The Government issued Decree No. 199/2025/ND-CP dated July 8, 2025 amending and supplementing Decree No. 26/2023/ND-CP on Export Tariff Schedule, Preferential Import Tariff Schedule, List of goods and absolute tax rates, mixed tax, and import tax outside tariff quotas.

This Decree takes effect from July 8, 2025.

Support for automobile manufacturing and assembly businesses

Decree 199/2025/ND-CP amends the conditions on minimum output to apply preferential import tax rates for imported auto components under the Tax Incentive Program.

This regulation aims to support businesses that manufacture and assemble cars, especially environmentally friendly cars.

Illustration photo.

Specifically, Decree 199/2025/ND-CP supplements Clause 3, Article 8 of Decree 26/2023/ND-CP:

In case an enterprise manufacturing and assembling automobiles using gasoline or diesel fuel considered for incentives also produces and assembles electric automobiles, fuel cell automobiles, hybrid automobiles, automobiles using completely biofuels, and automobiles using natural gas, the number of electric automobiles, fuel cell automobiles, hybrid automobiles, automobiles using completely biofuels, and automobiles using natural gas during the incentive consideration period shall be added to the minimum total output and minimum specific output of each group of vehicles and model of vehicles using gasoline or diesel fuel respectively to determine the minimum total output and minimum specific output of the group of vehicles and model of vehicles when considering incentives.

In case an enterprise holds more than 35% of the charter capital of automobile manufacturing and assembling companies that have been granted a certificate of eligibility for automobile manufacturing and assembling by the Ministry of Industry and Trade (hereinafter referred to as the owning enterprise), the automobile manufacturing and assembling companies, if meeting the prescribed conditions, may aggregate the automobile manufacturing and assembling output of those companies to calculate the minimum output when considering the conditions for enjoying incentives of the Tax Incentive Program.

The owning enterprise is responsible for determining the total output of automobile manufacturing and assembling companies eligible for the Tax Incentive Program and the charter capital holding ratio of over 35% during the tax incentive consideration period.

The customs authority where the automobile manufacturing and assembling company registers to participate in the Tax Incentive Program shall refund tax corresponding to the volume of automobiles manufactured and assembled by that company that have left the factory during the incentive consideration period.

In case the enterprise owns, manufactures or assembles cars and declares incorrectly, it will be subject to tax collection and penalties for violating tax laws.

Increase export and preferential import taxes on some goods

In addition, Decree 199/2025/ND-CP also increases export tax rates and preferential import tax rates for a number of goods specified in Appendix I - Export Tariff Schedule, Appendix II - Preferential Import Tariff Schedule according to the List of taxable goods issued with Decree No. 26/2023/ND-CP.

Specifically, the yellow phosphorus product code will apply an export tax rate of 10% from January 1, 2026 and continue to increase to 15% from January 1, 2027 (currently the tax rate is 5%).

Yellow phosphorus is an important input material in many fields, from fertilizer and pesticide production to high technology such as semiconductors and lithium batteries.

The adjustment of export tax rates aims to protect national resources, minimize environmental impacts and orient the development of strategic industries such as semiconductor chip manufacturing, electric vehicle batteries and high-end industrial chemicals.

The 0% import tax rate for the product code Black steel sheet (black steel) rolled for tin coating (Tin - mill blackplate - TMBB) will only be maintained from now until the end of August 2025. From September 1, 2025, the tax rate for this product code will increase to 7%.

Immediately apply the import tax rate of 2% to: Polyethylene containing alpha-olefin monomers of 5% or less; Polyethylene with a specific gravity of 0.94 or more; Ethylene-alpha-olefin copolymers, with a specific gravity of less than 0.94;... Previously, these product codes were applied the import tax rate of 0%./.

vietnamplus.vn

Source: https://baolaocai.vn/nhieu-chinh-sach-thue-nhap-khau-uu-dai-ho-tro-doanh-nghiep-oto-post648346.html

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

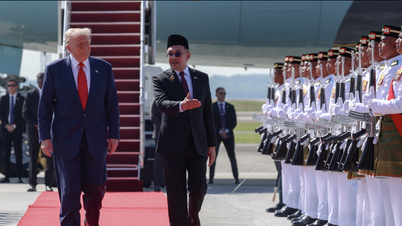

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)