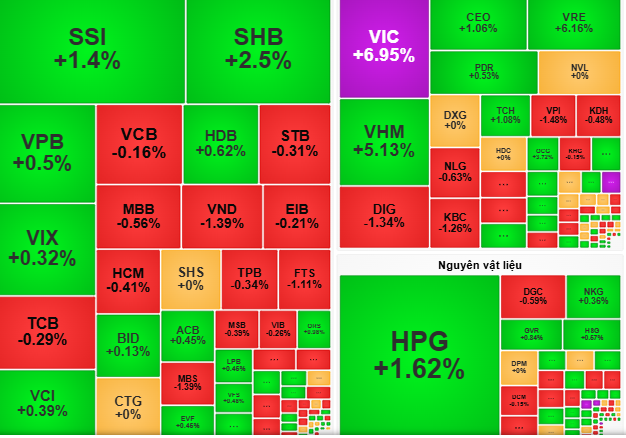

At the end of the stock market session on July 10, VN-Index closed at 1,445 points, up 14 points, equivalent to 1%.

VN-Index opened on July 10 up 6 points and maintained its upward momentum thanks to the push from large-cap stocks in the Vingroup and consumer groups (MSN). The real estate group (TCH, PDR, NVL) and seaports (VSC, HAH) also recorded strong cash flow.

Vingroup shares lead the market

In the afternoon session, the index fluctuated around the 1,440 point mark before regaining momentum thanks to increased demand from some banking stocks (SHB , VPB) and steel. Vingroup stocks (VIC, VHM, VRE) continued to lead the market trend in the last 30 minutes, helping the VN-Index approach the peak of the day.

However, selling pressure appeared on banking stocks such as MBB, TCB, VCB, along with MSN (consumer), POW (electricity) and ANV, DBC (food). Liquidity decreased by 40% compared to the previous session, showing that cash flow was concentrated on some blue-chip stocks. Foreign investors bought a strong net of VND1,074 billion, mainly in SSI, VPB and SHB.

At the end of the session, VN-Index closed at 1,445 points, up 14 points, equivalent to 1%.

VCBS Securities Company believes that the differentiation between industry groups continues, with blue-chip groups attracting strong cash flows. Investors should hold stocks that are on a good growth trend and consider exploratory disbursement into industry groups such as real estate, securities and codes that are net bought by foreign investors.

According to Rong Viet Securities Company (VDSC), the decrease in liquidity on July 10 shows that profit-taking pressure has weakened. If the 1,450-point threshold is exceeded in the July 11 session, the VN-Index could head towards 1,480 points. However, supply could increase again when the market hits the next resistance zones, and the increase could slow down if there is a strong dispute between supply and demand for stocks.

There will be a war of supply and demand for stocks.

With the current trend, demand will likely continue to focus on industries that are attracting cash flow such as real estate (TCH, PDR, NVL), securities (SSI) and seaports (VSC, HAH).

Banking groups (SHB, VPB) and steel can also maintain investors' purchasing power. Foreign investors continue to buy strongly, especially in blue-chip stocks, which will be a factor supporting the market. Investors should closely monitor the resistance zone of 1,450 points, where supply and demand can compete fiercely and consider disbursing funds in industry groups that are showing positive cash flow signals.

Source: https://nld.com.vn/chung-khoan-ngay-mai-11-7-luc-cau-co-phieu-se-dich-chuyen-196250710172651267.htm

![[Photo] Highways passing through Dong Nai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/12/1762940149627_ndo_br_1-resize-5756-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh attends a conference to review one year of deploying forces to participate in protecting security and order at the grassroots level.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/12/1762957553775_dsc-2379-jpg.webp)

![Dong Nai OCOP transition: [Article 3] Linking tourism with OCOP product consumption](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/10/1762739199309_1324-2740-7_n-162543_981.jpeg)

Comment (0)