Gold price today (June 18): Experts say that after many weeks of sideways trading, gold is ready for a more important move.

Domestic gold price today

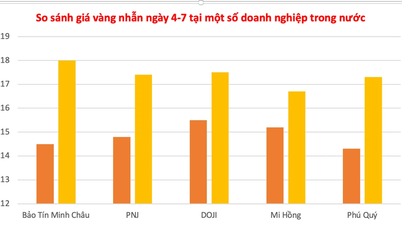

Domestic gold prices fluctuated slightly this morning and maintained a trading level of around 67 million VND/tael. Currently, the domestic precious metal prices are listed specifically as follows:

SJC gold price in Hanoi and Da Nang is currently being bought at 66.5 million VND/tael and sold at 67.12 million VND/tael. In Ho Chi Minh City, SJC gold is still being bought at the same price as in Hanoi and Da Nang but sold at 20,000 VND lower.

|

| Domestic gold prices fluctuated slightly this morning. Photo: VNA |

DOJI brand gold price in Hanoi is listed at 66.5 million VND/tael for buying and 67.1 million VND/tael for selling. In Ho Chi Minh City, this brand gold is buying at the same price but selling at 100,000 VND lower than in Hanoi.

Phu Quy SJC gold price is listed at 66.45 million VND/tael for buying and 67.05 million VND/tael for selling. PNJ gold is buying at 66.6 million VND/tael and selling at 67.15 million VND/tael. Bao Tin Bao Tin Minh Chau gold is listed at 66.52 million VND/tael for buying and 67.08 million VND/tael for selling.

Domestic gold price updated at 5:30 am on June 18 as follows:

Yellow | Area | Early morning of June 17 | Early morning of June 18 | Difference | ||||

Buy | Sell out | Buy | Sell out | Buy | Sell out | |||

Unit of measurement: Million VND/tael | Unit of measurement: Thousand dong/tael | |||||||

DOJI | Hanoi | 66.55 | 67.15 | 66.5 | 67.1 | -50 | -50 | |

Ho Chi Minh City | 66.5 | 67 | 66.5 | 67 | - | - | ||

Phu Quy SJC | Hanoi | 66.45 | 67.05 | 66.45 | 67.05 | - | - | |

PNJ | Ho Chi Minh City | 66.6 | 67.15 | 66.6 | 67.15 | - | - | |

Hanoi | 66.6 | 67.15 | 66.6 | 67.15 | - | - | ||

SJC | Ho Chi Minh City | 66.55 | 67.15 | 66.5 | 67.1 | -50 | -50 | |

Hanoi | 66.55 | 67.17 | 66.5 | 67.12 | -50 | -50 | ||

Da Nang | 66.55 | 67.17 | 66.5 | 67.12 | -50 | -50 | ||

Bao Tin Minh Chau | Nationwide | 66.57 | 67.13 | 66.52 | 67.08 | -50 | -50 | |

World gold price today

The gold market had a relatively active week, influenced by many important events and economic data. However, at the end of the trading week, gold was almost unchanged compared to the closing price of the previous trading session.

The gold market has been relatively stable in June, trading between $1,940 and just under $2,000 an ounce. But analysts warn that after weeks of sideways prices, gold is poised for a more significant move.

That move could go either way, according to precious metals expert Everett Millman of Gainesville Coins. “Gold has been trading sideways long enough that we’re primed for a bigger move in one direction or the other — a retest of $1,880 an ounce or a return to around $2,000 an ounce,” Millman said.

The Fed confused markets on Wednesday when it decided to pause interest rate hikes but left open the possibility of two more rate hikes. Millman explained: "What the Fed did was neutral for gold. The pause was good for gold, but it was the most hawkish pause we've seen. That's why gold has been trading sideways."

OANDA senior market analyst Edward Moya said gold is resilient to the Fed's warning of two rate hikes. At a press conference after the rate decision, Fed Chairman Powell did not commit to a rate hike in July, saying the US central bank's decision will remain data-dependent.

Analysts say the market is now pricing in another rate hike in July. If that changes, gold will react. Meanwhile, gold investors are paying close attention to macro data, the dollar’s movements and central bank gold purchases, which slowed in the second quarter.

|

| World gold price this morning is above 1,950 USD/ounce. Photo: Kitco |

Looking back at gold's performance over the past two years, Millman warned that gold is still at risk of facing a significant sell-off in the coming period.

Markets are looking ahead to Chairman Powell’s two-day testimony before the House and Senate next week, remarks from Fed officials, and macro data. Many believe that the upcoming macro data could have a big impact on the market, as Powell has previously said the Fed’s next move will depend on the data.

“Gold is still looking for confirmation that the Fed is done hiking and/or a negative catalyst for the USD. The data will become more sensitive and important in the July meeting where another rate hike seems certain,” said Nicky Shiels, head of metals strategy at MKS PAMP.

With domestic gold prices fluctuating slightly and world gold prices anchored at 1,958.2 USD/ounce (equivalent to nearly 55.8 million VND/tael if converted at Vietcombank exchange rate, excluding taxes and fees), the difference between domestic and world gold prices is currently over 11 million VND/tael.

TRAN HOAISource

![[Photo] General Secretary To Lam receives President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763723946294_ndo_br_1-8401-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763715853195_ndo_br_bnd-6440-jpg.webp&w=3840&q=75)

![[Photo] Visit Hung Yen to admire the "wooden masterpiece" pagoda in the heart of the Northern Delta](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763716446000_a1-bnd-8471-1769-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong receives Speaker of the Korean National Assembly Woo Won Shik](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763720046458_ndo_br_1-jpg.webp&w=3840&q=75)

Comment (0)