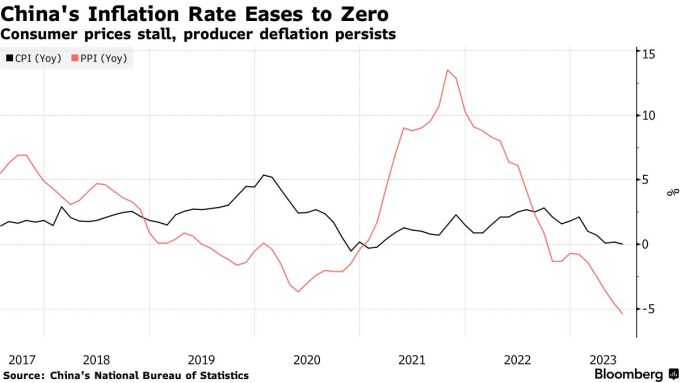

In June, China's inflation was at 0%, while the producer price index fell sharply, raising concerns about deflation and increasing the likelihood of Beijing launching an economic stimulus package.

China's consumer price index remained flat at 0% in June, its lowest level since February 2021, according to newly released data from the National Bureau of Statistics.

Core inflation (excluding energy and food costs) fell to 0.4% from 0.6% the previous month. The producer price index continued its downward trend, falling 5.4% year-on-year, a sharper decline than in May and the deepest drop since December 2015.

"The risk of deflation is present," commented Zhang Zhiwei, chief economist at Pinpoint Asset Management.

Both measures add further evidence that the recovery of the Chinese economy is weakening, with concerns about deflation weighing on confidence. This is likely to spur potential stimulus packages, seen as a "trump card" to revive the economy.

"The data right now supports more easing of policy, which policymakers are doing, but only cautiously," said Michelle Lam, economist at Societe Generale SA.

China's inflation was at 0% in June.

Manufacturers have spent months struggling with lower commodity prices and weak domestic and international market demand. If consumers and businesses continue to restrict spending or investment in the hope that prices will fall, it could lead to an even more severe deflationary spiral.

The main drag on consumer prices last month was pork prices. Pork prices – a staple in the Chinese diet – fell 7.2% in June compared to a year earlier, a sharper decline than the 3.2% drop in May.

The Chinese government has attempted to set a floor for pork prices to curb the sharp decline. Last week, the country announced it would purchase more pork for stockpiling to boost demand.

Producer price deflation is being driven by the sustained decline in international commodity prices. NBS statistician Dong Lijuan said that oil and coal costs continue to fall, partly due to last year's high base levels.

"A zero consumer price index and a deeper drop in producer prices in June suggest that China's post-pandemic recovery is losing momentum. The downward price trend, a sign of weak demand, also dims the economic growth outlook," commented David Qu, a Bloomberg economist. "The need for more stimulus from the central bank is increasing."

There have been many calls for Beijing to act to support the economy, but most measures so far have been limited in scope. The central bank made a small cut to its policy interest rate last month, and the government extended tax breaks for electric vehicle buyers.

Premier Li Qiang spoke with several Chinese economists last week about the possibility of increased economic stimulus, although he stressed that the policies would be "targeted, comprehensive, and well-coordinated"—reinforcing the notion that the stimulus package would not be large-scale. A limiting factor is the high debt burden of local governments. This resource has previously often been a driver of growth by generating more spending.

Minh Son ( according to Bloomberg )

Source link

![[Photo] Ho Chi Minh City decorated with flags and flowers ahead of election day.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/03/13/1773392076518_anh-man-hinh-2026-03-13-luc-15-53-29.png)

![[Photo] Prime Minister Pham Minh Chinh attends the inauguration ceremony of the Vietnam Space Center.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/03/13/1773397068038_ndo_br_dsc-3366-jpg.webp)

Comment (0)