World copper market shakes strongly

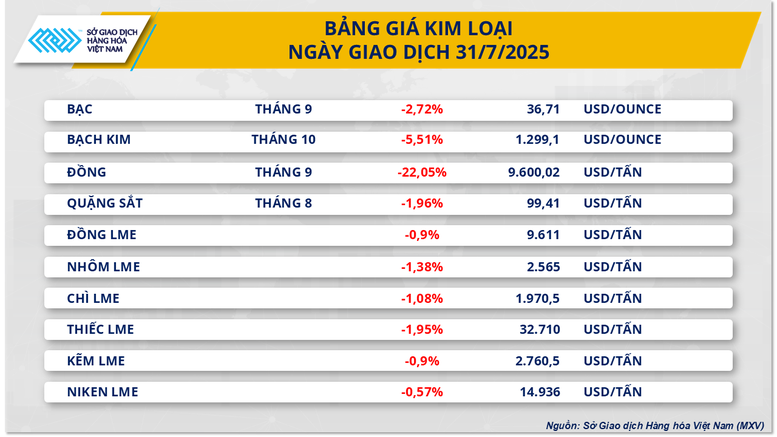

At the close of yesterday’s trading session, the metal market continued to witness widespread selling pressure across the entire metal market, as all 10 major commodities continued to sink into the red. The decline occurred in the context of the USD continuing to strengthen and investors cautiously assessing new signals about tariff policy in the US.

Notably, COMEX copper prices suddenly plunged more than 22%, falling to $4.35/pound (equivalent to $9,600/ton), marking the deepest drop in history. The sharp drop completely erased the difference between COMEX copper prices and LME copper prices, which had widened to 26% on July 28. COMEX copper prices are now at their lowest level since mid-April.

Early yesterday morning (July 31) Vietnam time, the White House unexpectedly announced a 50% tax on imported copper, but excluded refined copper from the list, completely contrary to the market's previous predictions. This information caught the market off guard as since March, refined copper imports into the US have increased sharply in anticipation of Washington imposing tariffs on this item.

Imported copper products into the US will be subject to a 50% tariff starting August 1, mainly on semi-finished products and derivatives containing high copper content. Within the next 90 days, the US Secretary of Commerce will complete the process, adding copper derivative products to the tax adjustment scope.

Notably, the risk of the US imposing tariffs on imported refined copper has not been completely ruled out. According to the US President's Statement, the Secretary of Commerce will closely monitor developments in the domestic copper market, as a basis for the President to assess the application of new tariffs on this item, specifically, applying a 15% tariff from January 1, 2027 and increasing to 30% from January 1, 2028 if implemented. However, this review process is still lengthy and it will be at least early 2027 before the new tariff can be applied, making the immediate policy risk not enough to prevent the decline in COMEX copper prices in the last trading session.

Looking at the global copper market, the International Copper Study Group (ICSG) said that in the first five months of this year, the market recorded a surplus of about 272,000 tons of refined copper, almost equivalent to the same period in 2024. This development reflects the current situation of global supply exceeding demand, thereby continuing to put downward pressure on copper prices in the international market.

In addition, the USD index in yesterday's session approached the 100-point mark, increasing by 0.15% to 99.97 points and extending its upward streak to the 6th consecutive session. The stronger USD has reduced the attractiveness of USD-denominated commodities such as copper, thereby limiting buying demand and reinforcing pressure on the price of this metal.

Cautious sentiment prevails in energy markets

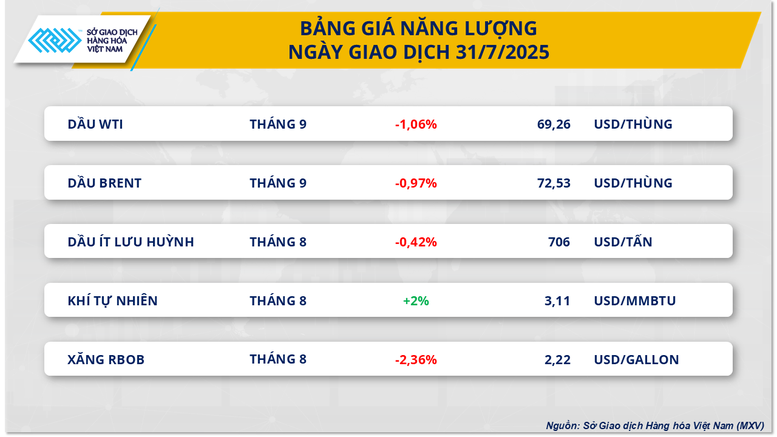

After many sessions recording positive signals thanks to newly signed trade agreements, the energy market yesterday returned to a cautious state due to concerns about the White House's tariff policy.

Tariffs on countries that have not yet reached a trade agreement with the United States are scheduled to take effect later today local time. Tariffs on global goods in general are expected to have a negative impact on global energy demand.

The prices of the two main crude oil products also reflected this concern in yesterday's trading session with a decrease of about 1%. Specifically, at the end of the session, the price of WTI oil once again returned below the threshold of 70 USD/barrel, stopping at 69.26 USD/barrel, corresponding to a decrease of 1.06%. The price of Brent oil also recorded a decrease of 0.97% yesterday, falling to 72.53 USD/barrel.

In another notable development, both the American Petroleum Institute (API) and the US Energy Information Administration (EIA) reported a significant increase in US crude oil inventories in the week ending July 25. According to data from the EIA, commercial crude oil inventories increased by 7.7 million barrels, putting downward pressure on oil prices in the international market.

However, data from the EIA also showed that US gasoline inventories fell by nearly 3 million barrels despite an increase in supply from refineries; thereby, showing increased consumer demand and helping to curb the decline in oil prices.

Source: https://baochinhphu.vn/gia-dong-comex-roi-tu-do-thi-truong-hang-hoa-chim-trong-sac-do-102250801085409171.htm

Comment (0)