Accordingly, cocoa prices hit a historic record at the end of March when futures prices reached more than $10,000 per ton. According to data from the ICE Futures exchange, cocoa prices have increased 2.4 times since the beginning of the year. Then, at auctions, prices were adjusted slightly to $9,992 per ton. However, this did not improve the situation much and will have consequences for the entire world confectionery market.

The world cocoa shortage has actually been going on for 2 years now and it seems that the situation will not improve by 2024. However, few people expected that cocoa prices would skyrocket.

The 350% price increase in a year and a half has shocked chocolate makers, but has not stopped them from continuing to buy the raw material, said Yaroslav Ostrovsky, head of strategic research at Total Research. The main factors behind this situation are, firstly, the weather conditions on which the harvest depends, and secondly, the fact that cocoa is produced only in certain places and cannot be produced worldwide.

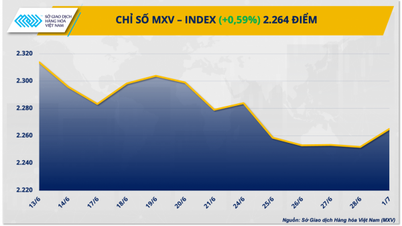

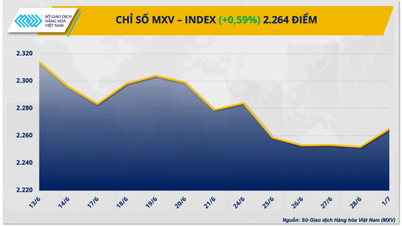

|

| Cocoa prices surged to not only historic records but also unprecedented highs. |

“More than 60% of the world’s cocoa production is concentrated in Ivory Coast and Ghana in Africa, another 15% in South America. West Africa is facing a weak cocoa harvest due to bad weather conditions, which also accelerates the aging of cocoa trees,” said Vladimir Chernov, an analyst at Freedom Finance Global.

The International Cocoa Organization (ICCO) predicts that in 2024, cocoa bean production will be the lowest in 17 years in Ivory Coast and in 13 years in Ghana.

According to Mr. Chernov, in the last trading week of March, world cocoa prices increased sharply amid news of financial problems for cocoa producers in Ghana, the world's second-largest cocoa exporter after Ivory Coast. Due to crop failures, Ghana has not been able to raise loans for cocoa. There are also logistical problems due to difficulties in transportation in the Red Sea.

Meanwhile, futures in London rose as much as 9.6% to an all-time high of £9,477 a tonne. Cocoa is now worth more than some precious metals and is rising faster than Bitcoin.

According to the European Cocoa Association, the volume of cocoa grinds – beans processed by the industry to eventually be turned into chocolate – fell by 2.5% in the first three months of the year compared to the same period last year.

Years of low cocoa prices have left farmers short of cash and unable to invest in improving aging plantations. Bean grinding is used as a gauge of chocolate demand, but analysts and industry insiders say the current figures reflect the difficulty traders, processors and manufacturers have in finding enough beans.

Farmers in Ghana and Ivory Coast have recently been forced to renegotiate contracts with traders to delay deliveries as they face crop disease outbreaks, adverse weather caused by climate change and the El Niño phenomenon.

The cocoa market will be short 374,000 tonnes this season, up from a deficit of 74,000 tonnes last season, according to ICCO. ICCO forecasts that global cocoa stocks at the end of the 2023-2024 season will fall to 1.395 million tonnes, equivalent to 29.2% of the volume of ground cocoa, the lowest level in the past 45 years.

Cocoa prices are expected to remain higher for a long time as crops in West Africa are hit by disease and a series of extreme weather events, leaving the world with a third consecutive supply shortage.

There is still no clarity on the next crop, which starts in the autumn, said Fuad Mohammed Abubakar, head of cocoa marketing company Ghana UK Ltd. The challenge for Ivory Coast and Ghana is that no one knows how they will solve their production problems. There will be no supply rescue in the next few months.

Meanwhile, Mr. Darren Stetzer, Vice President of Agricultural and Soft Goods in Asia of Stonex Group (USA) said: The market is currently in crisis due to concerns that there will not be enough cocoa to meet existing long-term contracts; the current risk is that cocoa prices may continue to increase for several more years.

Source

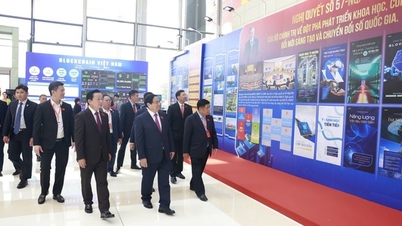

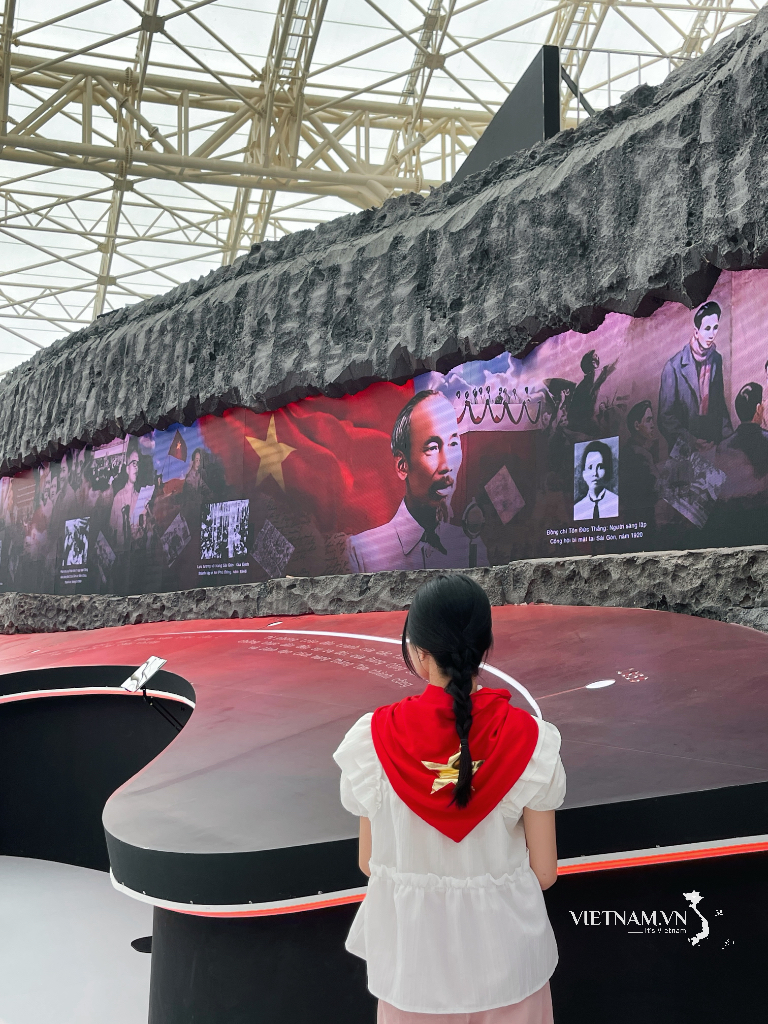

![[Photo] Solemn opening of the 1st Government Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/13/1760337945186_ndo_br_img-0787-jpg.webp)

Comment (0)