"Sell in May and go away" is a famous saying in the stock investment world. According to this strategy, investors will sell stocks in May and reinvest in November. Because this is often considered "profit-taking season". However, the reality of the Vietnamese stock market in May is completely opposite.

Make a lot of money

The Vietnamese market increased steadily in the first half of May and then stagnated for about a week, without a sharp decline. During this time, many groups of stocks took turns increasing sharply in price, such as real estate, securities, construction, electricity, steel - construction materials, oil and gas... helping investors who caught the right "wave" to make a lot of money.

Up to this point, most stock groups have increased in price by 10%-20% compared to 1 month ago, with some stocks doubling in price, such as PSH of Nam Song Hau Petroleum Investment and Trading Joint Stock Company, from 6,300 VND to 13,000 VND; some other stocks such as CIG increased by over 80%, ABR increased by 62%, EVG and QBS increased by nearly 54%, ITC increased by approximately 50%... However, there are also many stocks that have decreased in price significantly after the increase in April.

Investor Pham Quang Binh (Binh Thanh District, Ho Chi Minh City) said he made a profit of more than 15% in a few weeks thanks to catching the right "wave" with the stock code BCG of Bamboo Capital Group. However, because he was worried about the market correction and the "Sale in May" effect, he sold the shares early, and if he had continued to hold until now, he would have made more profit. Similarly, Mr. Hoang Thanh (Thu Duc City) bought 100,000 FCN shares at a price of more than 11,500 VND/share in early May. More than a week later, the FCN code increased sharply to 13,500 VND/share, he sold to take profit and pocketed nearly 200 million VND. However, the stock then continued to increase to more than 14,000 VND/share.

However, not everyone catches the right "wave" and makes a lot of profit. There are still many investors who accept to hold money and stay out of the market because they are afraid of the "Sell in May" effect, worried about the market correction, worried about the economic difficulties or waiting for the stock price to decrease further before buying... Up to now, most of these investors have expressed regret. "I sold all my stocks since the end of April to wait for a new time to buy. However, the stocks I am interested in have not decreased but have increased strongly. Looking at the price increase, I feel really regretful" - Ms. Thu Tam, an investor in Phu Nhuan, Ho Chi Minh City, admitted.

Ms. Thanh Hong (District 7, Ho Chi Minh City) said that because she was subjective and did not follow the broker, she lost all her profits in the "wave" in May. With HHV shares of Deo Ca Transport Infrastructure Investment Joint Stock Company, which she "held a loss" for 6 months, when it had just recovered slightly, she sold everything to switch to buying securities industry stocks. However, after selling, HHV code still increased in price by another 14%, while the stock code she bought did not increase but decreased slightly and then remained flat at a high price.

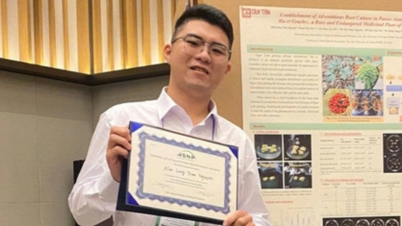

The stock market in May helped many investors make big profits, but also made many people regret missing the "wave". Photo: Hoang Trieu

Be careful, avoid buying in haste.

Dr. Le Dat Chi, Director of the Joint Program of Bachelor of Applied Finance (France), said that for a long time, the domestic and foreign stock markets have always followed the "January effect" which is always positive and May is the month to sell stocks, i.e. "Sale in May". However, the market this May is not like that, because the fundamental factors of the domestic and foreign economies are changing in a more positive direction. Domestically, the Government is making efforts to promote resources to recover the economy.

On the other hand, the economy still has many concerns, interest rates are still high, the world macro is still unstable and the risk of recession is still evident... This explains why the market continuously increases and then adjusts, stocks are strongly differentiated and not unanimous as before. Only businesses with good business results and prospects of benefiting during the economic recovery will have strong stock prices, while businesses facing difficulties will have stocks that go sideways, or even fall sharply if the internal situation of the business is too bad.

Mr. Nguyen The Minh, Director of Analysis of the Individual Client Division of Yuanta Vietnam Securities Company, assessed that the stock market in May this year did not have a "Sell in May", nor did stock prices decrease for investors to "hunt for sales" as expected. In the first half of May, the market increased quite well, stocks were differentiated by groups, and cash flowed strongly into small and medium-cap stocks, which are highly speculative stocks. However, in the second half of May, the market showed signs of cooling down because economic growth was not as expected.

"The positive changes in the market recently are mainly due to the positive sentiment and expectations of investors, not from the internal situation of enterprises and the economy. That is also the reason why the market fluctuates, "increases and adjusts" continuously, which is very uncomfortable. Therefore, investors need to avoid worrying too much, and should not be impatient to "buy and chase" but should patiently observe and wait for a new cycle when they have missed the wave in some stocks or groups of stocks" - Mr. Minh expressed his opinion.

Meanwhile, Mr. Huynh Anh Tuan, General Director of Dong A Securities Company (DAS), said that the market has been both shaking and rising since the end of April, with cash flow continuously jumping from one group of stocks to another because the cash flow is not strong enough to pull a group of industries up for a long time. Not to mention, investors also have a "safe" mentality, so they sell when they get a profit of 5%-10% or at most 15%-17%, rather than waiting longer, so it is difficult for groups of stocks to maintain a sustainable growth momentum.

According to Mr. Tuan, the cash flow into the market is not strong because businesses are still struggling with difficulties, the pressure to repay bonds is still high, exports, retail and consumption have not really recovered. Meanwhile, although bank interest rates have decreased, they are still high. "If participating in the market at this stage, investors must know how to divide the cash flow into industry groups according to strategies with analytical tools. In particular, they must monitor and closely follow the market to be able to trade as quickly as possible, then profits will meet expectations" - Mr. Tuan said.

Long-term benefits

As a group of stocks that play a leading role in the market, bank stocks have not had a strong breakthrough recently, although they are expected to benefit from the State Bank's continuous interest rate reduction.

Ms. M.Ngoc (residing in Thu Duc City, Ho Chi Minh City) has held SHB shares since the end of last year at the price of 11,000 VND, and now they have only increased by a few percent to 11,850 VND/share. Similarly, many other investors are holding shares of banks with positive news such as VIB planning to pay a 35% dividend; VPB is about to pay a 10% cash dividend; ACB is paying a 25% stock and cash dividend... also the price has not increased as expected.

"Compared to stocks in real estate, construction, securities, oil and gas..., bank stocks have almost not increased in the past few months even though every bank has profits from several thousand to tens of thousands of billions of dong" - Mr. Duc Thanh (an investor with 3 years of experience in the market) wondered.

Talking about bank stocks, a securities expert said that compared to the pandemic period (2020-2021), the "cheap money" period, current interest rates are still higher. Not to mention, banks are facing the pressure of increasing bad debt due to difficulties in businesses, especially real estate; the rate of non-term deposits (CASA) of many banks has decreased; the net interest margin (NIM) of many banks has also narrowed. These pressures make it difficult for "king" stocks to break out.

A recent banking industry report by FiinGroup, a financial specialist, also shows that except for banks with their own "stories", most commercial banks are hesitant to set lower or even lower profit growth targets. The reason is the current unfavorable macroeconomic context, specifically high interest rates, weak export activities, weak domestic consumer demand, and sluggish real estate and corporate bond markets.

"The banking industry's profit outlook in 2023 is being affected by three factors: interest income is expected to decline due to low credit growth and NIM is unlikely to increase due to competition for lending to good customer groups. Income from other activities, mainly insurance cross-selling, also increased slowly. Provisioning pressure increases as asset quality weakens due to the consequences of adverse developments in the real estate and corporate bond markets. Therefore, investors are wary of bank stocks" - FiinGroup experts commented.

Regarding the impact of the State Bank's interest rate cut on stocks, Mr. Nguyen The Minh said that in the short term, this positive information will not support the market, and investors will even react by selling to take profits with small and medium-sized stocks that have increased sharply in recent times.

In the long term, in the last 6 months of the year, stocks may benefit when listed enterprises access credit capital with lower capital costs, and lending interest rates decrease to support struggling sectors such as real estate.

Thai Phuong

Source

![[Photo] The Steering Committee of the 2025 Fall Fair checks the progress of the organization](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760918203241_nam-5371-jpg.webp)

![[Photo Series] Crowds flock to Tri An dam base to 'hunt for nature's bounty' after southern Vietnam's largest hydropower plant closes floodgate](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/20/1760923304725_5_20251019135535_20251019212212.jpeg)

Comment (0)