, registration tax is 0.5%.

Many economic experts also believe that it is time for Vietnam to issue a comprehensive tax policy to regulate market behavior, helping the real estate market develop healthily.

Source: https://tuoitre.vn/hon-80-nha-dau-tu-luot-song-kiem-loi-lam-gi-de-dieu-tran-thi-truong-bat-dong-san-2024120413032902.htm

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

Comment (0)