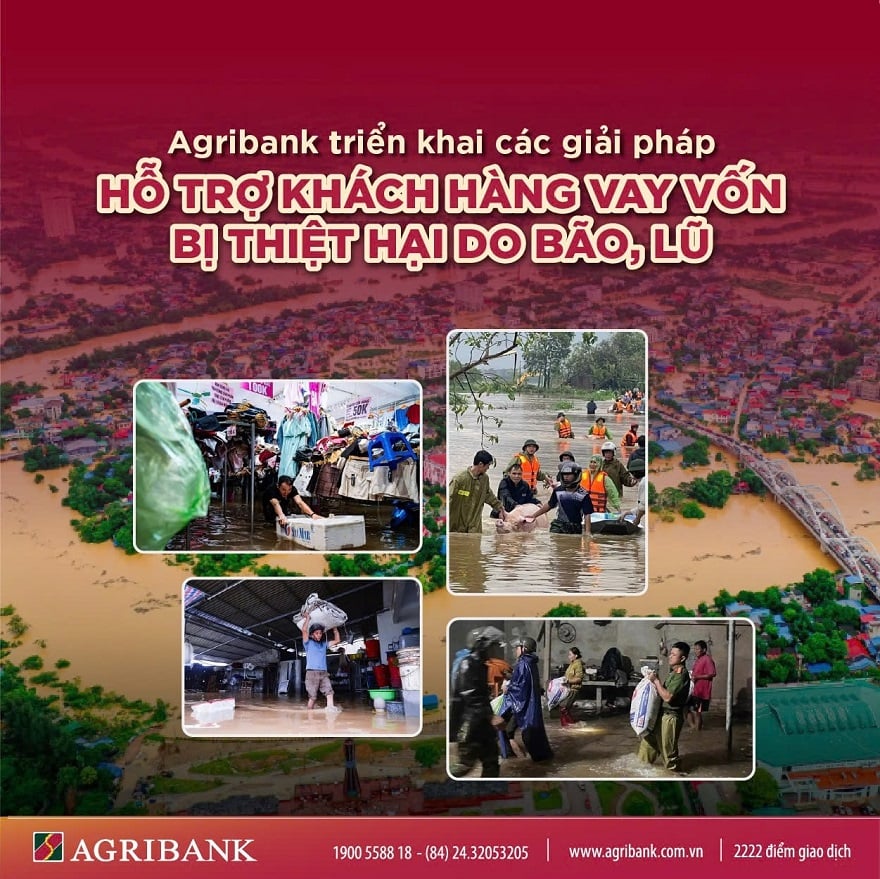

Consecutive storms in September and October 2025 caused serious damage to people and property, greatly affecting people's livelihoods and business production activities.

To support provinces, cities and people to overcome the consequences, the Government and the State Bank directed credit institutions to proactively review and assess the damage situation of customers who are borrowing capital, and promptly apply support measures to remove difficulties for customers.

|

Proactively and promptly support customers in disaster areas

Seriously implementing the direction of the Government and the State Bank, Agribank immediately issued a document directing branches to deploy support solutions for customers who suffered damage to people, property, materials, crops, livestock, and production and business establishments in the provinces and cities directly affected by storms and post-storm floods.

Accordingly, for existing outstanding loans (including VND and USD) as of September 30, 2025 (excluding loans applying other preferential interest rate programs at Agribank), based on the level of damage of customers, Agribank will reduce the loan interest rate by 0.5% to 2%/year, not collect late payment interest, and adjust the overdue interest rate to the interest rate for the term loan from October 1 to December 31, 2025.

For new loans arising from October 1 to December 31, 2025, Agribank reduces the loan interest rate by 0.5%/year compared to the interest rate applied at the time of disbursement, applicable for a maximum period of 6 months from the date of disbursement.

In parallel with the policy of reducing lending interest rates, Agribank has also synchronously implemented many other support solutions: (i) restructuring debt repayment terms; (ii) exempting and reducing loan interest rates; (iii) continuing to provide new loans with preferential interest rates, helping customers restore production and business activities and stabilize their lives after natural disasters.

Agribank leaders directly go to flood-affected areas to share with people

Demonstrating the spirit of social responsibility and the tradition of “Agribank – Compassion for the community”, immediately after the storm, Agribank working groups went directly to the severely affected localities to grasp the damage situation, direct customer support and hand over social security funds to support local authorities and people to overcome the consequences.

|

On behalf of Agribank, Chairman of the Board of Directors To Huy Vu presented 5 billion VND from the Welfare Fund to support social security in Nghe An province. |

During September 30 - October 1, 2025, in the face of storm No. 10 causing heavy damage to people in the provinces of the North Central region, the working delegation led by Comrade To Huy Vu, Party Secretary, Chairman of the Board of Members of Agribank, worked with branches in Nghe An province to grasp the actual operations of the units and direct the work of overcoming the consequences of natural disasters, and at the same time, hand over social security funds to support local authorities and people to overcome the damage caused by storms and floods.

Promoting corporate responsibility towards the community, with the spirit of "mutual love", from the beginning of 2025 up to now, Agribank has spent nearly 40 billion VND to sponsor disaster recovery work out of a total of more than 400 billion VND spent to support community activities and social security.

With timely and synchronous policies, Agribank hopes to support customers in optimizing costs, having more resources to quickly overcome difficulties, rebuild production and business activities, and stabilize their lives.

Source: https://baodautu.vn/agribank-giam-toi-2nam-lai-suat-cho-vay-voi-khach-hang-bi-thiet-hai-do-bao-lu-d409255.html

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] General Secretary attends the parade to celebrate the 80th anniversary of the founding of the Korean Workers' Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/11/1760150039564_vna-potal-tong-bi-thu-du-le-duyet-binh-ky-niem-80-nam-thanh-lap-dang-lao-dong-trieu-tien-8331994-jpg.webp)

Comment (0)