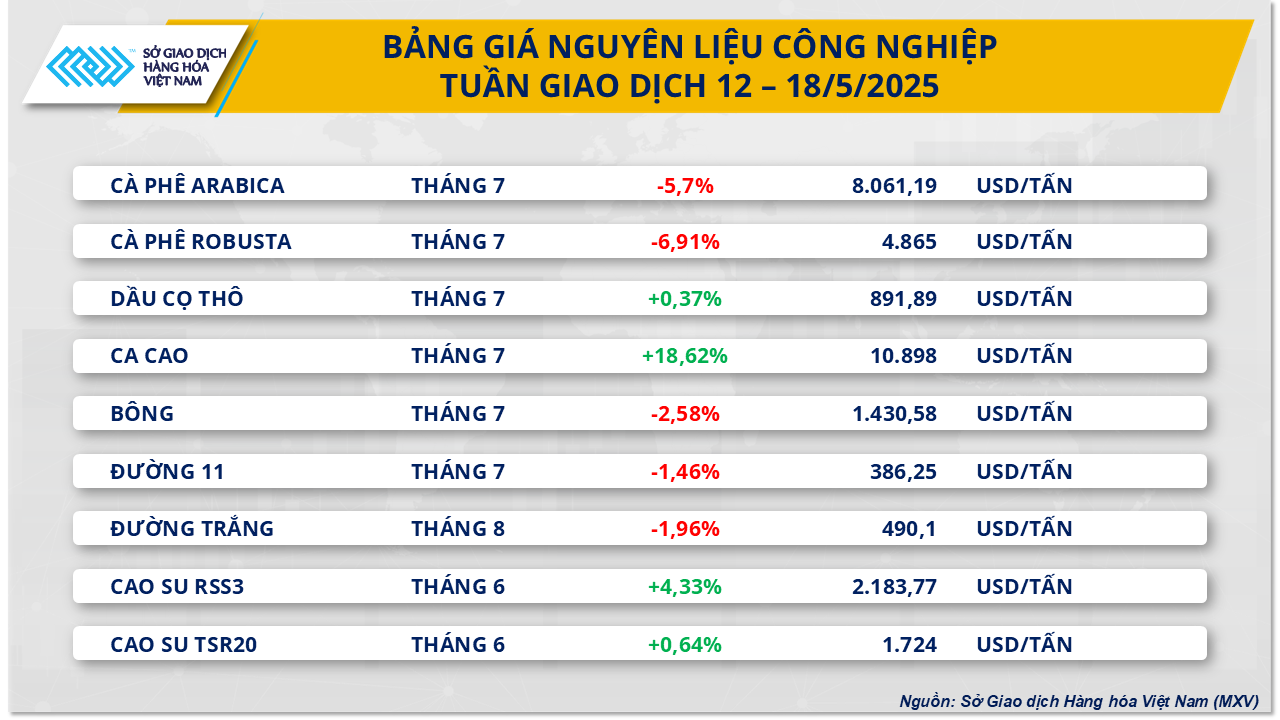

For the industrial raw material group, at the end of the last trading week (May 12-18), the price of industrial raw materials was mixed with green and red. Cocoa attracted attention when the price approached the historical peak in January, reaching 10,898 USD/ton, up 18.6%; meanwhile, the price of two coffee products simultaneously plummeted. Specifically, the price of Robusta coffee continued to plummet 6.9% to 4,865 USD/ton, marking the third consecutive week of decline, while the price of Arabica coffee also fell sharply by 5.7%, down to 8,061 USD/ton.

Concerns over Ivory Coast’s mid-crop output continue to be a major driver of the cocoa price surge. Late rains have hampered crop development, with Ivory Coast’s mid-crop output – the smaller of the two main crops – expected to be around 400,000 tonnes, down 9% from the same period last year, according to a new Rabobank report.

In particular, recent cocoa bean counts in Ivory Coast have raised concerns about a potential supply shortage, amid continued production declines due to adverse weather and plant diseases.

In addition, Reuters data shows that cocoa arrivals in Ivory Coast during the week of May 5-11 were only 24,000 tonnes, down 22.5% from the previous week and below the five-year average. Cumulatively, since the beginning of the 2024-2025 crop year, total cocoa arrivals have reached 1.56 million tonnes, up from the same period last year but still significantly below the five-year average of 1.78 million tonnes.

Meanwhile, although cocoa prices continue to hit record highs and many forecasts are concerned that consumption will decline sharply, actual figures show that demand for this item is still quite positive. Specifically, the amount of cocoa grinding in the first quarter of 2025 in North America decreased by only 2.5% compared to the same period last year, down to 110,278 tons. In Europe, grinding decreased by 3.7% and in Asia by 3.4%, both lower than the forecast of at least a 5% decrease.

Source: MXV

In addition, cocoa imports from the US and Indonesia – one of the world’s largest consumer markets – reached 125,600 tonnes in the first quarter, up 29% year-on-year. Indonesia also recorded a sharp increase in imports of 127.6% to 68,700 tonnes in the first three months of the year, indicating that demand remains very positive.

In terms of coffee, the latest forecasts for global coffee supply continue to put pressure on prices. According to Conab, Brazil’s coffee production in 2025-2026 is expected to increase by 2.7% compared to the previous year, while the USDA also forecasts that Honduras and Uganda’s coffee exports will both increase by 2.6%, while El Salvador will record a slight increase. This development has caused the market to reconsider its supply outlook in the coming period and contributed to the consecutive declines in coffee prices in recent weeks.

In terms of harvest progress, Brazil is currently in the robusta harvest season, while Indonesia has also started harvesting robusta, further increasing downward pressure on the market. The arabica coffee harvest in Brazil is expected to start in the middle of this month. According to data from the same period last year, as of May 21, 2024, about 22% of the robusta area and 15% of the arabica area in Brazil had been harvested, indicating that this year's harvest is progressing on schedule.

Warm weather and limited rainfall have hit Brazil’s coffee-growing regions in recent days, and the trend is expected to continue for much of next week, the World Weather Service said. While not completely dry, the scattered rains are considered too brief and light to offset evaporation, potentially reducing yields if prolonged. Meanwhile, frequent showers and thunderstorms will continue in Colombia and western Venezuela, helping to maintain favorable growing conditions in those areas.

Brazil's arabica coffee harvest has just begun, and although it is the low season in the biennial cycle, the outlook has improved compared to earlier in the year.

In addition, high coffee inventories are also a direct factor putting pressure on prices. According to ICE, robusta inventories reached 4,890 lots - the highest level in 7.5 months, while arabica inventories were approximately 851,170 60kg bags, the highest level in nearly three months.

In the energy market, according to MXV, oil prices continued to maintain their upward momentum thanks to market optimism after the US-China trade agreement, before concerns about oversupply returned.

Source: MXV

At the end of the week, Brent oil price surpassed the threshold of 65 USD/barrel, increasing by 2.35% to 65.41 USD/barrel; while WTI oil also recorded an increase of 2.41%, to 62.49 USD/barrel.

After the trade agreement between the US and the UK was announced on May 8, creating optimism among investors, the market continued to receive more positive information at the beginning of the new week. Accordingly, after negotiations last weekend, the US and China agreed to simultaneously reduce tariffs on each other's imported goods, with a temporary effect of 90 days. Specifically, the US reduced tariffs on Chinese goods from 145% to 30%, while China also reduced tariffs on US goods from 125% to 10%. Although it is only a temporary agreement, the moves to cool down tensions between the two largest economies in the world have created a positive effect, helping many markets, including the energy market, to recover after a long period of trade tensions.

In addition, US inflation indicators also contributed to supporting oil prices. Accordingly, the CPI in April increased by 2.3% compared to the same period last year, the lowest level since March 2021, increasing expectations that the US Federal Reserve (FED) will soon cut interest rates.

Positive news from the world’s two largest oil consuming countries has been the main driver of oil prices rising sharply for much of the past week. However, market sentiment quickly reversed as concerns about a global supply glut emerged in the final trading sessions of the week. These concerns stemmed from new developments in negotiations between the US and Iran, along with updated reports from major energy organizations around the world.

On May 15, US President Donald Trump said the US and Iran had resolved many differences in previous rounds of negotiations and were very close to a new agreement on Tehran’s nuclear program. If the agreement is accompanied by the lifting of sanctions, oil supplies from Iran – OPEC’s third-largest producer – could return to the international market, with an estimated additional 800,000 barrels per day.

In addition, OPEC+'s unusual decision to increase production has further raised concerns about the supply-demand imbalance in the oil market. According to the International Energy Agency's (IEA) May 2025 report, global oil supply is expected to increase faster than demand, with an increase of 1.6 million barrels per day this year, while demand growth is only 740,000 barrels per day. This has caused the prices of the two oil products to fall by more than 2% in the session on May 15. Previously, reports of a sharp increase in US crude oil reserves from the US Energy Information Administration (EIA) and the American Petroleum Institute (API) also created great downward pressure on prices in the session on May 14.

Source: https://baodaknong.vn/thi-truong-hang-hoa-19-5-luc-mua-chiem-uu-the-tren-thi-truong-252979.html

Comment (0)