[embed]https://www.youtube.com/watch?v=2lQ01xjlFyc[/embed]

In 2021, Ms. Cao Thi Hue's family in Giang Hong 2 village, Cam Giang commune, Cam Thuy district was given a loan of more than 100 million VND from the Cam Thuy District Social Policy Bank to develop a model of livestock farming combined with afforestation. From this capital, the family initially invested in buying more than 100 pigs, raising fish and planting 1 hectare of hybrid acacia. Thanks to the effective investment, Ms. Hue's family invested in increasing the herd of pigs to 300 and expanding the acacia planting area to more than 10 hectares. On average, each year, after deducting expenses, the family makes a profit of 300 - 400 million VND.

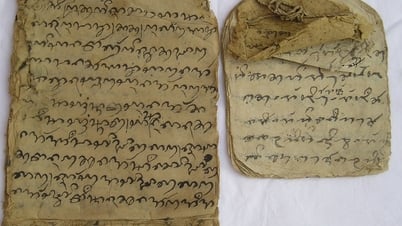

Farm of Ms. Cao Thi Hue's family, in Giang Hong 2 village, Cam Giang commune, Cam Thuy district

To help farming families develop the economy, especially poor households, from 2023 to present, the Vietnam Bank for Agriculture and Rural Development Thanh Hoa Branch and the Thanh Hoa Provincial Bank for Social Policies have lent capital to more than 189,000 households in mountainous districts of Thanh Hoa with an amount of more than VND 25,487 billion. By the end of 2023, the total outstanding loans under inter-sectoral agreements 01 and 02 at Agribank branches in Thanh Hoa province reached VND 18,410 billion. Of which, outstanding loans under inter-sectoral agreement 01 through the Farmers' Association channel were over VND 11,500 billion; loans under inter-sectoral agreement 02 through the Women's Union channel were over VND 6,800 billion. In general, credit quality in localities up to now is good, credit quality is always guaranteed, the bad debt ratio accounts for only 0.04% of total outstanding loans.

Mr. Phan Van Hung, Head of Personal Customer Department, Bank for Agriculture and Rural Development, Thanh Hoa Province Branch

With practical and effective policies, the program of lending capital for production development in mountainous areas has been playing a positive role, becoming one of the important solutions to successfully implement the goal of sustainable poverty reduction. In the coming time, in addition to implementing solutions to clear and direct capital flows into the rural agricultural sector, strengthening the review, simplifying processes and procedures, shortening loan approval time, creating favorable conditions for customers to access credit capital, the Bank for Agriculture and Rural Development of Vietnam, Thanh Hoa Branch and the Bank for Social Policies will also reduce short-term loan interest rates by 2%/year, medium-term and long-term loans will be reduced by 1.5%/year for customers who are farmers, thereby helping these subjects reduce arising costs, contributing to stabilizing their lives and developing production.

Source: Thanh Hoa News April 13, 2024

Source

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)