Many farmers in Hoang Hoa commune have received bank loans to develop their economy effectively.

Implementing Decree No. 55/2015/ND-CP of the Government on agricultural and rural development and the directives of the State Bank, Agribank branches in the province have effectively coordinated with socio-political organizations, in which the core is the Farmers' Association and Women's Union at all levels to effectively implement credit policies for agricultural and rural development. Currently, Agribank branches in the province have deployed loans through loan groups in 100% of communes and wards in localities across the province. The activities of loan groups have made positive contributions to credit activities for agricultural and rural development of units. In addition, the effective implementation of loan activities through loan groups has created a strong change in banking activities associated with the implementation of policies for agricultural, farmer and rural development, linking Agribank's activities with socio-economic development in localities.

By July 2025, Agribank branches had coordinated to establish more than 4,800 loan groups for nearly 138,380 members to borrow with outstanding loans of over VND 19,071 billion. Along with that, banks also adjusted loan interest rates for tens of thousands of customers with interest reductions of tens of billions of VND, along with reductions in service fees. Lending activities through loan groups were expanded by banks in both quality and scale, outstanding loans increased annually, credit quality was guaranteed, creating a connection between farmers' associations, women's unions, authorities, people, customers and Agribank.

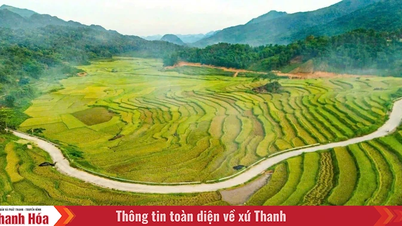

From Agribank's capital, through the hard-working, diligent and creative hands of farmers, our province's agriculture and rural areas have changed a lot, developing strongly thanks to effective economic restructuring. The countryside has more "billionaire" farmers who not only enrich themselves but also create thousands of jobs with stable income for the people. Mr. Le Dang Quyen's family in Dong Thanh village, Hop Ly commune was approved by the Commune Farmers' Association to borrow 200 million VND from Agribank Trieu Son - Thanh Hoa to invest in expanding the ornamental plant and pig farming model. Mr. Quyen excitedly said: "My family currently has more than 4,000m2 of ornamental plants, raising 12 sows and more than 30 pigs. Each year, the farm's revenue reaches more than 1 billion VND. Having an effective farm, I do not forget the important role of Agribank's capital loan through the loan group right from the first days of starting a business".

Agribank has provided a variety of products and services to members of the group associated with the digital banking model, applying loan transactions, automatic debt collection, non-cash payment services through electronic transaction channels (money transfer payment, collection and payment on behalf, card issuance, opening payment accounts, SMS registration, Agribank Plus...). Through the loan group, members have increased access to loans, and are provided with payment, money transfer, and insurance products and services by the bank in a convenient and effective manner. Members of the loan group have access to loans and use banking services to develop production and business, thereby increasing income, improving life, and contributing to limiting black credit in society.

In addition, the development of lending activities through loan groups has contributed to reducing administrative procedures in banking activities and simplifying loan applications. Through loan groups, customers are fully and detailedly guided on loan procedures, ensuring compliance with regulations and lending processes of the bank; in addition, disbursement and debt collection through loan groups, mobile loan groups, mobile transaction points by specialized cars according to fixed schedules at transaction points in communes, villages, hamlets... has contributed to saving customers' travel costs, helping customers access loan sources and banking services more conveniently and easily.

From the results achieved in coordinating the implementation of inter-sectoral agreements with socio-political organizations, Agribank branches in the province have made certain contributions to the success in developing and improving the economic efficiency of households, promoting production and business, solving employment problems, and improving the lives of people in rural areas.

Article and photos: Khanh Phuong

Source: https://baothanhhoa.vn/tang-kha-nang-tiep-can-von-cho-nguoi-dan-khu-vuc-nong-thon-255242.htm

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

Comment (0)