Investment comments

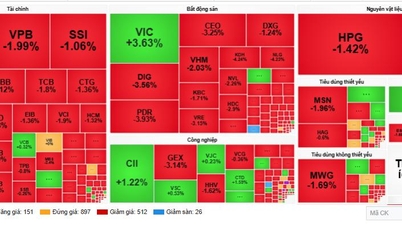

Bao Viet Securities (BVSC) : VN-Index is forming an accumulation oscillation within the area limited by the upper resistance zone of 1,115 - 1,125 points and the lower resistance zone at 1,055 - 1,075 points. The index will need to overcome the resistance zone converging between the MA200 and MA50 lines to open up the opportunity for a short-term increase in points in the last month of 2023.

Investors continue to implement trading strategies at the price channel's thresholds. In a positive scenario, VN-Index surpasses the MA200 line, investors can consider increasing the proportion of stocks.

Dong A Securities (DAS) : With positive signals from public investment disbursement in the final stage of the year, VN-Index increased points, breaking out of the choppy trading range, possibly starting the final wave of 2023.

The stock price level is quite attractive for medium and long-term investment portfolios, in which investment opportunities come from the group of stocks that benefit from public investment when disbursement is in the urgent stage at the end of the year, in addition to the energy group (oil and gas, electricity), retail and industrial zones. For short-term strategies, you can be interested in securities stocks, real estate, steel and construction materials.

Asean Securities (Aseansc) : Aseansc believes that the short-term trend of the market has become more positive when the VN-Index opened strongly, creating a gap, breaking out of the MA50 line with large liquidity. The next resistance zone will be the 1,125 - 1,130 point area and it is likely that the VN-Index will experience slight fluctuations here.

Therefore, Aseansc recommends that investors focus on observing the market, and may consider increasing the proportion of stocks in their portfolios during volatile sessions.

Stock news

- Fed Chairman dismisses expectations of an early interest rate cut. Chairman Jerome Powell does not expect the Fed to cut interest rates aggressively in the near future, saying it is still too early to declare victory over inflation. Despite many positive signals on inflation, the Fed leader said the US Federal Open Market Committee (FOMC) intends to keep its policy "tight" until it feels confident that inflation is moving towards 2% sustainably.

- BoJ: Too early to lift monetary easing policy. With inflation exceeding the Bank of Japan's 2% target for more than a year, the market is increasingly expecting the BoJ to lift monetary easing policy next year. Japan has not yet achieved price increases due to wage increases to overcome recent high inflation due to rising cost factors. This shows that it is too early to lift the Bank of Japan's (BoJ) monetary easing policy, BoJ board member Asahi Noguchi said .

Source

![[Photo] Urgently help people soon have a place to live and stabilize their lives](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F09%2F1765248230297_c-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam works with the Standing Committees of the 14th Party Congress Subcommittees](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/09/1765265023554_image.jpeg)

Comment (0)